Investing is a pursuit that suits many. An ideal means of increasing your income and boosting your bank balance, it also offers excitement, challenge, and complexity to those seeking a new and compelling pastime.

It’s common for those thinking of investing to struggle at the start of their venture. Many people simply don’t know where to begin, and with so many instruments and options to consider, this is hardly surprising.

So, to help you gain a head-start, here are three of the best investment options to add to your portfolio…

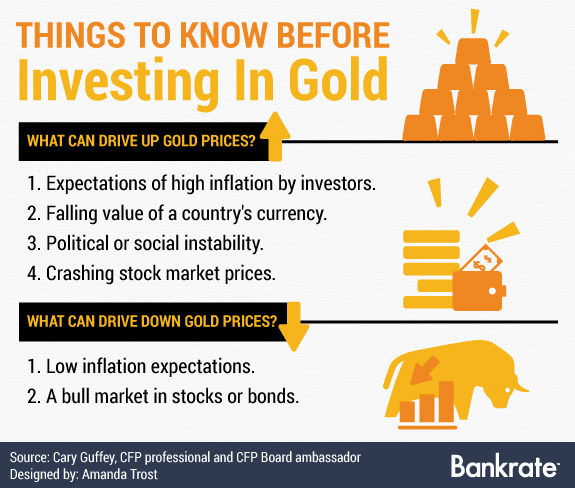

#1: Precious Metals

Precious metals are always a good starting point for those who choose to invest, and this is largely down to their ‘safe haven’ properties. Gold, in particular, tends to hold its value during periods of economic turmoil, and indeed often sees an increase in its price tag when times are tough. Silver acts in a similar way, but has the added advantage of enjoying a surge in popularity thanks to its growing usage in industry. With products as diverse as cars, cameras, and even industrial machinery utilising it, it’s worth looks set to continue booming throughout 2016, making it an ideal addition to your portfolio.

#2: Forex

For those looking for a more high-risk venture than precious metals can offer, the foreign exchange might be worth considering. Trading around the clock, the currency markets are flexible, accessible, and have the potential to be highly profitable. Indeed, with a reputable broker like OANDA to aid them, many investors enjoy significant successes. Although the risks can be just as great as the potential rewards, forex trading remains an ideal challenge for those looking for excitement, exhilaration, and the chance to make big money.

#3: Shares

Thirdly and finally, look at investing in shares. The stock markets are filled with a wide variety of different businesses, all offering you the opportunity for part ownership. A lot of inexperienced investors, in particular, gravitate towards these, thanks to the familiarity of the names that you’ll be trading. Offering a unique chance to play a role in the future of your favourite companies, as well as the possibility of making some tidy profits, the stock markets can be an ideal addition to any investor’s portfolio.

Choosing the assets that you add to your portfolio is essential to your success on the financial markets: choose well, and profits are there for the taking; choose poorly, and you could scupper your opportunities. Do your research, make your selection with care, and secure the future you’ve been dreaming of.