In Singapore, a low-paying job is generally defined as one where the monthly wage falls below the national median salary. According to the Ministry of Manpower (MOM), jobs with salaries under SGD 2,500 per month are often classified as low-wage. Approximately 10-15% of employed residents are in such positions, equating to around 200,000 to 300,000 people.

Navigating life in Singapore on a low income can be quite challenging. However, with determination and careful financial planning, you can improve your situation. Here are some practical tips to help you make the most of your circumstances.

#1: TRANSPORTATION

Rethink your daily commute. Public transportation in Singapore is efficient and affordable, so consider taking the bus or MRT instead of hailing a cab. If you must ride a car, look into carpooling options with colleagues to share the costs.

#2: LIVING EXPENSES

Living frugally doesn’t mean sacrificing quality of life. It means being mindful of your spending. Cut down on non-essential expenses like dining out frequently or subscribing to multiple streaming services. Instead, cook at home more often and enjoy free or budget-friendly entertainment options like parks and community events.

#3: INTERNET ACCESS

Take advantage of free Wi-Fi available at local coffee shops, libraries, and community centers. If you need internet at home, see if your employer offers any allowances or find bundle deals that include other services you need, such as cable or phone.

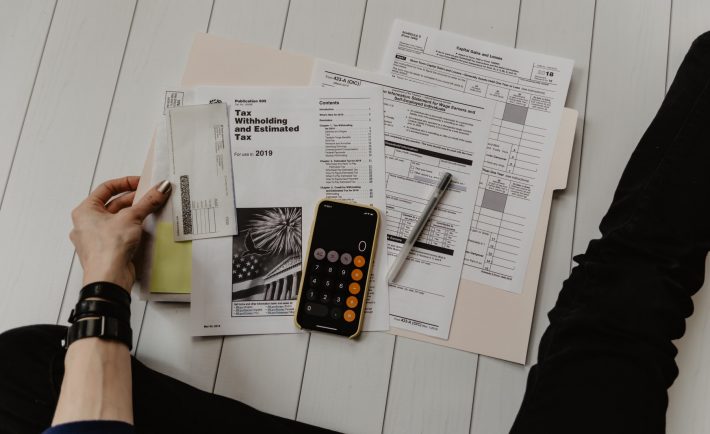

#4: DEBTS

Imagine the relief of no longer having to worry about monthly mortgage or credit card bills. Prioritizing debt repayment can free up your finances, reduce stress, and provide more flexibility in your career choices. While it’s easier said than done, start by addressing your smallest debts to build momentum, and then gradually tackle larger ones.

#5: FINANCIAL SUPPORTS

Many low-income individuals are eligible for financial assistance from government agencies. The Singaporean government, for instance, has set S$2,906 per month as a reasonable starting point for a living wage.

Image Credits: pixabay.com

If you earn less than S$2,500 per month and are over 30, you might qualify for the Workfare Income Supplement (WIS) scheme, which provides cash payments and additional contributions to your Central Provident Fund (CPF). See if you qualify.

#6: BACK-UP PLAN

Saving for emergencies can be tough, especially when you are living from paycheck to paycheck, but it’s crucial. If you can’t build an emergency fund quickly, consider having a credit card with available spending power as a backup for urgent situations. Just be cautious with its use to avoid accumulating debt.

#7: UPSKILL

Investing in your education and skills can open up new opportunities and potentially higher-paying jobs. Look for free or low-cost courses online or at community centers. For starters, SkillsFuture Singapore offers credits that can be used for a wide range of courses.

#8: SUPPORT NETWORK

A strong support network can provide emotional and practical help. Connect with family, friends, and community groups. Sometimes, just talking to someone who understands your situation can make a big difference.

#9: HEALTH CONCERNS

Staying healthy can prevent costly medical bills. Regular exercise and a balanced diet improve health and reduce medical needs.

Furthermore, Medisave and MediShield Life provide additional support. Medisave is a savings scheme for medical expenses, while MediShield Life covers up to 80% of hospitalization costs. These schemes, along with government subsidies, ensure affordable access to medical care.

#10: FINANCIAL GOALS

Finally, set achievable financial and personal goals. Try to be as positive as you can while doing so. A positive mindset can make a significant difference in how you handle financial challenges.

Image Credits: pixabay.com

Living on a low income in Singapore can present significant challenges, but with careful planning and a commitment to improving your financial situation, it is possible to manage your finances more effectively and enhance your quality of life. Remember, small steps and a willingness to adapt can make a meaningful difference.