Picture a curve going up. This is your lifetime money curve. Every decision you make affects the direction of your curve. For example, once you earn money from your first job then, the money curve will go up higher. But living in reality, your money curve are exposed in certain financial pressures such as taxes and bank fees, which, will push the money curve direction down. The good news is that, with a strategic plan that evaluates the potential pressures, you can survive or prevent the downward money curve. This strategic plan is called a Financial Plan.

Financial planning is an important process that draws out your monetary future. It is a process of managing your finances and knowing where you want to go. Here are 5 pointers to guide you…

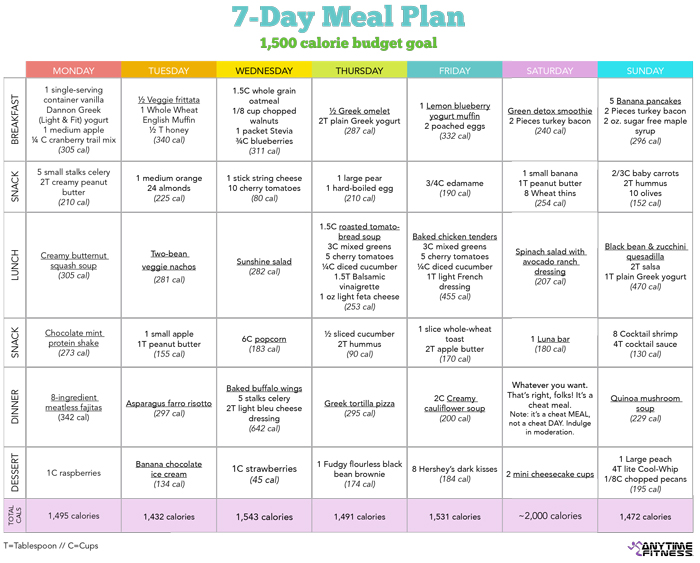

1. INFORMATION GATHERING

In order to manage your finances, the first step is to gather all the important documents (e.g., bank statements, insurance policies, and investment accounts) and financial information. Organize these records by using a folders or filing accessories that will cost less than S$5 at Popular Bookstore or Daiso.

2. EVALUATING

After you gathered all the essential information, you must evaluate all the areas of your financial life including long-term savings (e.g., retirement and college fund), short-term savings (e.g., payment for bills and emergency fund), key documents (e.g., durable power of attorney and will) and insurance (e.g., life and car insurance). Calculating your net worth is also in this step.

3. SETTING GOALS

Following evaluation is goal setting. It involves two things: identifying your goals and knowing what resources you need. Identifying your financial goals both short-term (e.g., staycation in Bali) and long-term (e.g., retirement at 50s) is vital to knowing what your next plan of action will be. After plotting your goals, you must know the resources you will need to achieve them.

4. TAKING ACTION

Since your goals are set, your next plan of action is to decide whether you shall do it on your own or to hire a professional financial advisor. The personal actions you can take may include purchasing life insurance, creating a will, and setting a side money for your retirement. While, hiring a professional can help you reach your objectives in the midst of time your constraints.

5. MONITORING

The last step is monitoring. Monitoring involves tracking your progress and altering your goals based on the reevaluation of your current economic situation.

With a systematic and a holistic Financial Plan, may your money curve take a flight…leading you to success! 🙂

Sources: Entrepreneur and MoneySense