Heard of Lombok?

I first saw it via an article somewhere and did a search because it was my first time hearing of the name too.

Anyway, if it’s your first time too, Lombok is apparently an Indonesian island east of Bali and it’s only less than 3 hours from Singapore.

Flight time, yeah?

I think it’s a lesser-known area worth exploring if you’re into beaches, surfing, and snorkeling.

So to aid you in your planning, here’s a quick list of well-rated resorts and villas in Lombok, Indonesia to stay in 2025.

Thank us later!

Pearl Sunset Resort

Agoda Rating: 9.4 (1.6K+ reviews)

First up at Pearl Sunset Resort, you can access the sands of Gili Trawangan Sunset Beach in a six-minute stroll.

Stake your claim on a sunbed with an ice-cold cocktail from Malibu Beach Club and soak up the Indonesia sunsets while waves lap at your feet.

When it’s time to turn in, take your pick from deluxe rooms to suites overlooking the sea.

Royal Avila Boutique Resort

Agoda Rating: 9.4 (720+ reviews)

Or consider this resort on a cliff’s edge between a turquoise sea and hillsides.

The Royal Avila Boutique Resort is a 5-star Lombok accommodation mere minutes from Malimbu Hill, one that seduces with luxury and Balinese magic.

Whether it’s a premier room you book or you choose to splurge on an oceanview suite or penthouse, picture-postcard scenery awaits.

There’s also an on-site infinity pool overlooking the waves.

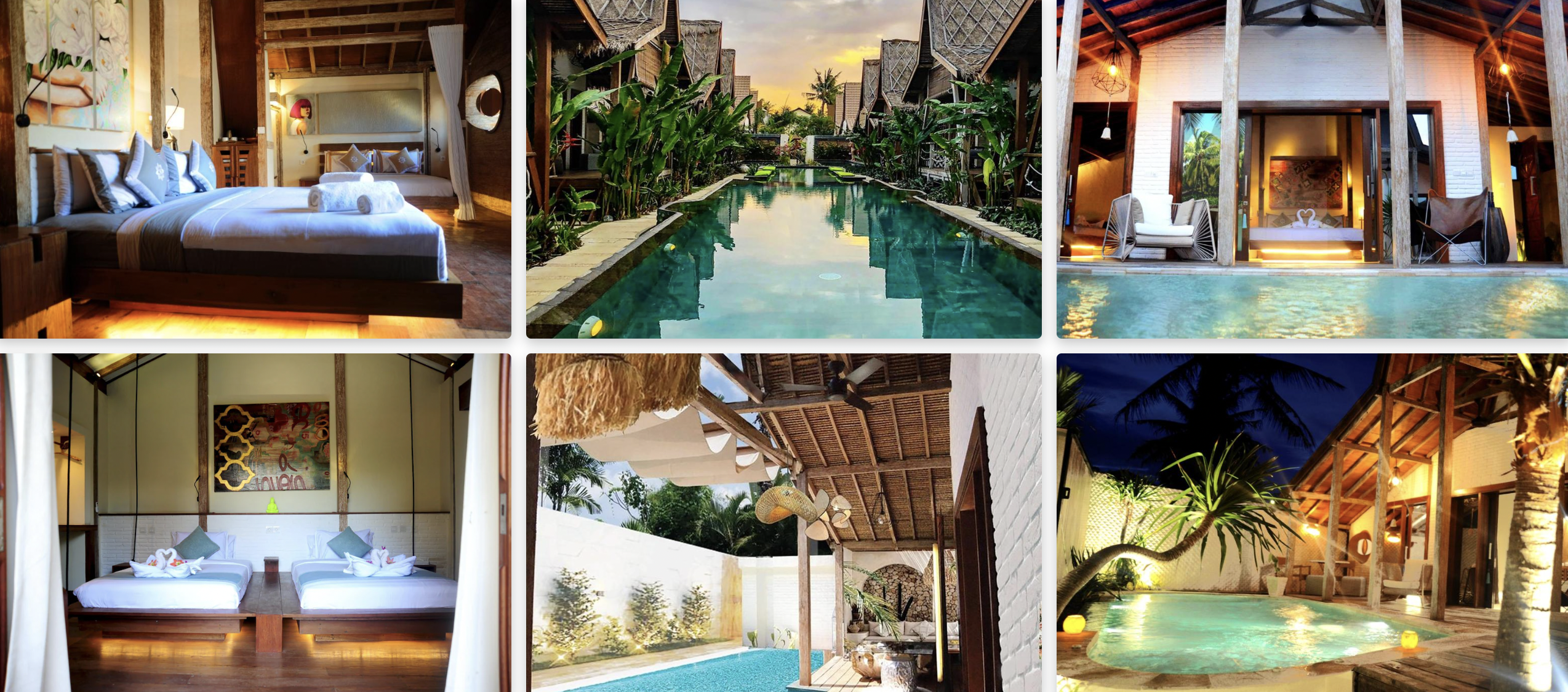

Kaleydo Villas

Agoda Rating: 9.4 (720+ reviews)

Here’s your slice of paradise just 500 m from La Cala Beach Club Gili Trawangan.

Kaleydo Villas offers various villa options including deluxe twin and family villas.

Honeymoon villas are available too!

For indulgence at its peak, you may want to book a villa with a private pool for undistracted dips under the stars.

Of course, you will also have access to the shared pool when you’re in the mood to see other humans.

However you spend your days in Lombok, returning to your Kaleydo villa is like the cherry on top.

The Oberoi Lombok

Agoda Rating: 9.4 (670+ reviews)

Next, we have The Oberoi Lombok, a 5-star beach resort with its stretch of sand and blue waters just steps away.

Unwind in pavilion rooms, luxury villas, or royal ocean-view villas with private pools.

The resort’s location is right on The Lombok Lodge Beach and a walkable distance to Medana Bay Marina Beach means more shores to explore.

Shape up at the on-site pavilion-style gym if you’d like or opt to lounge poolside if calorie-burning isn’t a priority.

For home-like stays, the royal villas offer full kitchenettes.

The Chandi Boutique Resort

Agoda Rating: 9.3 (1.4K+ reviews)

Last but not least, situated just a short stroll from the Makam Batu Layar scenic spot and a 6-minute drive from Senggigi Beach, we have The Chandi Boutique Resort offering various room options including standard ones and garden/ocean villas.

The pool area also has ocean views—a great spot to sip a cocktail and watch the sunset.

Speaking of drinks with a view, the resort also offers al fresco dining.