Insurance is a safeguard against unfortunate and unforeseen events. It is a strategic way to manage various risks. Insurance companies offer individuals or policyholders protection from potential losses in exchange of payments called premiums.

To manage your policy letters better, insurance companies offered their own apps. It sounds like a great idea for people who possess a couple of policies from different insurance companies. However, it is quite a chore for people who hold several policy documents. That is when PolicyPal comes in.

PolicyPal, developed when a startup took part in the Startupbootcamp FinTech Singapore, is a versatile platform that gathers all the policy documents from a wide array of insurers. It provides you with a “digital overview and analysis of your existing policies to identify any protection gap in your insurance portfolio and help you to better understand your coverage.”

HOW IT STARTED

Ms. Valenzia Yap is the brainchild behind PolicyPal. About two years ago, Valenzia’s mother was diagnosed with a serious illness. Her mother was diagnosed with one of the most notorious illnesses across the globe – CANCER. The unfortunate turn of events did not stop there. She was surprisingly rejected by the insurance company because of several lapses that they were not aware of.

The inconvenience that she went through while sorting out her mother’s policy letters gave her an idea to digitize the collation of the insurance policies and other documents. So, Valenzia collaborated with two programmers named Rick Wong and Jun Wei Ng to create the PolicyPal. Necessity was truly the mother of invention this time around.

ITS CURRENT SITUATION

This impressive app received over a thousand of users since its launch. Majority of these users are either on their late 20s or early 30s. Interestingly, their policies range from 1 to 12. These information simply shows how a significant number of Singaporeans are conscious about their health and safety choices.

THE EASY PROCESS

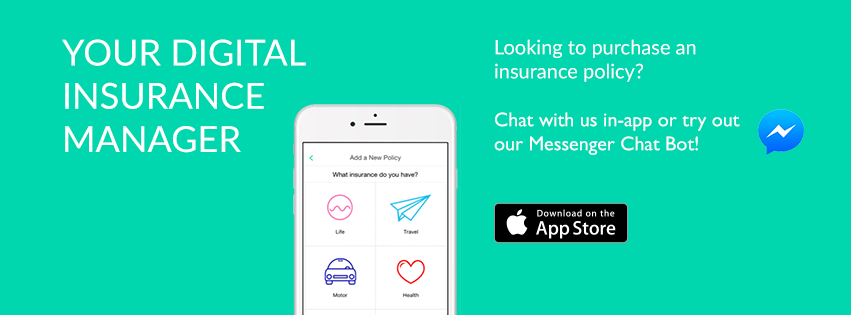

In simpler terms, PolicyPal follows these steps:

1. Capture an image of your policy’s first page.

2. Taking a snap of the second page is only necessary if you have riders.

3. Wait for the app to process your data. It will analyze the policy number, premiums, coverage, and expiration dates.

4. View your premiums and coverage in a graphical overview or a comprehensive chart.

5. Request for a review.

6. Get a free portfolio review to understand your coverage its gaps.

7. Purchase from the available policies if necessary.

Eager to get your very own PolicyPal app, visit policypal.co to download it for FREE!

MORE FINTECH APPS

There are other incredible financial technology startups that originated from the Lion City aside from PolicyPal. These startups came up with smartphone apps that make financial services more efficient, convenient, and prompt. They challenge the traditional businesses that are less reliant on the potency of software.

Do yourself a favor and know more about the Call Levels (i.e., providing live updates for traders and investors), the TradeHero (i.e., gamifies trading), and the Dragon Wealth app (i.e., one-stop shop for financial advisors)!