Investors of any age would do well to revise their current portfolios when they take age, risk appetite, retirement goals, understanding and correlation to other assets in the portfolio into consideration.

The rise of fintech now adds alternative assets like peer-to-peer lending, cryptocurrencies and microloans to the sheer variety of investment options. No longer do investors contend with just commodities, stocks, bonds and real estate.

Investors who accept that there isn’t a one-size-fits-all solution to building a diversified portfolio stand to do better. Here are general principles on finding the asset class that’s right for each investor portfolio.

1. Age and investment horizon

Assets behave as they should when given the time to do so. For example, it’s a well known saying that stocks outperform bonds; which is more likely to be true over a longer investment horizon.

Stocks will almost certainly outperform bonds over the next 30 years, for example, as fundamental facts like inflation make this outcome the most probable. But no one knows for certain if stocks will outperform bonds next year, or the year after, especially with the current Sino-US trade war.

As such, when considering the performance of any asset class, it is important to understand that the more time you give it, the more likely the asset will perform as expected. Wealth managers may tell clients to reallocate from equities to bonds when they get older.

In general, older investors will want to favour fixed income securities, be they perps or simple annuities, while younger investors can be more aggressive. Given their longer investment horizon, younger investors can pursue long-term capital gains, and expect their assets to behave more or less planned.

2. Financial goals, risk appetite and capacity

Personal financial goals is as much about psychology as mathematics. An asset class must meet the risk appetite, or “sleeping point”, to prevent stress or impulsive moves.

For example, there may be many good reasons why cryptocurrency fits a particular investor’s portfolio. She is young, affluent, and such an investment would make up only 5% of her portfolio. But if she is risk-averse and uncomfortable with volatility, the sleepless nights and stress may outweigh the value of the asset, regardless of what the numbers suggest.

If the risk is beyond the investor’s appetite, there is also an increased likelihood that an investor will derail their long-term financial goals. A news report on falling cryptocurrency prices, for example, could set off a panic that results in offloading the asset and incurring a loss.

In general, monthly obligations, inclusive of a home mortgage and premiums for an endowment plan, should not exceed 40% of an investor’s monthly income. Any asset class that pushes beyond this limit is likely taking them past their risk capacity.

3. How the asset class fits within quantified retirement goals

When deciding to invest in an asset class, investors should have quantifiable goals and ways to measure outcomes.

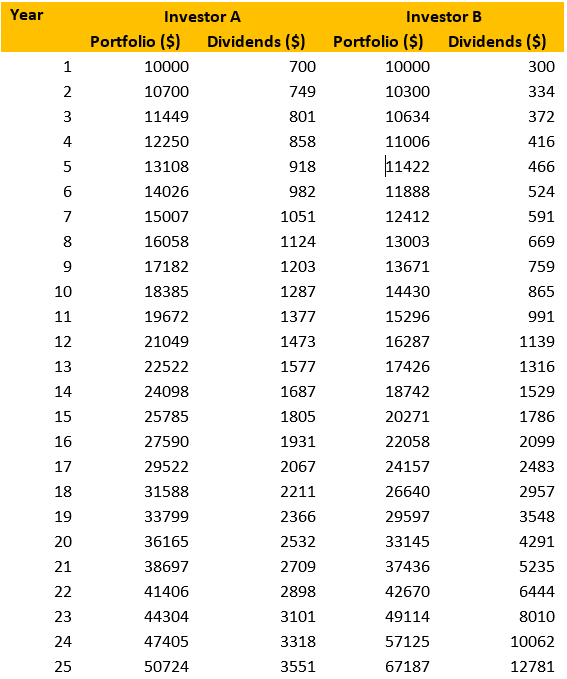

For example, an investor should have a clear idea on how much they need by the age of 65 to retire, with an income replacement rate of at least 80%. Only then is information about an asset class’ historical returns useful.

Investors should also note that every asset class rises in value over time. They need to ensure the returns are sizeable and fast enough to meet quantified retirement goals.

Some examples include microloans tailored towards invoice financing for small businesses. These commit capital for terms of at most 12 months, which limits what investors can lose while ramping up returns to make up for the shorter investment horizon. Late starters with 20 years or fewer to retirement, can consider these alternatives to conventional assets, such as stocks or bonds.

4. Education and understanding of the asset

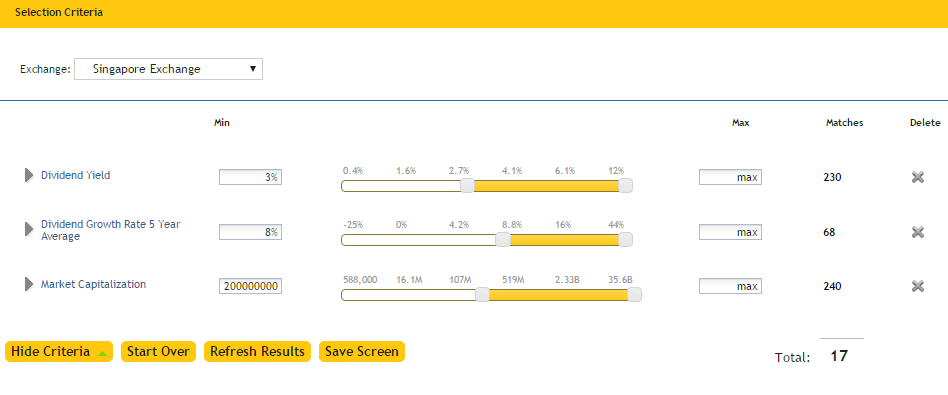

Investing in a poorly understood asset means ignoring risk appetite, as the investor tends to overestimate or underestimate the risk involved. Without proper education and understanding of the asset, there are also important subtleties within asset classes that investors may miss.

For example, investing in peer-to-peer lending is often perceived as being high risk. But this varies greatly based on the jurisdiction and platform. While China is struggling with it as a shadow banking problem, peer-to-peer lenders in Singapore and Malaysia have seen default rates of less than 1%, even lower than the default rate suffered by some commercial banks.

Many investors in Exchange Traded Funds (ETFS) may have also ignored that a partial replication ETF does not include smaller stocks by market cap. In the event of a small-cap led bull run, this can result in the ETF yielding lower returns than the benchmark.

5. A low correlation to other assets in the portfolio

Before introducing a new asset class, it is best to confirm that there is a low correlation to other assets in the portfolio. Strong correlations might mean a lack of diversification.

For example, an investor who already owns commercial retail properties might reconsider investing in a commercial Real Estate Investment Trust (REIT) that is heavy on malls. A downturn in the retail industry would impact both the REIT and real estate.

The correct mix of assets varies for each individual. But as a near-universal principle, investors should avoid banking too heavily on the same interlinked group of assets. A qualified wealth manager should be consulted on the right mix for each portfolio.

Looking beyond conventional assets

For a truly diversified portfolio, investors should think of asset classes beyond stocks, bonds and real estate. The emergence of fintech has given rise to peer-to-peer loans and microloans which offer unprecedented opportunities for high growth in a low interest rate environment.

Some new asset classes are also structured in a way to mitigate risks found in conventional assets, such as long maturity periods, opaque structures, and high initial cash outlays.

By taking various factors into serious consideration, investors of any age would do well to revise their current portfolios and look for new alternatives that can complement or replace older asset classes.

About the contributor

X.Y. Ng is VP, Brand and Digital at Validus Capital, a leading growth-financing fintech platform that connects accredited investors with growing SMEs across Southeast Asia.