While we were searching for good reads, we came across Cary Siegel’s “Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By”. We’re not even halfway done with the book but already learning so much from the retired business executive.

Here are 12 personal money management life lessons adapted from the book.

#1: Marry someone who has good financial habits

Image Credits: The Straits Times

If you’re already married, you might agree that money is the top reason why couples fight. It could be very much due to a non-full disclosure during the dating process. Singles planning to tie the knot should learn how to facilitate money conversations to identify each other’s financial habits.

Here are some crucial questions you can ask:

- How much debt do you have?

- At what age do you want to retire?

- Do you want to have kids? If so, how many and how soon?

- What is an ideal amount for an emergency fund?

- Are we ready to leave the workforce to be a full-time parent? If yes, which one of us and for how long?

#2: Stay married to the same person

Image Credits: Pinterest

According to Singapore Legal Advice, divorce fees may cost up to S$3,500 for simplified uncontested divorces and S$10,000 to S$35,000 for contested divorces. Let’s not forget about pre-divorce payments, alimony, and child support charges. Need we say more?

#3: Know the cost of raising kids

Image Credits: MindChamps

The obvious expenditures include education, healthcare, clothing, and food. Other costs include moving to a larger HDB flat and getting a new car to shuttle them to school and enrichment classes.

Prudential Singapore has examined various costs involved in the parenting journey. From pregnancy to childbirth and education to recreation, you must plan your finances for the long road ahead.

#4: Buy only when you can afford it

Image Credits: Carsome

When you don’t heed this principle, you will find yourself on a downward spiral to possible bankruptcy. Live below your means, and you will find extra cash to save and invest at the end of the month.

#5: Take care of your stuff

Image Credits: atulhost.com

By stuff, we mean the things you own. It could be your white shirt, your latest mobile device, or even your car. When you learn how to take care of your stuff, you will find them lasting longer over time and requiring fewer repairs or replacements. This equates to more savings!

We wrote an article several months ago with tips to help you apply basic maintenance to your electronic gadgets to help them last longer. Click through the link if you’re keen to find out more details on battery inspection, data clearance, and more.

#6: Build lasting friendships

Image Credits: Visit Singapore

One of the greatest gifts on earth is connecting and learning from people from all walks of life. Whether your secondary school classmates or polytechnic school friends are working within the financial sector or not, there are still personal money management experiences you can tap on from them.

#7: Take away more by giving more

Image Credits: HealthHub

This applies to your career in the early stages. Do you believe that you take away more from your company by giving more? The extra time and effort you’re donating to a work project can return tenfold because you gain valuable skills, knowledge, and experience by doing. Think of it as getting paid to learn!

With that said, those who are forced to work extra hours, make sure your employer is compliant with the Ministry of Manpower’s (MOM) practices. Click here for some FAQs relating to overtime work and rest days.

#8: Spend an hour per week learning about personal finance

Image Credits: ConversionLab

There are tons of free resources online, and a quick Google search can reveal the top-ranking ones. The Straits Times also has an “invest” section you can take advantage of if you’re a subscriber. Don’t underestimate the little hour you spend a week because it’s significant when it adds up over the years.

#9: Enjoy the slow journey to wealth

Image Credits: unsplash.com

Not all millionaires are made overnight. Do a quick search, and you will probably come across several rags-to-riches stories that will inspire you.

Please note that you don’t have to be exactly like any of the high profiles out there because everyone has their set of money management principles. Find your own and be comfortable in your unique journey to wealth.

#10: Pen down attainable short-term financial goals

Image Credits: unsplash.com

Short-term financial goals refer to your quarterly plans or annual ones. This could include the exact amounts for savings and investments. You can also note down personal reward amounts if you’re expecting big purchases. Remember to review your goals frequently and spot the hits and misses.

#11: Set realistic long-term financial goals

Image Credits: unsplash.com

When you have your short-term plans ready, it’s good to spend some time setting realistic long-term financial goals. If you like it, you may call it “the big picture” or “a bird’s eye view”. Long-term goals could mean you look far ahead in 5 years, 15 years, or even more.

Here’s a look at the author’s long-term financial goals when he was 25:

- Buy my next car with cash (within 5 years).

- Pay off all college loans by the age of 30.

- Own a home by 35.

- Attain a net worth of $1 million by the age of 40.

- Own a beach property by age 45.

- Retire by the age of 50.

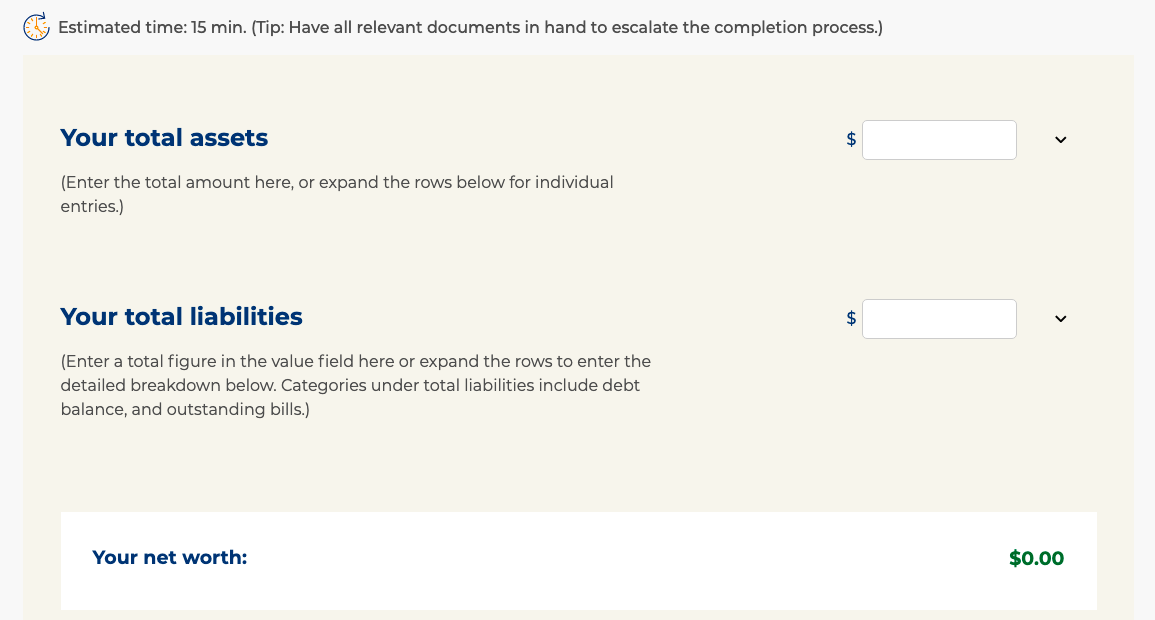

#12: Develop a simple net worth statement

Image Credits: MoneySense

There are online resources available to help you find out your net worth. It’s nothing too difficult to understand. For example, MoneySense has a net worth calculator you can use. All you have to do is input your total assets and total liabilities and let the webpage work its magic.

So what are your thoughts on a peek at Siegel’s “Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By”?

Let us know if you want more insights from his book, and we will prepare them in the coming weeks. If not, you can also grab a copy yourself and be enriched with more personal money management principles to live by. Happy reading!