Money issues are some of the main reasons why people end up in divorce court. Money is a touching subject that plays a vital role in any household. If you have enough money, you will be able to meet your basic needs and have some measure of happiness.

There are many reasons why couples have trouble communicating about money. Here are some of them:

#1: DIVERSE MONEY EXPERIENCES

Some Singaporeans have opportunities to learn money management skills growing up; many did not. Money is tight for some, so as adults, people may take steps to avoid the consequences of not having enough money.

How money matters were discussed and handled in previous relationships will affect how people handle their money in their current relationship. Learning how to make wise choices is important.

#2: DISSIMILAR COMMUNICATION STYLES

There are different communication styles that people typically use. While some are passive, others are aggressive. Passive communicators avoid expressing their thoughts and feelings about money. They often feel resentful, anxious, or even hopeless. Aggressive communicators overly express themselves in a powerful manner. These people dominate money conversations.

Lastly, assertive communicators share their thoughts and feelings respectfully. These people know how to listen and reflect on what they are hearing from the other person. Aim for this type of communication style.

#3: DIFFERING MONEY VALUES

When it comes to finances, we tend to spend money on things we value. For instance, a person who values security spends his money on insurance. If someone values freedom, he may throw caution to the wind with their money and spend impulsively.

We decide what our values are through experience, which means they could change throughout our lives. Some factors that influence our values include our educational background, culture, age, gender, socio-economic conditions, marital status, and other expectations.

#4: NEED FOR CONTROL

If you are in a relationship where both people want to be the head of finances, problems can ensue. Different ideas of how control looks like affects how we see our financial futures. Some of us have more controlling personalities than others. However, what if both of you are controlling?

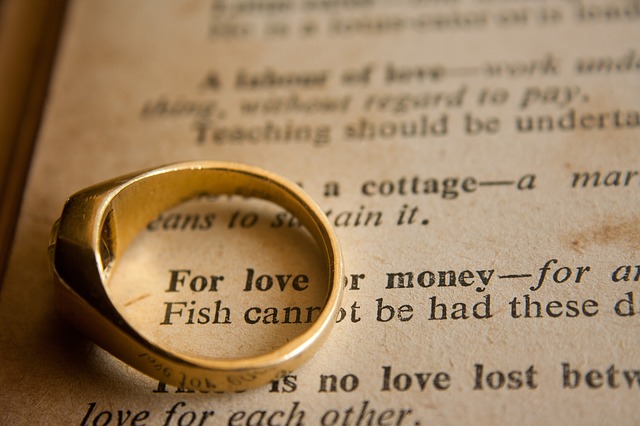

Image Credits: unsplash.com

#5: INCOMPATIBLE SPENDING HABITS

If she likes to eat out and you like to cook at home, the two of you do not see eye to eye about how to spend money on food. Discuss household responsibilities and learn how each other feels. Find a middle ground where you both compromise.

#6: COMPETING SAVING HABITS

A saver and a spender can have different dynamics at home. The saver needs to understand that the spender wants to live a comfortable life, while the spender needs to be more careful and realistic with money.

#7: DISPARITIES IN INCOME

It can be challenging to get along if one person earns substantially more than the other. One of the best solutions for this situation is to let each person pay for bills based on the percentage of total income they earn (per month).

Do not let these seven elements become obstacles that get in the way of your relationship. Create a schedule for regular money discussions.