Singapore investors love their dividend stocks. According to the Investment Trends Singapore Broking Report 2015, 75% of investors polled stated that they usually invest in dividend stocks when trading on the Singapore market. And they are spoilt for choice! Many companies that list on SGX pay dividends. But with so many dividend-paying stocks out there, which stock would you consider?

A High Dividend Yield Stock: Better than a Low Dividend Yield Stock or?

That is the question. The stock with the highest dividend yield in the industry may look attractive now, but is a stock with 10% dividend yield better than one with 3% in the long run? Does a high yield stock always outperform a low yield stock?

High dividend yield should not be taken at face value. It always pays to dig deeper and find out the real story behind certain attractive numbers before deciding to invest.

Companies with a high dividend yield compared to the market average may not necessarily equate to companies with good financial performance. The high dividend yield could be the result of declining share price due to weak fundamental such as inconsistent earnings, high debt etc. Besides, high dividend yield may not be sustainable. If earnings fall, the management may cut dividends or eliminate the pay-out altogether. Hence, investors should also look at companies with consistent dividend payouts and with the cash flows coming from actual core operations.

A Dividend Growth Strategy

If a stock with a high dividend yield is not necessarily the best choice for long-term investors, then what other strategies are there? A dividend growth strategy for one, is something you might want to learn more about.

To clarify, dividend yield is the dividend amount divided by the share price. Dividend growth meanwhile is how much the dollar-amount of dividends given out increases each year.

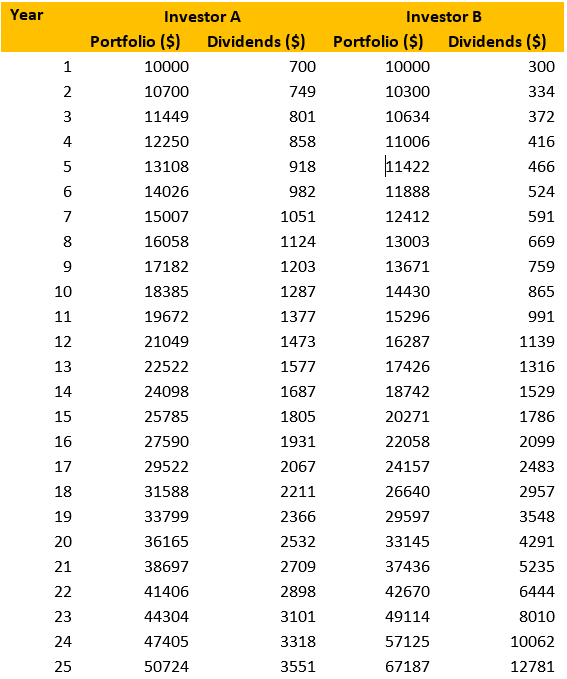

Take this hypothetical example which compares the performance of two investors (based on certain assumptions where indicated).

Investor A: Invests in ABC Company which pays 7% dividend yield at the outset and every year after that.

Investor B: Invests in XYZ Company which pays 3% dividend yield at the outset.

XYZ Company has a lower dividend yield because they choose to reinvest some of their earnings into the business. The business grows, and so does their dividend pay-out – to the tune of 8% every year (e.g. $0.03 dividend per share in year 1, $0.032 in year 2).

Assume that the share prices for both of these companies remain unchanged for 25 years and both investors reinvested their dividends every year. Their performance can be found in the table below.

The Results

Investor A, the high yield investor, beats Investor B during the beginning years but the dividend pay-out and portfolio value of Investor B caught up in year 16 and 22 respectively. In the end, the total dividends received by Investor B are more than 3 times that of Investor A.

So, while Investor B received low pay-outs initially, he was rewarded with future growth. This is the underlying principle of the dividend growth investing strategy. Length of the period of investment would also affect the total dividends received.

Finding Dividend Growth Stocks

That will be the next question on your mind if you want to explore using a dividend growth strategy. Stock screeners come in useful here. A stock screener allows you to choose certain criteria, and to find stocks that fit the criteria you have selected.

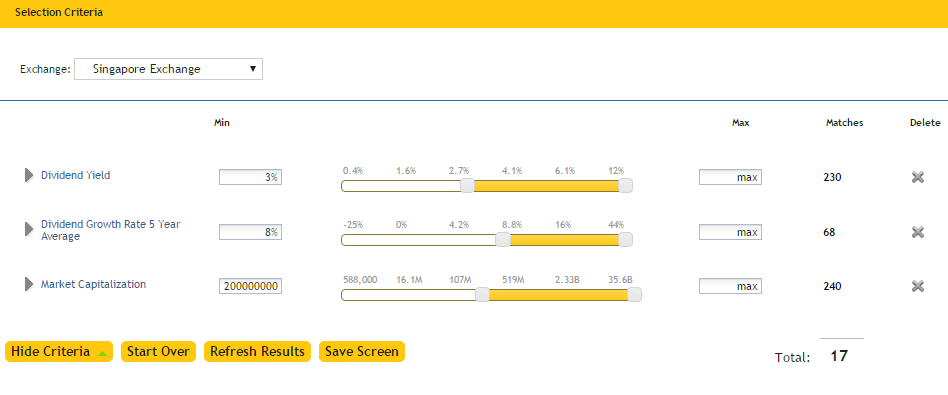

Here is a set of criteria that could be used to pull dividend growth stocks:

- Dividend yield>3%

- Market capitalisation>200 million

- Dividend growth rate (5-year average)>8%.

The stock screener below, for example, has found 17 stocks that match the above criteria. This provides a good starting point for investors to do further research into these specific stocks. Try to come up with your own set of criteria and see how it works.

Source: Recognia Strategy Builder on Maybank Kim Eng’s KE Trade platform as at March 2016