How you spend your dollar is just as important to your financial health as your decision to save or to pay for debt. Savvy spending habits keep you from overspending on an item or a service. Nobody needs a stack of infomercial items paid for by impulse buying.

Spending smartly by kicking your bad habits to the curb allows your dollar to go further. Lead a resolute year by leaving these spending habits in 2019! A better 2020 is up ahead.

ADDITIONAL ATM FEES

I am guilty of paying for out-of-network ATM fees at the expense of my convenience. I withdraw money from other banking institutions from time to time as it is more favorable proximity-wise. The service fee may be minimal, but it adds up. A good solution is to open up an account at a bank that is more favorable to where you live in or where you work at.

SPENDING MONEY YOU DO NOT HAVE

Many Singaporeans are guilty of spending money that they do not have. How is this so? They spend money through taking loans, cash advances, or credit cards. Spending money you have yet to earn creates a pile of debt for year 2020. It will continue to grow, if you do not fully repay your debt each month.

Image Credits: pixabay.com

Solve this bad habit by cutting down your expenses and relying on your debit card or income to pay for your essentials and wants. Prioritize your needs first.

BOTTLED WATER EXPENSE

Speaking of expenses that pile up, you must look into your bottled water expenses. Water is a necessity, which we cannot escape from. Your daily water consumption can cost you more than S$1,000 per year. Reduce this number by drinking from the just-as-healthy tap water from the tap. In the long run, a little savings goes a long way.

CREATING MORE DEBT

Using debt to pay off your debt is not healthy. You are lying to yourself when you think that you are solving your problems by paying your initial debts with other cards. You are simply shuffling your debt around and incurring more interest in the process.

Using debt to “pay off” debt can only be beneficial if you can transfer a balance from a high-interest rate credit card to a lower limit one. Be careful when you do this. Transferring balance to take advantage of a good rate is different from continually dodging your credit card payments.

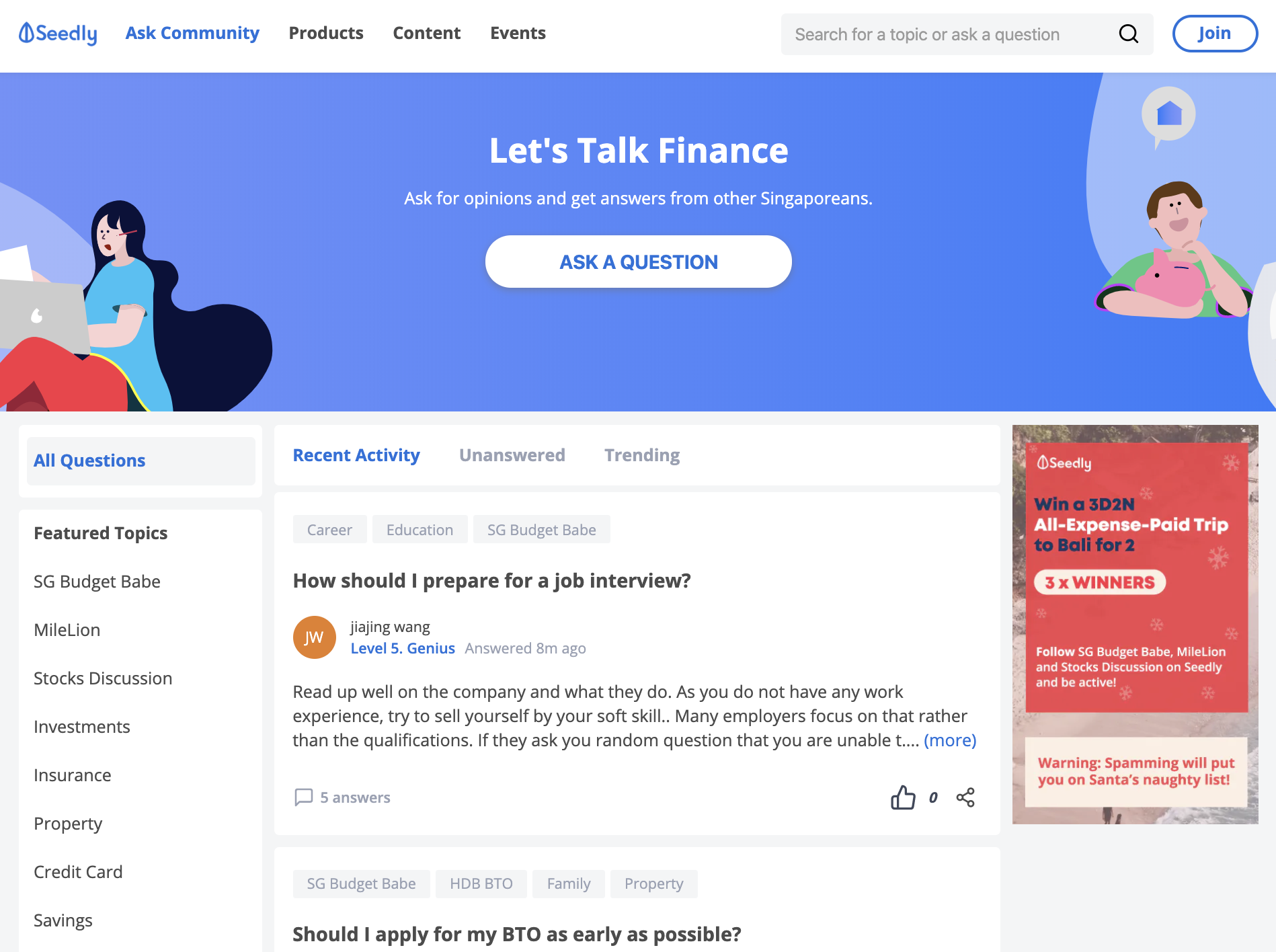

LIVING WITHOUT A TRACKER

Last year, I refrained from using a money tracking app. I lived without a financial tracker to see how my finances will be affected. Interestingly, I spent more within the year than I ever did in the past couple of years. Keeping up with your expenses is a healthy way to ensure your financial health.

Image Credits: pixabay.com

You can either whip out a ledger or download a money tracking app. Start using a budget tool such as Mint or Spendee to stay on top of your spending habits and to eliminate unnecessary expenses.