I have good news for you! Reducing costs in your business does not have to take a lot of time or a significant amount of effort. In most cases, it comes down to making smarter choices. Continue reading on to find out what I meant.

MARKETING COSTS

Use technology to your advantage as you jump on the social media marketing wagon. Social media has a vast and diverse audience that you can tap. You are missing out on the potential of having fast-paced and low-cost marketing when you do not make use of Instagram, Facebook and Twitter. What’s more? You can collaborate with other advertisers or influencers.

Image Credits: pixabay.com

As I spearhead a school, I have teamed up with an mommy influencer to market our program offerings. In exchange of a post, the influencer was given free classes to fully immerse her child in our school environment. Bartering in an exchange of goods or services without handing out any cash is a good way to maximize your marketing budget.

TRAVEL COSTS

Unless you are taking the public transportation route, traveling domestically or internationally can be hefty. Eliminate the travel costs that come with business conferences by using downloadable software such as Skype or FaceTime to allow you and your client to have face-to-face conversations from anywhere around the world.

Reducing your travel costs does not mean that you must eliminate it entirely. Meeting in person with a client can bring serious profits and can close major deals. Thus, you must save your travel funds for high-priority situations.

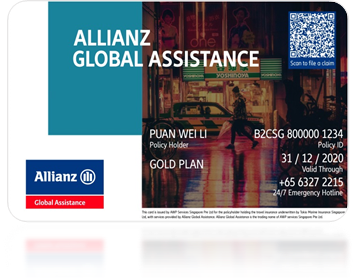

PRINTING COSTS

How does one begin to emphasis the price tag that comes with printing? For starters, most of my school expenses surround paper and ink. Not to mention, maintaining a machine can be a time consuming. Just calculate the amount of time you spend dealing with printer issues!

Printing costs add up in a snap. Eliminate as much paper as possible by going paperless when it comes to waivers, contracts, or memos. Use online signature apps to sign contracts. Alternatively, you may invest in one printer to cut back the printing of the entire office.

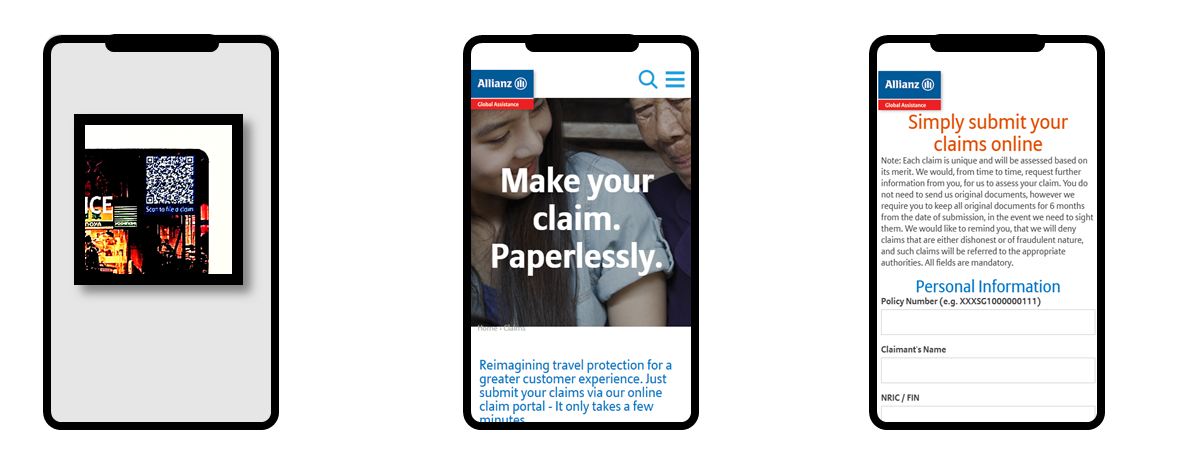

MANPOWER COSTS

Is it necessary to hire a full-time graphic designer when you can outsource positions for short-term roles? There are numerous platforms such as Fiverr and Upwork that can offer the right talent at reasonable rates. This also helps other talented individuals to grow their businesses.

Image Credits: pixabay.com

Furthermore, you can try designing posters or other artistic materials for free through websites such as PosterMyWall and Canva. You do not have to be as artistic as Bob Ross to execute the task! These websites are easy to use as they have ready templates available. Isn’t that amazing?