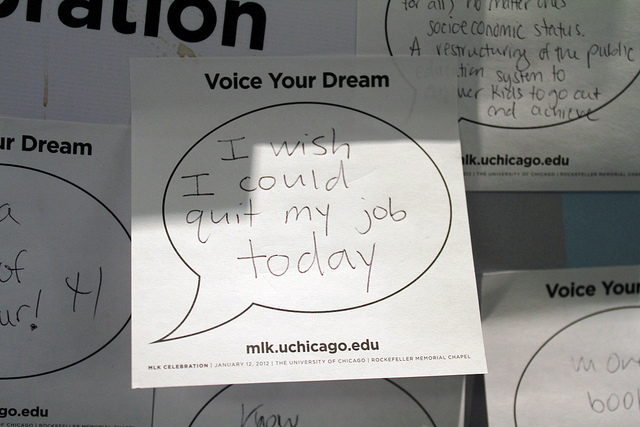

While some of us have a career that makes us feel energised every single day, most of us are in a job that we fantasise about quitting. Whether it’s the early mornings, the stress level, or the over-commitment of time, there are often a few common reasons.

If you’re feeling at a loss on what to do, this article will share some red flags you need to ponder over. Maybe it’s about time you quit your job and say “yes” to a better work opportunity somewhere else?

#1: Spending all weekend dreading Monday

Most of us suffer Monday blues, but if you are dreading Monday morning so much that it leeches all of the fun out of your weekend, quitting should take a front position on your mind. A career that drains and has to have you give up a well-deserved weekend isn’t worth keeping.

#2: Having deep hatred for your job

Image Credits: Getty Images/iStockphoto

Do you hate everything about your job – your boss, your employees and, even your work tasks? It’s time to quit. Plain and simple. Yes, we understand that most of us are working to bring food to the table. But consider your mental health if you want to keep your feet on the race track.

#3: Getting passed over for deserved promotions

Have you been putting in extra time and effort to better yourself on the job but keep getting passed over again and again for a promotion? This is a real reason for concern.

Sure, it makes sense if the person who won the position is more qualified. However, if someone underqualified or entirely undeserving gets that promotion, maybe it’s time to pack up and go somewhere else where your skills are better valued.

#4: Feeling unappreciated and stagnant

Image Credits: Human Resource

Working with a management team who doesn’t appreciate your presence or contributions is dangerous for your overall sense of self-confidence. Simply put, you deserve to work at a place that takes you seriously.

Also, peeps who think they have stayed too long and become stagnant in their learning curve should rethink their position. A job is not all about money. It’s also about growth opportunities. It’s your chance to be a better administrator, consultant, or marketer (for example) than you were when you first started.

#5: Continually running on the work treadmill

From dawn to midnight and from Monday to Friday, work may constantly be plaguing you. Maybe it’s the worry or stress over deadlines, or perhaps it could just be the general fear of it overhanging you.

But if it’s always on your mind, even on rest days, it’s probably time for a change. Folks who find themselves venting about it endlessly to their loved ones should also take this as a warning sign.

After all, work is just work and shouldn’t invade your personal life to such an unhealthy extent.

Final thoughts

Image Credits: Monster Jobs

Deciding to quit your job is often very challenging, indeed. It can be even scarier for those who’ve been with the company for long enough to feel too “okay” to move.

However, if you think about it, having a job that fulfils you and makes you feel treasured has a more prominent part to play in retaining you for the road ahead. Well, sleep on it and make the decision when you’re ready.

An excellent way to get started is to begin browsing for job openings and sending resumes. When a suitable role presents itself, and you’re offered a contract, then you know it’s the right time to send in that long-awaited resignation email.