I’ve been on the lookout for a credit card with the best rewards and after some research, I stumbled on this combo:

UOB Lady’s Credit Card x UOB Lady’s Savings Account

I’m excited to make the most out of my savings and spending, knowing that signing up for both can earn me up to an impressive 25X UNI$ per S$5 spent, equivalent to 10 miles per S$1!

How It Works for Me:

- UOB Lady’s Credit Card: I earn 10X UNI$ per S$5 spent on up to two of my preferred rewards category(ies). That’s 4 miles for every S$1 I spend.

- UOB Lady’s Savings Account: I boost my rewards with up to an additional 15X UNI$ per S$5 spent on my preferred rewards category(ies), adding up to 6 more miles per S$1.

Plus, there’s no lock-in period, giving me the flexibility to choose and change my preferred rewards category(ies) every quarter.

And the best part? There’s no minimum spend required, allowing me to earn rewards on my terms!

Painting the Picture:

I have plans to maintain a S$50,000 Monthly Average Balance (MAB) in my UOB Lady’s Savings Account and spend S$800 each month on my preferred rewards category(ies) with my UOB Lady’s Credit Card.

For me, a monthly S$800 spend is easily attainable since I spend the bulk on the Beauty & Wellness and Dining categories.

Here’s the rough breakdown if you’re interested:

- Gym membership ($100)

- Beauty/cosmetic buys ($100)

- Personal grooming such as hairdressing, facial treatment/hair removal, nails/lash/eyebrows, etc. ($300)

- Dining at my favourite restaurant and ordering food via foodpanda ($300)

This means in just one month, I could rack up 3,200 UNI$.

Keeping this up for 12 months means I could gather a whopping 38,400 UNI$ in a year!

Redeeming My Rewards:

I can convert these UNI$ into 76,800 KrisFlyer miles (1 UNI$ = 2 miles).

With that, I could snag my round-trip business class ticket to Hong Kong* within a year! It would be my first-ever business class experience.

But if I decide not to spend all my UNI$ on flying, I have plenty of other options too.

I can redeem my UNI$ for rewards from a variety of dining, shopping, and travel merchants on UOB Rewards+.

In essence, whether I’m aiming for luxury travel or indulging in simple everyday perks, the benefits add up quickly!

*Based on Singapore Airline’s Saver Awards Chart as of October 2023, excluding taxes, charges, and fees.

Maximizing Your Rewards:

You can choose and change your preferred rewards category(ies) every quarter. These include:

- Dining

- Travel

- Fashion

- Beauty & Wellness

- Family

- Transport

- Entertainment

This flexibility means you can adapt as your spending habits and priorities shift.

Switch to whatever categories you deem fit quarterly to maximize your UNI$ and get the best rewards for your spending and savings!

For example, during the year-end holiday season, I can switch my rewards category to Travel. This allows me to book air tickets and easily hit the S$800 spending target in a single transaction!

By consistently managing my spending, I can easily accumulate a significant amount of UNI$ annually. During travel months, I can reach the monthly spending target even faster by booking air tickets and covering other travel expenses.

If you have more savings to park aside and can maintain at least a S$100,000 MAB, you can earn an additional 15X Lady’s Savings Bonus UNI$ on your preferred rewards category(ies).

So, it’s smart to consolidate your purchases with the Lady’s Credit Card to maximize your Lady’s Savings Bonus UNI$.

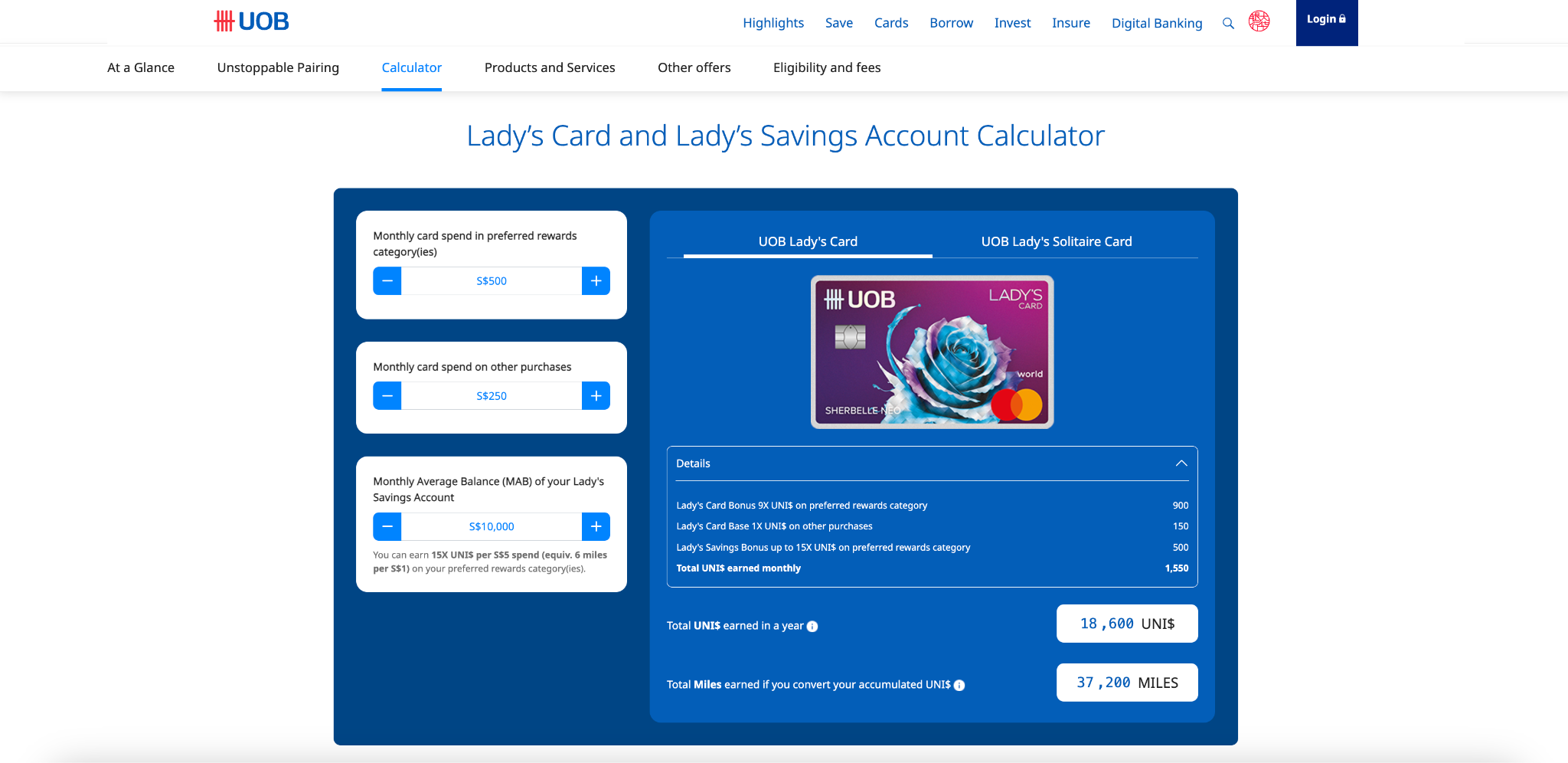

Curious About Your Rewards?

Wondering how many UNI$ and miles YOU can rack up based on YOUR spending and savings?

Simply click this link to UOB’s official website and click on ‘Calculator’ to access the ‘Lady’s Card and Lady’s Savings Account Calculator’ to enter your details and see your potential rewards in a flash!

Just like this:

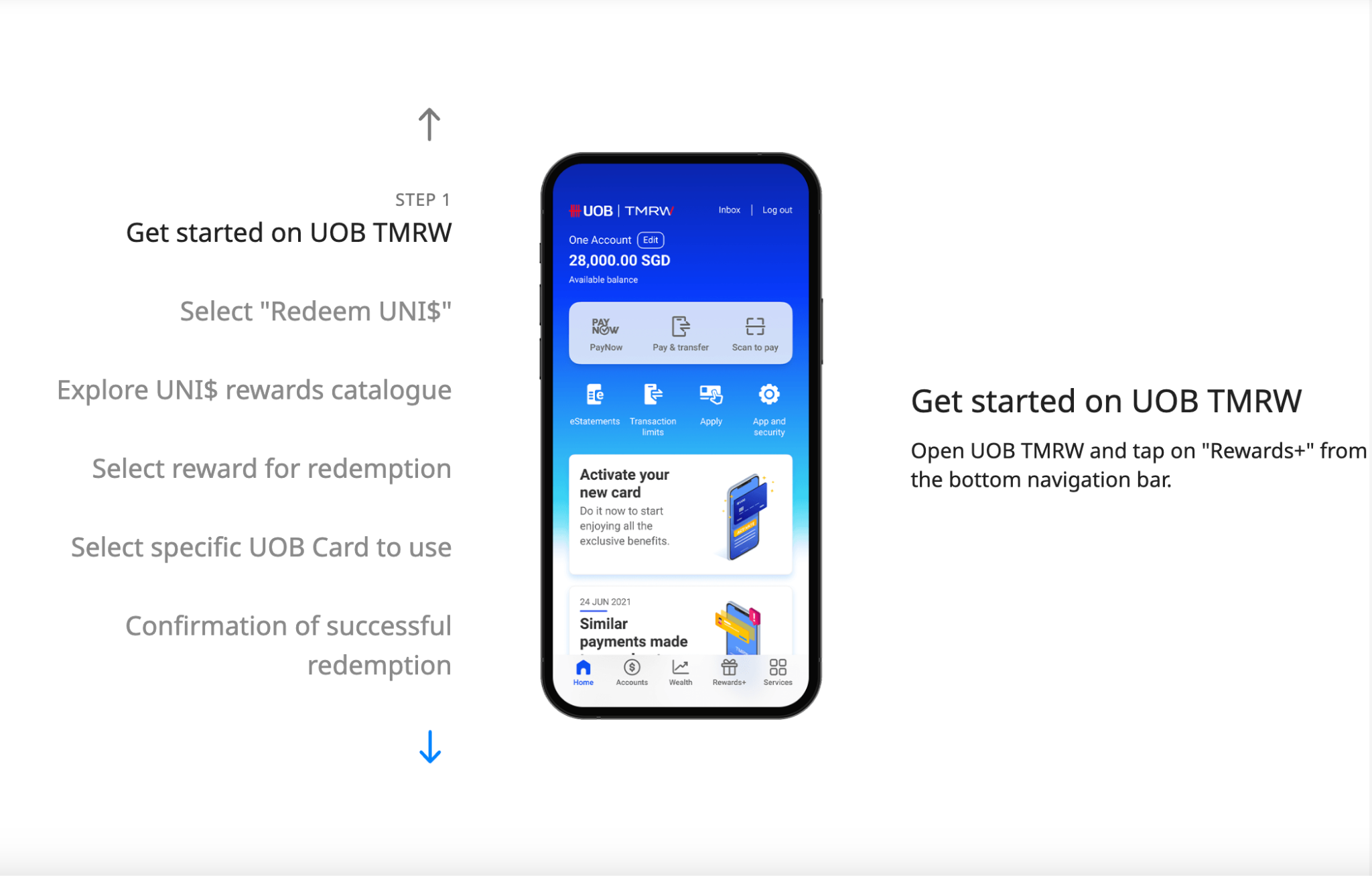

Subsequently, as a card member, you can easily view, track and redeem your UNI$ rewards all on the UOB TMRW app.

For details on how to redeem your UNI$ on the go with the UOB TMRW app, click through the link to learn more.

Additional Perks:

With the UOB Lady’s Card, you can also enjoy:

- 0% LuxePay Interest-Free Payment Plan over 6 or 12 months on your luxury purchase (shoes or bags)

- Exclusive Birthday Treats during your birthday month

- e-Commerce Protection for your online purchases

- Complimentary Travel Insurance covering up to 100,000 USD

- Receive a S$250 Sephora Gift Card when you spend a min. of S$6,000 on your UOB Lady’s Credit Card. Limited to the first 280 eligible cardmembers.

For the UOB Lady’s Savings Account:

- Receive a Bespoke Puffy Bag with Rose Leather Charm worth S$98 by reBynd, an eco-conscious brand by Bynd Artisan, when you apply for the account online and deposits S$5,000 new funds into the account. Limited to the first 150 customers in each calendar month from 8 March to 30 April 2025 only.

That’s not all. UOB is also rewarding ALL customers who hold both the UOB Lady’s Credit Card and UOB Lady’s Savings Account as of 30 Apr 2025 with a lucky draw chance to win an Éclat KNOT Alone® Double Pave Bangle worth S$520 or Gentle Monster sunglasses worth S$490.

T&Cs apply, of course. Insured up to S$100k by SDIC.

So stop waiting and join me right away by signing up now here.

Happy saving and spending together!