Recent news has been dominated by political and economic slowdown issues in both emerging and developed countries and it shows little sign of abatement. Global and local investors are increasingly feeling queasy about the financial market performances that has inevitably led to spikes in volatility.

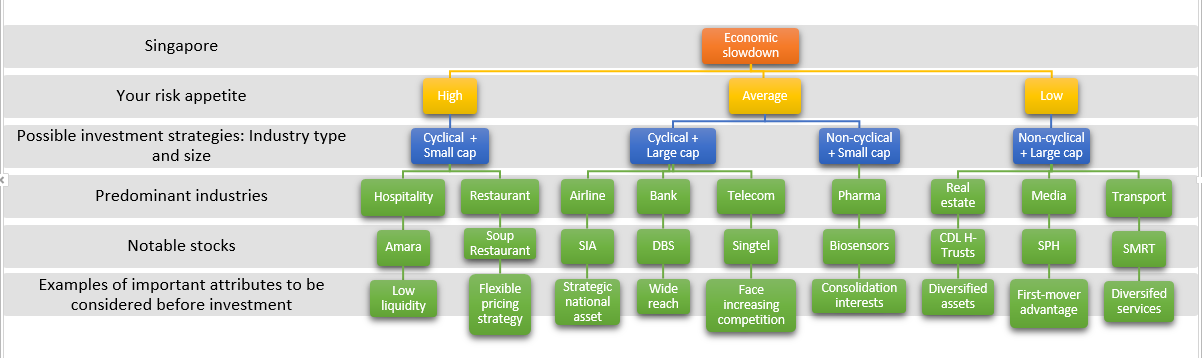

While uncertain economic times may take a typical investor on a rough ride, it presents a cornucopia of gainful opportunities for the learned eye. Indeed, as detailed in the diagram below, the key is to align your risk appetite with the right investment strategies sorted by industry type and size. Next, an insightful analysis would also consider company-specific attributes that could potentially act as a lever or a damper on the stock returns.

It is also crucial to understand and consistently apply the Singapore context to the specific industry and company under review. For example, as shown below, it is paradoxical to categorise the real estate industry as non-cyclical. However, given Singapore’s major land constraint, strategic location, extensive infrastructure and favourable policies for trade and investment, real estate would be significantly less prone to cyclical influences than our counterparts.