This is a contribution by Alison, who blogs at www.heartlandboy.com

Readers may be surprised that Heartland Boy is suggesting that an actual banking account, as opposed to some plain-vanilla fixed deposit schemes, offers the best fixed deposit rates in town currently. Ever since DBS launched its DBS Multiplier Programme with headline grabbing interest rates, it has forced its key competitors to react accordingly. As a result, this has spawned a new type of hybrid savings account which typically rewards account holders with significantly higher interest rates than the moribund 0.05%. OCBC has its own OCBC 360 Account while UOB has its UOB One Account. After comparing the various bank offerings, Heartland Boy chose the OCBC 360 Account as he thinks it offers the best fixed deposit rates amongst the local banks.

HOW THE OCBC 360 ACCOUNT WORKS

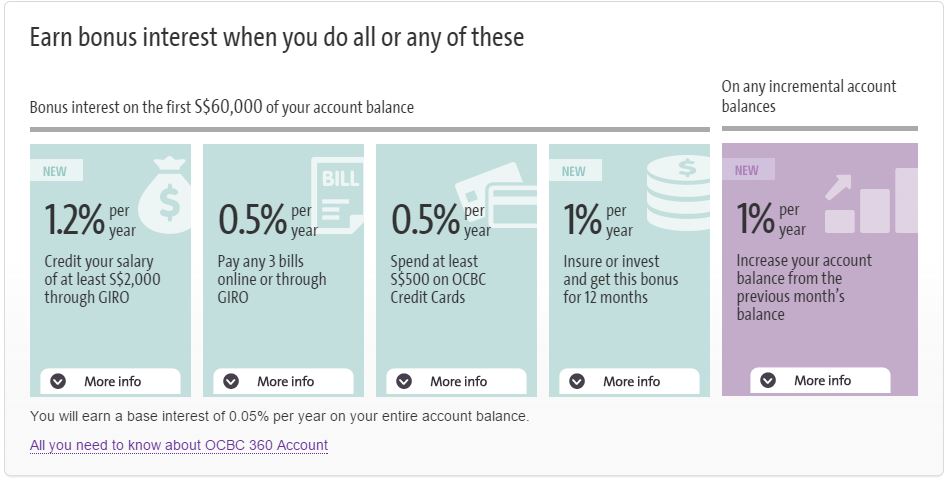

OCBC rewards account holder bonus interests for completing a myriad of tasks. This is in addition to a base interest of 0.05% per annum. The respective bonus interests applicable to the first $60,000 of the account holder balances are:

- 1.2% per annum when your credit your salary of at least S$2,000 through GIRO

- 0.5% per annum when you pay any 3 bills online or though GIRO

- 0.5% per year when you spend at least S$500 monthly on OCBC Credit Cards

- 1% per annum when you purchase a new insurance (eg: Policies of at least S$2,000 in annual premium) or investment product (Unit Trusts or Structured Deposits of at least S$40,000) with OCBC

Source: http://www.ocbc.com/personal-banking/accounts/360-account.html

The bonus interest accumulates and pays when you do all of the above of any of the following. As an illustration, if you satisfy only criteria 1 and 2, you would still be eligible for 1.7% bonus interest per annum.

TIPS ON MAXIMISING THE OCBC 360 ACCOUNT

- Make sure that the salary credited into your OCBC 360 Account uses a code recognised and approved by OCBC in order to earn the 1.2% bonus interest.

- A working adult should easily satisfy the criteria of paying 3 bills online (mobile phone, credit cards, insurance premiums etc). If you do not meet the criteria of paying 3 bills online, offer to help pay some of the household bills, such as broadband or utility charges, online.

- Whenever possible, apply for GIRO so that the bill payments are automated. This ensures that you will never forget and are guaranteed to complete that task.

- OCBC offers plenty of attractive credit cards, such as the OCBC 365, OCBC FRANK, OCBC Robinsons etc. Choose a credit card that is most compatible to your spending habits. For instance, if you enjoy dining out on weekends, you may apply for the OCBC 365 credit card to earn 6% cashback. If you are an online shopaholic, you can earn 6% rebate on OCBC Frank credit card.

- If you are paying bills to an organisation which OCBC Credit Card has a partnership with, you can apply to pay through GIRO for greater bang on your buck. For instance, Heartland Boy’s M1 bills are deducted monthly via GIRO on his OCBC 365 credit card. He gets a 3% cashbackfor setting up a recurring telco bill, as well as becoming closer to achieving the S$500 minimum spending on an OCBC credit card as required by the OCBC 360 Account. That is equivalent to killing 2 birds with 1 stone.

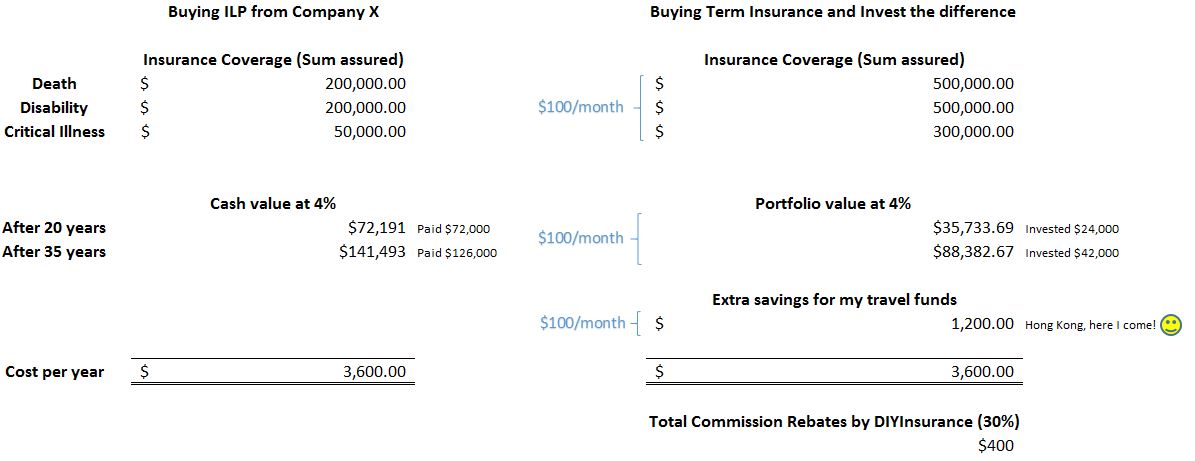

- If you are capable of making your own investments, you may consider forgoing the 1% bonus interest applicable for new insurance or investment products. That is because the expenses and fees that these products typically charge may well exceed the incremental 1% bonus interest that you earn.

- The bonus interest is calculated based on average daily balance, so you cannot “game” the system by withdrawing money at the beginning of the month and depositing money at the end of the month and still hope to get the full interest over the month.

WHAT HEARTLAND BOY LIKES ABOUT THE OCBC 360 ACCOUNT

- Previously, Heartland Boy was using the POSB Savings Account, an account his parents set up for him after he got tired of playing with his piggy bank. This account was paying a miserable 0.05% per annum and yet Heartland Boy continued using it out of habit and convenience. This was despite Heartland Boy knowing that he was actually losing money in real terms as Singapore’s historical average inflation was probably 2% per annum. However, since switching over to OCBC 360 Account, Heartland Boy feels awesome whenever he sees the bonus interest roll into his OCBC 360 Account. It was the same feeling he had when he was a small kid collecting candies after accumulating a series of stamps at the funfair.

- There is no lock-in period and you are free to utilize the savings inside the OCBC 360 Account whenever you need to. This is in contrast to the traditional fixed deposit schemes whereby there is a lock-in period.

- Informing Heartland Boy’s Human Resources Department to change his salary crediting account was surprisingly straightforward. All it took was an email instruction and he only had to do it once!

If you are unconvinced and still fret over the hassle of changing your monetary habits, Heartland Boy can assure you that once you have done it, it will become habitual eventually and you will thank yourself for having done so!