Good news for JB goers.

Because starting this month, travelers arriving at or departing from our little red dot through the Woodlands and Tuas checkpoints can clear immigration using QR codes.

To be exact, from Tuesday, 19 March 2024.

No more physical passports

Once rolled out, you won’t need to present your physical passport to Immigration and Checkpoints Authority (ICA) officers at the car counters.

Instead, all you need to do is this:

Just scan a single QR code. Swee.

This QR code is generated through the MyICA mobile app before arriving at a checkpoint and can be shared by all travelers in the car.

While you will eventually be able to do “self-clearance” from your car with minimal officer involvement, the in-car clearance process starting this month is not fully automated yet.

And quite understandably so for a start, yeah.

That said, officers will still be at the manual counters, as ICA mentioned last May at a seminar.

This isn’t a bad thing because that means you can still choose to present your physical passport to ICA officers at the counters instead of using QR codes.

The “old school” method is sometimes safer too, a guaranteed bet that won’t fail you.

Anyway, the QR code initiative only applies to Singapore’s checkpoints for now and you will still need to show your physical passports at Malaysia’s checkpoints.

How to generate your QR code

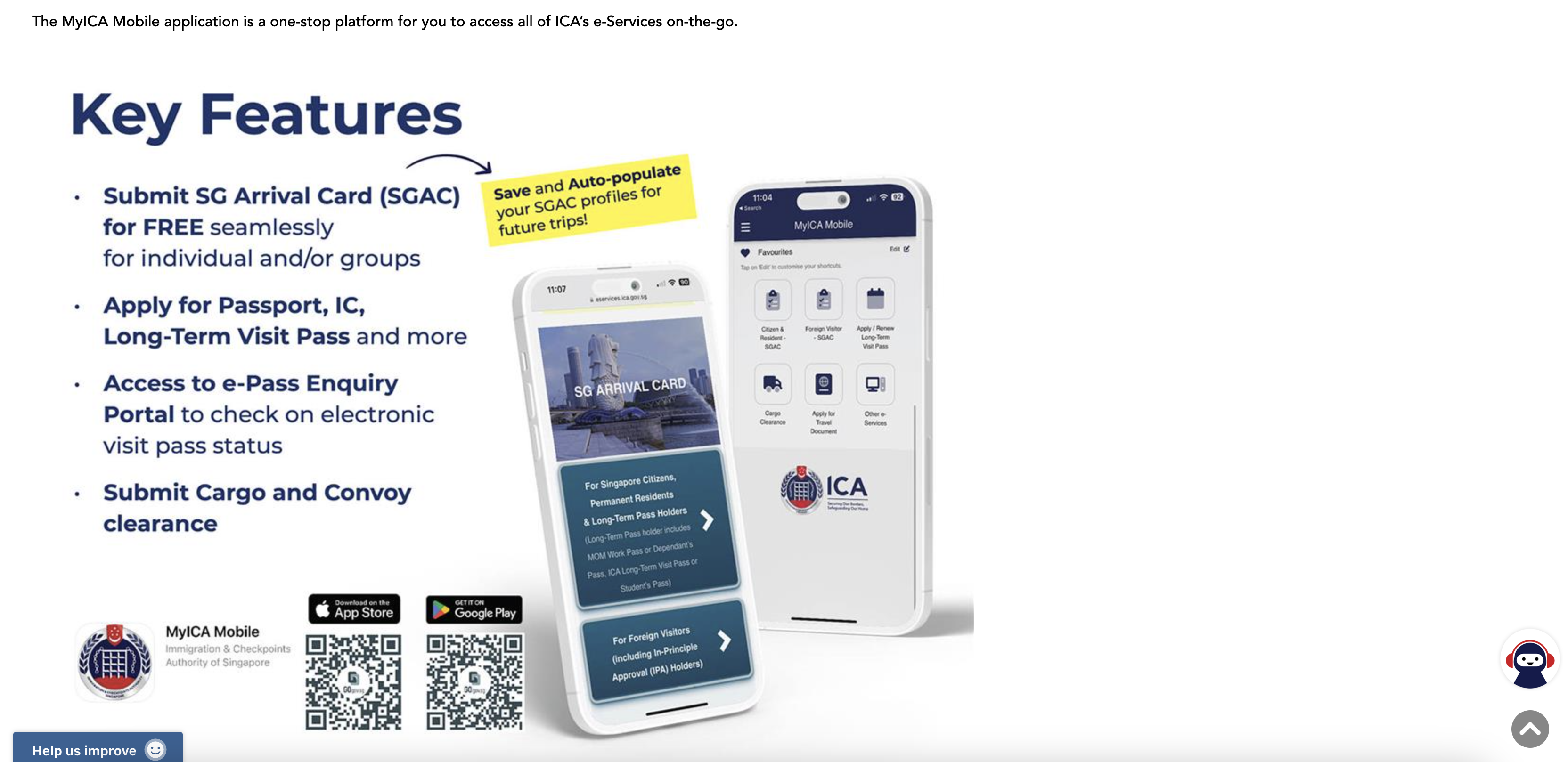

To generate your unique QR code, first, go download the MyICA mobile app.

Image Credits: ica.gov.sg

If you’re a Singapore resident, you can auto-populate your passport details using Singpass or scan your passport’s machine-readable zone with the app’s camera.

Foreign visitors who previously visited Singapore can also auto-populate details by scanning their passports.

Meanwhile, first-time visitors and those re-entering Singapore with a different passport need to present their physical passport.

But they can then use QR codes for future trips.

One QR code for all

To simplify things and save time, you can also generate one group QR code for everyone in a vehicle.

For example, if you’re a family of five, you can store your family members’ passport details on your phone and generate a family-unique QR code.

Or you can also create multiple codes for different groups of up to 10 travelers each.

Which makes sense because we don’t always travel with the same group to JB, right?

Do the codes expire?

As with most things, there’s an expiration date.

Here’s what you need to know:

- Your individual QR code expires after one year or upon your passport’s expiry, whichever is first.

- A group’s QR code expires after one year or the earliest passport expiry of an individual that makes up the group, whichever takes precedence.

With the QR codes generated and stored in the app, you can then scan it at the counter yourself.

Or if you would like, you can also generate individual codes even when traveling in a group.

After the scanning process, officers will conduct face-to-face checks using the QR code data.

For now, there are no dedicated QR code lanes.

But there are plans to open them at Tuas from 2026 and Woodlands’ redevelopment from 2028, 2 to 4 years from now.