Singaporeans are known for their relentless drive, balancing demanding careers and personal commitments. A well-structured morning routine can boost productivity and financial success. Here’s how to start your day right.

#1: WAKE UP EARLY

The early bird catches the worm. Many successful people rise before 6 AM to maximize their mornings. Quiet early hours are perfect for planning and reflection, setting a positive tone for the day.

TIP: Gradually adjust your wake-up time by 15-minute increments to make the transition smoother.

#2: HYDRATE & REFRESH

Start your day with a glass of water to kickstart your metabolism. A splash of cold water on your face or a refreshing shower can invigorate you.

TIP: Add a slice of lemon to your water for a vitamin C boost and improved digestion.

#3: GET PHYSICAL

Physical activity increases energy levels and improves focus. Whether it’s a brisk walk, a gym session, or yoga stretches, exercise releases endorphins that keep you positive and energized.

TIP: Try HIIT (High-Intensity Interval Training) workouts if you’re short on time but want maximum results. Or, try a workout at Jewel @ Changi Airport for a view.

#4: EAT A HEALTHY BREAKFAST

Fuel your body with a nutritious breakfast. Opt for a balanced meal with protein, healthy fats, and complex carbohydrates. Try oatmeal with fruits and nuts, a green smoothie, or eggs with whole-grain toast.

TIP: Prepare your breakfast the night before to save time in the morning.

Image Credits: unsplash.com

#5: TRY MINDFULNESS OR MEDITATION

Take a few minutes to practice mindfulness or meditation to reduce stress and increase focus. Apps like Headspace or Calm can guide you through short, effective sessions.

TIP: Spend 5-10 minutes in a quiet space, focusing on your breath and clearing your mind.

#6: PLAN YOUR DAY

Review your goals and tasks for the day. Prioritize your to-do list and break down larger tasks into manageable steps. This boosts productivity and keeps you organized.

TIP: Use productivity tools like Trello to keep track of your tasks and deadlines. Alternatively, keep it old-school by writing in a journal (I prefer this).

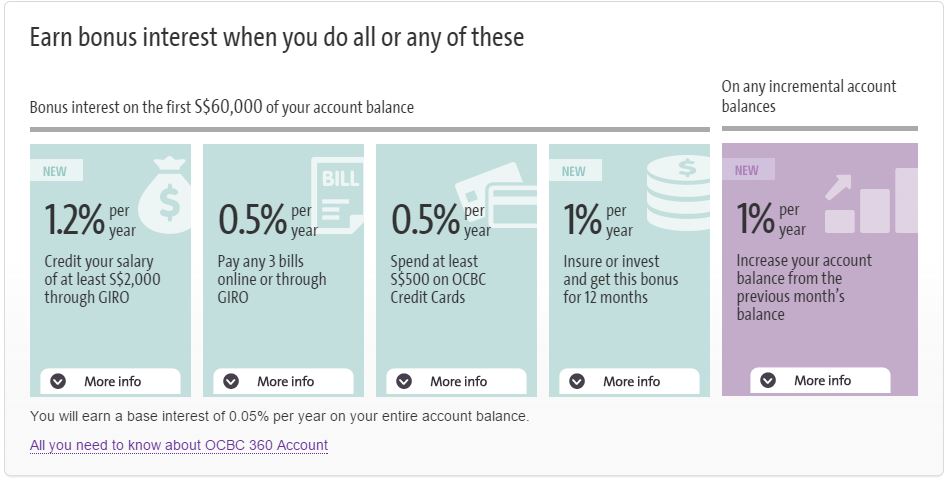

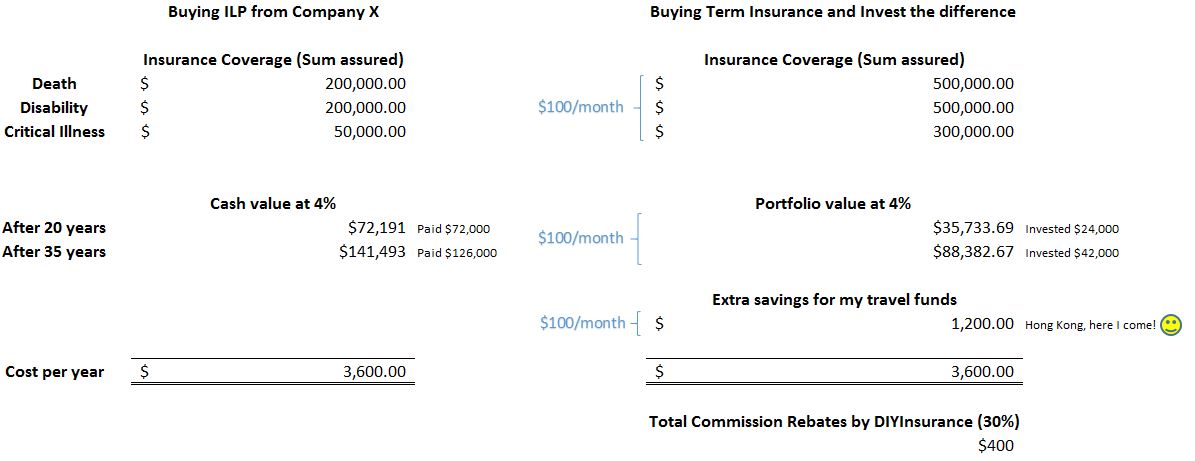

#7: REVIEW FINANCES

Dedicate a few minutes each morning to review your financial goals and status. Check your bank accounts, review your spending, and ensure you’re on track with your savings and investments.

TIP: Set up automatic transfers to your savings or investment accounts to ensure consistent contributions.

#8: LIFELONG LEARNING

Incorporate personal development into your morning routine. Read a book, listen to a podcast, or take an online course. Continuous learning opens up new opportunities and improves your skill set.

TIP: Choose content that aligns with your career goals or personal interests to stay engaged and motivated.

#9: HAVE POSITIVE AFFIRMATIONS

Start your day with positive affirmations. This boosts self-confidence and sets a positive tone for the day. Affirmations like “I am capable of achieving my goals” or “I am confident and successful” can have a powerful impact on your mindset.

TIP: Write down your affirmations and place them where you can see them every morning, such as on your bathroom mirror or next to your bed.

#10: CONNECT WITH LOVED ONES

Spend a few moments connecting with family or loved ones. This can be a fun game session or a quick chat over breakfast. Strong relationships contribute to your well-being and provide a support system.

TIP: Schedule a weekly breakfast date with a family member or friend to strengthen your bond and start your day on a positive note.

Image Credits: unsplash.com

IN A NUTSHELL

A well-crafted morning routine can set the stage for a productive and financially successful day. Start small, and gradually build a routine that works best for you.

Here’s to a more productive and financially rewarding life, one morning at a time!