Life is full of unexpected twists and turns. Car repairs, medical bills, or maybe that dream vacation you’ve been eyeing—whatever the reason, sometimes you need a little financial boost. That’s where personal loans come in. They provide quick access to cash when you need it most.

But many people find themselves overwhelmed by the sheer number of options and confusing terminology. It’s easy to feel lost or even make a decision you’ll regret later. This comprehensive guide will explain the ins and outs of personal loans, help you understand the key terms, and walk you through the steps to find the perfect loan for your unique situation. Read on.

Understanding Personal Loans

Personal loans serve a specific purpose and can be incredibly handy in the right situation. Several different types are available, each with unique features.

Secured vs. unsecured

Secured loans require you to offer something valuable as collateral, like your car or savings account. This gives the lender a safety net, so they often offer lower interest rates. Unsecured loans don’t require collateral, but they might come with slightly higher rates.

Fixed-rate vs. variable-rate

A fixed-rate loan means your interest rate stays the same throughout the entire loan term. On the other hand, variable-rate loans can fluctuate with market conditions. It might be lower initially, but it could also rise, making your payments unpredictable.

Debt consolidation loans

If you’re juggling multiple high-interest debts (credit cards, student loans, etc.), debt consolidation personal loans could be your lifesaver. You combine all your debts into one loan with a lower interest rate, making it easier to manage and potentially saving you money in the long run.

Here are some key terms you’ll encounter:

- Principal: This is the amount you borrow, the core of your loan.

- Interest rate: Think of this as the lender’s fee for letting you borrow their money. It’s expressed as a percentage of your principal.

- APR (Annual Percentage Rate): This is a broader measure of the cost of borrowing, including both the interest rate and any fees.

- Origination Fees: Some lenders charge an upfront fee to process your loan application.

- Prepayment Penalties: Some lenders might charge a penalty if you pay off your loan early.

Knowing these terms helps you understand loan offers, compare options, and ultimately make the best decision for your financial well-being. Don’t be afraid to ask lenders questions if anything is unclear. After all, knowledge is power!

Assess Your Financial Needs

Before you apply for a loan, take a step back and assess your financial needs. Start by asking yourself some key questions:

Why do you need a personal loan?

Be honest with yourself. Is it for a home renovation project, consolidating high-interest debt, or covering unexpected medical bills? Knowing your purpose will help you determine the right loan amount and repayment term.

How much do you need to borrow?

Don’t be tempted to borrow more than you actually need. Crunch the numbers and figure out the exact amount required to achieve your goal. Remember, every dollar you borrow will need to be paid back with interest.

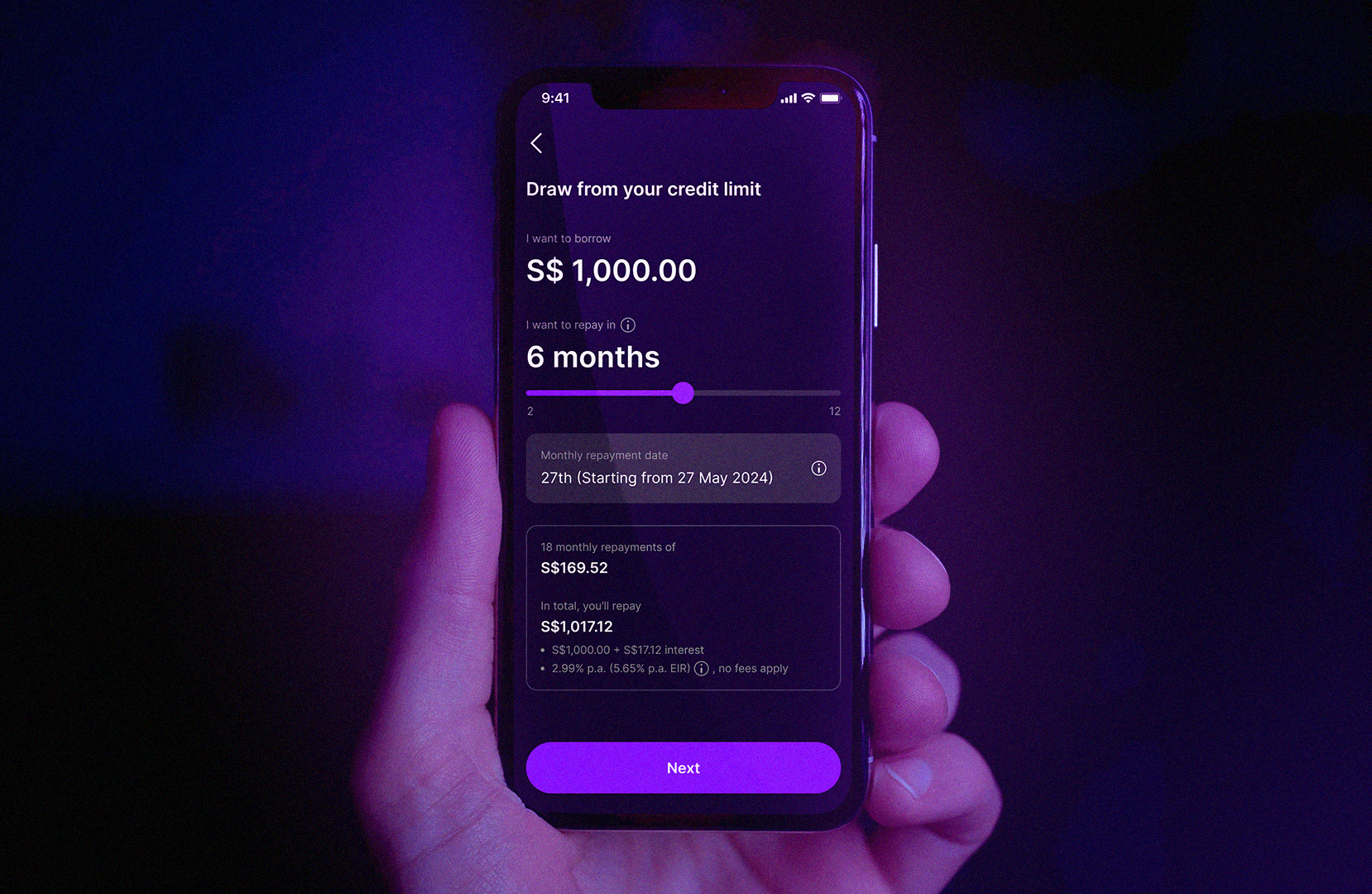

How long do you need to repay the loan?

Shorter loan terms mean higher monthly payments but less overall interest. Longer terms offer lower monthly payments, but you’ll pay more interest in the long run.

What is your ideal monthly payment?

Take a look at your income and expenses to figure out how much you can comfortably afford to pay each month. There are plenty of online calculators that can help you estimate payments based on different loan amounts and terms.

Answering these questions will help you narrow down your loan options and choose the one that best suits your situation.

Research Lenders

Each lender offers different loan products with varying interest rates, fees, and terms. It’s crucial to shop around and compare your options to find the best fit for your needs.

Traditional banks

Traditional banks offer a wide range of financial products and services, including personal loans. If you already have a relationship with a bank, they might offer you preferential rates or terms. However, they tend to have stricter eligibility requirements, especially for those with less-than-perfect credit.

Credit unions

Credit unions are member-owned, not-for-profit organizations that often offer competitive rates and personalized service. They might be a good option if you’re looking for a more community-oriented approach.

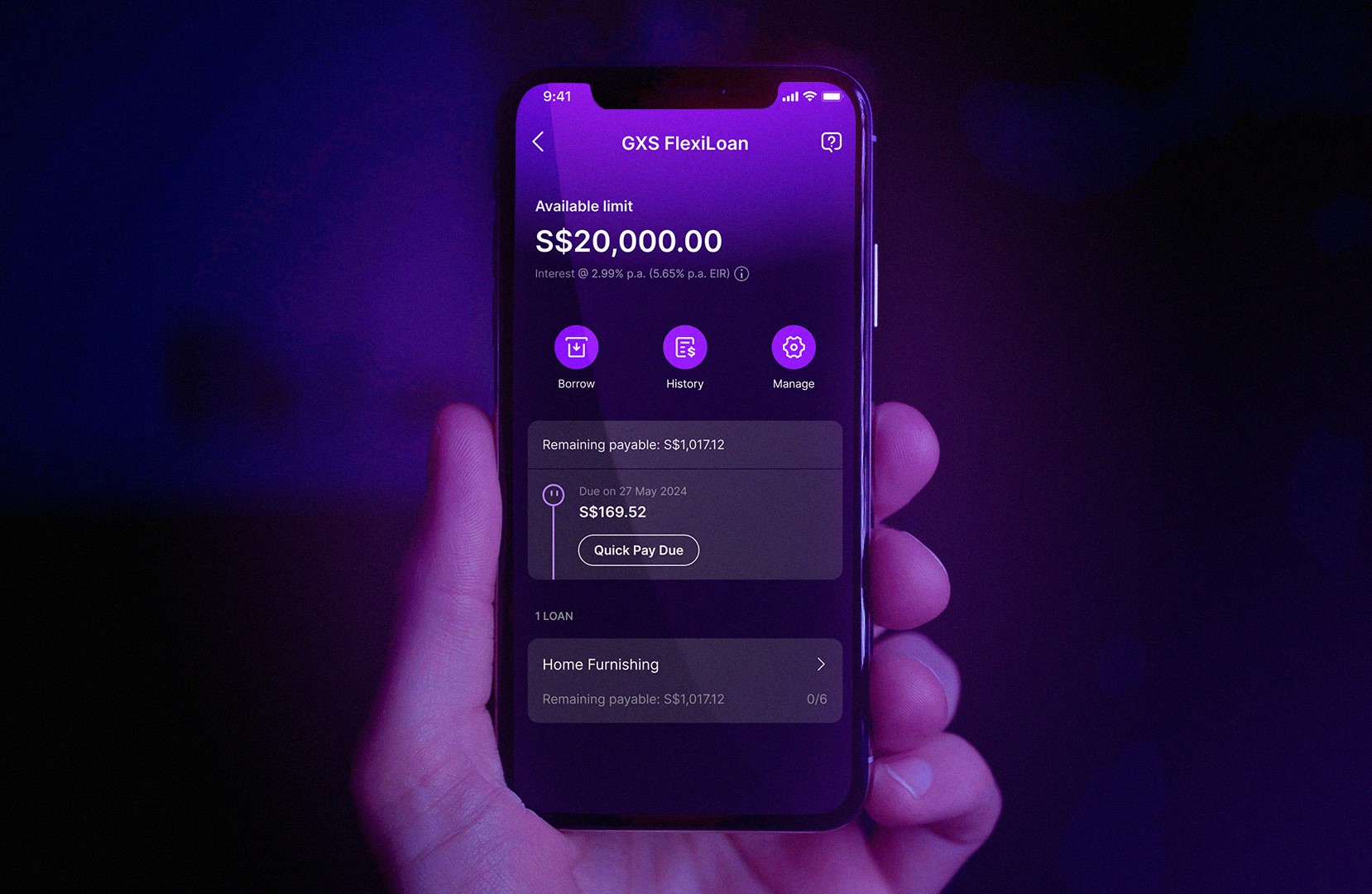

Online lenders

These lenders offer convenience and speed, with many applications processed entirely online. They may be more flexible with their eligibility requirements, but their interest rates can vary widely, especially for those with lower credit scores.

Peer-to-peer lending platforms

They connect borrowers directly with individual investors, cutting out the traditional middleman (the bank). This can lead to more flexible terms and potentially lower rates, but it’s important to research the platform and its reputation.

So, how do you actually research lenders? Here are a few tips:

-

- Check their websites: Most lenders list their loan products, rates, and terms online.

- Read reviews and ratings: See what other borrowers have to say about their experiences with different lenders.

- Talk to friends and family: Get recommendations from people you trust. They might have had positive experiences with certain lenders.

- Use comparison tools: Many websites and financial tools allow you to compare multiple loan offers side-by-side.

Remember, don’t be afraid to ask questions and negotiate with lenders. You’re the customer, and you have the power to choose the lender that best suits your requirements.

Evaluate Your Eligibility

Lenders have specific criteria they consider in determining whether you’re a good candidate for a loan. Here are the main factors they check:

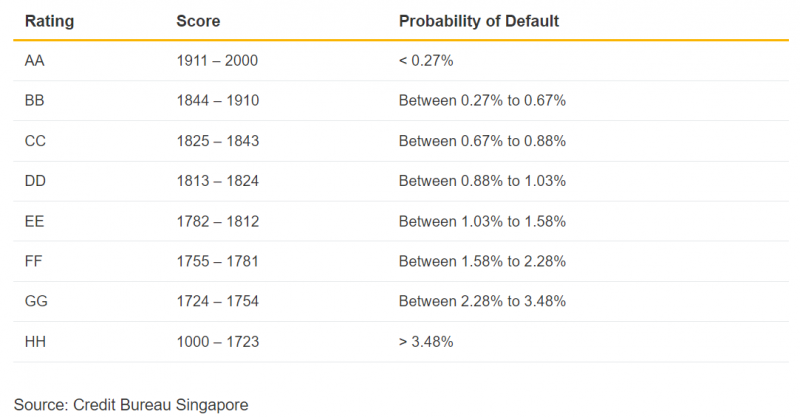

Credit score

Your credit score summarizes your credit history, including your payment history, outstanding debts, and credit utilization. A higher score signals to lenders that you’re a responsible borrower.

Income and employment history

Lenders will typically ask for proof of income, such as pay stubs or tax returns. A stable job history demonstrates reliability and increases your chances of approval.

Debt-to-income ratio (DTI)

The debt-to-income ratio measures your monthly debt payments (including credit cards, student loans, and potential loan payments) relative to your income. Banks prefer borrowers with lower DTIs, as it indicates they have more disposable income to handle additional debt.

By understanding these factors, you can set realistic expectations and increase your chances of finding a loan that works for you.

Final Thoughts

The path to securing the best personal loan might feel winding, but with a bit of knowledge and the right tools, you can find something that aligns with your needs and financial goals. So, take a deep breath, trust in your newfound knowledge, and embark on your journey towards financial freedom. The right personal loan is out there, waiting to help you turn your dreams into reality.