1. BY NOT CLAIMING YOUR REWARDS

A credit card is utilized at the point of sale as means of paying for services or goods. Credit cards come in different looks and sizes, much like assorted chocolates. What’s more? They vary in the rewards they entail. Some give discounts whenever you shop while others give you travel miles. If you are confused with how the rewards scheme of your credit cards works, it is best to ask your issuer openly on how you can maximize its use.

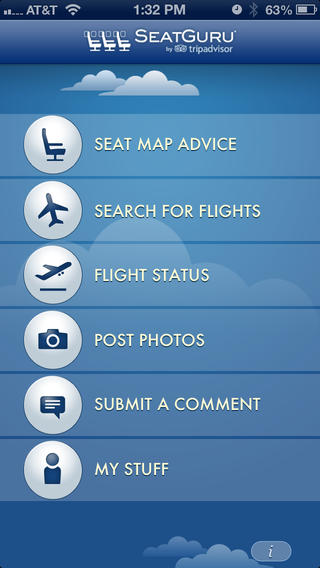

Take a cash-back rewards card to your advantage by putting the sum to your emergency fund. Or, gather up all the miles you can get (e.g., by offering to pay for your friends and later reimbursing it with cash) to enjoy a free trip in your dream destination. To put your “power” into good use, utilize your rewards wisely.

2. BY NOT CONTROLLING YOUR MOBILE PHONE USAGE

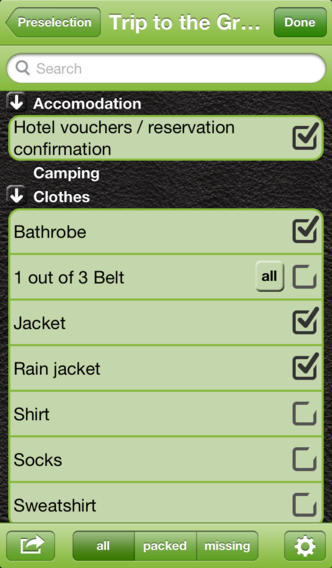

Millions of people around the world overpay for their postpaid plans because they underestimate their usage in minutes, in messages, and in bytes of data. When you are paying for minutes, messages, and gigabytes that you do not use then, you are flushing away money every single month.

For your convenience, I shall impart how much you will pay for excess usage in SingTel and StarHub plans. For Singtel users, excess local 3G data is charged up to S$10.70/1 GB and excess data beyond the bundled plan is charged at S$0.50/100 KB. While StarHub 4G users get to pay S$10.70/1 GB in excess. Considering that almost every place in Singapore have free WiFi, paying this much is really costly!

To intelligently estimate your total usage, analyze your mobile phone billing statements for the past few months and average each factor. Then, you can select a postpaid plan best suited for your needs. Keep track of your data usage better by installing an App like My Data Manager (free to download on iOS and Android). My Data Manager App enables you to know how much each App consumes and alerts you whenever you are close to hitting the limit.

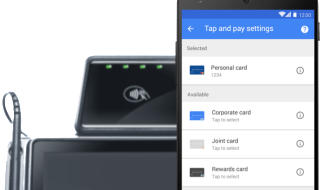

3. BY NOT CHOOSING BUNDLED SERVICES OR POLICIES

If you are getting a TV, landline (home digital line), mobile phone, and a wireless broadband plan, it is best if you consider getting all of these services under the same provider. This process is called bundling.

By bundling the services or policies, the telecom companies are able to offer you discounts and promotional packages to help you save more. For example, SingTel’s Fiber Home Bundle will cost you as low as S$49.90 a month (Terms & Conditions apply)!

With the help of this list, may you stop “flushing your money down the drain” by increasing buyer’s awareness.