Singapore is known for its efficiency and safety, but it’s not immune to fraudsters. With digital platforms becoming an integral part of our lives, cybercriminals have found new ways to exploit unsuspecting victims.

From love scams to phishing traps, read this guide to some of the most common scams in Singapore and how you can protect yourself.

#1: LOVE SCAMS

Imagine building an emotional connection with someone online, only to find out that their affection was a lie designed to drain your bank account. Love scams typically involve fake online relationships, where the scammer eventually asks for money, often citing urgent personal crises.

PROTECT YOURSELF: Be cautious when interacting with people online, especially if you’ve never met them in person. Avoid sending money to anyone you haven’t met, no matter how convincing their story may be.

Image Credits: unsplash.com

#2: TELEGRAM SCAMS

Telegram has become a popular messaging app, but its privacy features are also being exploited by illegal groups. From drug deals to illicit pet trades, scammers operate within seemingly harmless chat groups. Users are often lured in with attractive offers and end up becoming victims of fraud or even criminal investigations.

PROTECT YOURSELF: Join reputable and verified groups on Telegram. If a deal seems too good to be true, it probably is. Always report suspicious activity to the relevant authorities.

#3: PHISHING SCAMS

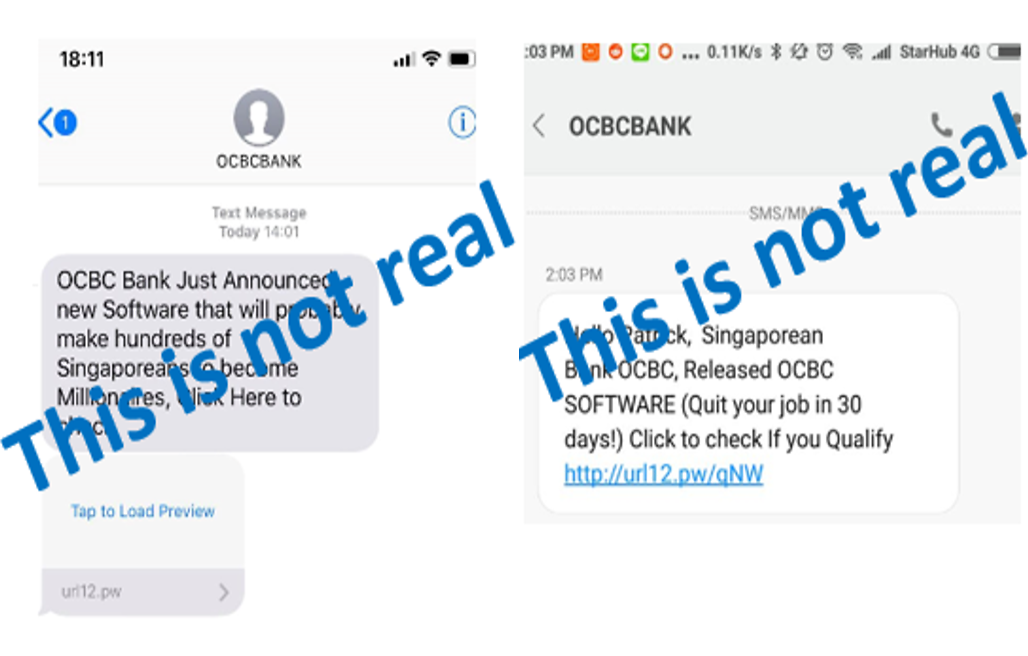

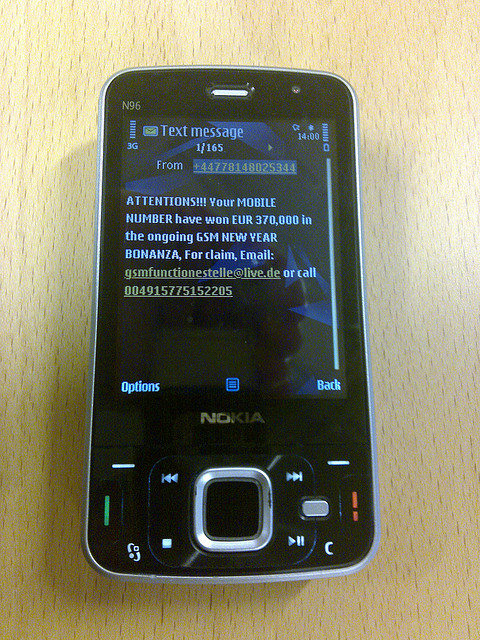

Phishing scams involve fraudulent emails or text messages that trick you into revealing personal information like your bank account details or passwords. Scammers often impersonate legitimate companies or even government agencies.

PROTECT YOURSELF: Many apps, including Google’s new Android upgrade, offer features to block scam messages and prevent harmful apps from being installed. Enable these features and keep your apps updated to ensure you’re protected from the latest threats.

Furthermore, never click on links from unknown or suspicious sources. Instead, double-check the URLs of websites you visit to ensure they’re legitimate.

#4: E-COMMERCE SCAMS

Online shopping is convenient, but it also opens doors for e-commerce scams. Fraudsters often create fake online stores or advertise products at ridiculously low prices, only to disappear once payments are made.

PROTECT YOURSELF: Stick to trusted e-commerce platforms with strong buyer protection policies. Then, regularly read reviews before making a purchase.

#5: JOB SCAMS

Looking for a new job? Be careful of job scams, where fraudulent job offers are used to extract personal information or request upfront payments for job allocations. These scams usually promise high pay for minimal work, which is a major red flag.

Image Credits: unsplash.com

PROTECT YOURSELF: Legitimate employers will never ask for payment during the hiring process. Verify job offers through official company websites or directly with their HR department.