Are you in need of quick cash for an emergency? One of the most important factors when considering applying for a personal loan is the interest rate.

Whether you’re planning to go for the Standard Chartered CashOne Personal Loan (as low as 3.48% p.a.) or CIMB CashLite (3.5% p.a.), pause for a moment to think it through.

Ask yourself these questions before getting a personal loan.

#1: Why do you need the money?

There are many reasons you may wish to borrow money. Maybe you’re faced with medical bills or unexpected home renovations.

For those looking to pay off high-interest debt, applying for a personal loan would make sense too. For example, if you have a credit card debt at a 25% interest rate per year, it would be wise to take up a personal loan with a 7% interest rate to consolidate your debts and pay it off first.

Go ahead and get that personal loan if you know it’s for a good cause, such as reducing the interest.

#2: What is the interest rate?

Image Credits: Investopedia

Speaking of interest, here’s our next point.

Before you borrow money, understand that the lender will make a profit by charging you interest. According to Investopedia, interest is a charge applied to you, expressed as a principal percentage. And, of course, a lower interest rate is better for you as the borrower.

However, it’s not as simple as it seems. There are two rates to consider: Applied Rate (AR) and Effective Interest Rate (EIR). In short, AR keeps the loan principal as a constant over the life of the loan. In contrast, EIR calculates the reduction in principal as you pay down the sum.

Do more research if you are unsure of the terms.

#3: Are there other charges?

In addition to interest, there may be additional fees.

Possible charges include a fixed annual fee tagged to borrowing, a late payment fee if you miss a payment, or a change fee if you need to renegotiate your loan terms.

Some banks even charge an early repayment fee as early repayments affect a portion of their predicted profits. Be aware of these possible charges before you move forward with the application.

#4: Can you manage the loan repayments?

Image Credits: The Economic Times

When considering whether to take up a personal loan, you must decide if you can handle the repayments.

Once you know the interest rate, extra fees, and anticipated monthly repayment amount, make necessary calculations from your income to see if you can afford to pay it back.

To do so, you want to write out a detailed budget including your spending needs on groceries, household bills, and miscellaneous expenses. From the breakdown, see if you have enough leftovers to weather an unforeseen financial storm.

Yes, that’s for your rainy days.

#5: How will it affect your credit score?

Lenders use credit scores to decide whether to issue you a loan. Credit scores affect loan terms such as interest rates, tenure, and principal limits.

Your payment history, the ratio of debt to credit, the age and quantity of your accounts you own, and any derogatory reports such as loan defaults can affect your credit score.

If you think you can do without a personal loan this time around, then skip it. Ensuring that your credit is in good shape will help you get a better loan in the future when you seriously need it.

#6: What is your borrowing limit?

Image Credits: Yahoo Finance

Are you aware that The Monetary Authority of Singapore (MAS) has established a Credit Limit Management Measure (CLMM)?

It prevents financial institutions from lending new credit facilities to borrowers with debts greater than six times their monthly income. This credit limit helps to protect borrowers from getting into high debts too much to bear.

And of course, other than CLMM implemented by the authorities, other factors will also affect your borrowing limit. This includes your credit score, monthly salary, and the relationship you have with the bank.

#7: How reliable is the lender?

Be mindful that some people and institutions may not be worth your time and transaction in any situation involving money.

If a lender fails to run a credit check, seems disorganised, or cannot answer basic questions, be wary. You want to deal with a reputable banking institution and not one that agrees to a loan without reviewing your credit history.

#8: When will you get the funds?

Image Credits: Jmc Accounts

Most people seeking personal loans are racing against time. If that is a factor, you want to find out how long is the approval process. From approval to disbursement of the loan, speeds will vary from bank to bank.

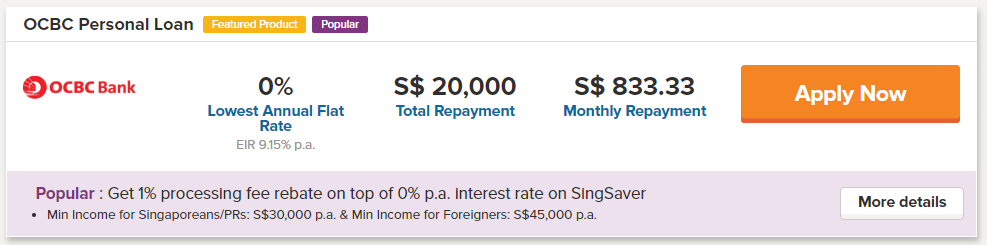

Here are three personal loans promising instant processing times:

- UOB Personal Loan (4.25% p.a.)

- DBS Personal Loan (as low as 3.88% p.a.)

- OCBC ExtraCash Loan (as low as 5.42% p.a.)

Final thoughts

The decision to borrow money should be considered carefully. Evaluating and understanding your loan’s reasons, the interest rates, loan repayments, and more mentioned in this article can help you make the best decision possible when seeking a personal loan.