All is fine and dandy when your life is nicely panned out for you, but as Singaporeans, we can never be too cautious. What if a once-in-a-lifetime opportunity knocks, and you suddenly require a larger-than-expected sum of money to seize this opportunity?

Opportunities can come in different forms in your various stages in life. There may be investment opportunities, a chance to go abroad on an exchange programme, or a chance to further develop your skill sets.

If you find yourself short on cash and need a sum of money to tide you over a short period of time, a personal loan can come in useful.

When we think about loans, most would frown upon it. We would assume that borrowers are incapable of managing their own finances, or that they are financially irresponsible. That is but a misconception, as personal loans are merely tools that can improve our lives if used in a responsible and wise manner.

As compared to home loans, car loans or educational loans which have specific purposes, personal loans are a more flexible type of loan which can be used for almost any purposes you wish. The most straightforward of which are personal instalment loans, where you borrow a lump sum of money from a bank. You can use the borrowed cash for any reason you like. Payment is in fixed monthly payments over a specified time period.

You never know when you might need a loan, but it’s always good to be aware that there is this option out there without breaking the bank. A loan can be useful in the following situations:

- A buffer for depleting all your savings – taking a personal loan instead of using up your emergency savings in case of, well, emergencies, and you need the savings

- Seizing opportunities with smaller cash outlays – taking a personal loan for immediate cash to enrol in a workshop or class to improve your skill sets and employability, which will result in an eventual higher return

- Fulfilling aspirations – perhaps an exchange abroad, a hobby you’ve always wanted to master or even an important bucket list item

- Repaying a high-interest loan first – taking a personal loan to pay off higher-interest loans, such as credit card bills

Not all banks and money lenders are created equal. Different financial institutions offer different incentives – some offer lower interest rates while others have lower minimum criteria.

Ultimately, it’s always good to compare loans before applying for one, so you end up with the best bang for your buck for your personal goals and budget – one that has the lowest interest rate, the lowest fees, meets your requirements and has the best welcome offers.

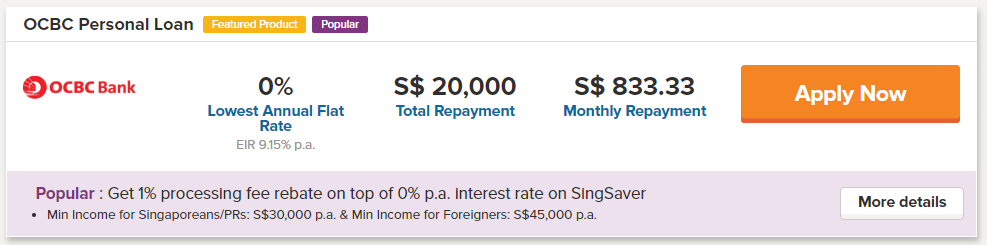

SingSaver offers a convenient platform for comparing between different financial institutions. For a limited time only, get the first 3 months of interest FREE when you apply from SingSaver’s website. That’s not all — SingSaver has also partnered OCBC to offer 0% interest free loan applicable for loan with 2 years tenure.

Not only does choosing the right loan mean meeting your goals earlier, it also means that you can pay off your loans faster.

So while you’re all up for borrowing, be aware of the higher interest rates accounts that you’re liable to paying, so that you clear off those loans first.