FRAUDS

SCAMMERS

PHONIES

CON ARTISTS

IMPERSONATORS

All these people share one mission: to use different techniques in order to acquire your hard-earned money. Here are some of the methods that you must watch out for:

1. FAKE CHECKS

Fraud artists employ diverse types of scams in order to get substantial amount of money or to get what they want. One of the most common type of scams is the “fake cheque or check”. Fake check occurs when the artist curates counterfeit checks that seem legitimate. From watermarks to routing numbers, these comprehensive checks can fool the novice eye easily!

Artists use these checks to deposit money to their temporary bank accounts or to pay for a company’s products or services. This is why you must be vigilant when accepting checks. The first step to ensure that the bank or the institution that issued the checks really exists.

Prevention: You do not want to fall prey to checks that are not genuinely from DBS. Is that watermark really pertain to the Development Bank of Singapore or is it from the institution called Doing Bountiful Scams?

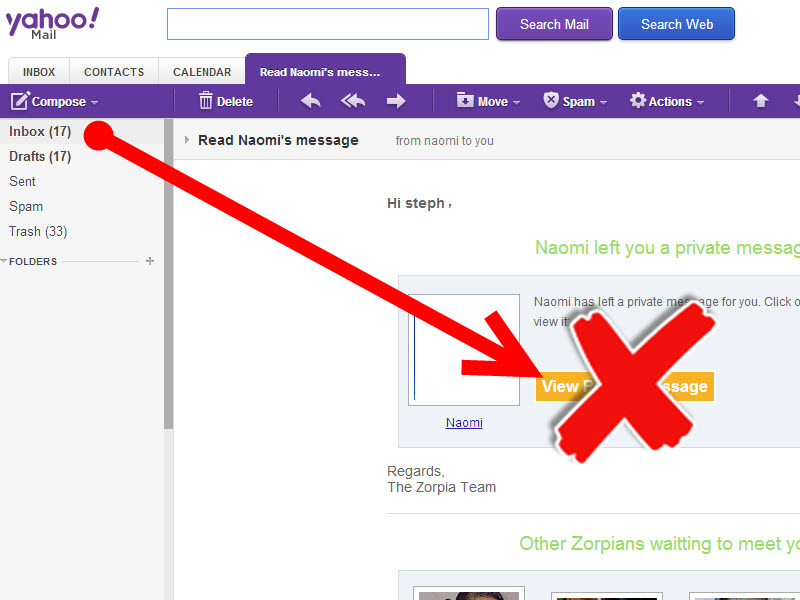

2. FAKE BANK EMAILS

Transacting or sending funds online can be convenient but, it can make you vulnerable. I am not completely discouraging online funds transfer or remittance services. Singapore is the most secure Asian country for data privacy after all. According to a recent survey by Artmotion, our nation received a relatively low risk score of 1.9%. It was even ahead of other powerful nations such as USA and UK.

What I am telling you is that providing information for your online activities can put your identity and your wealth at risk.

Prevention: Avoid this by being cautious at all times. For instance, no financial institution will ask for your sensitive information directly thru email. Providing information for your online activities can put your identity and your wealth at risk. To avoid this, you must be informed and cautious at all times.

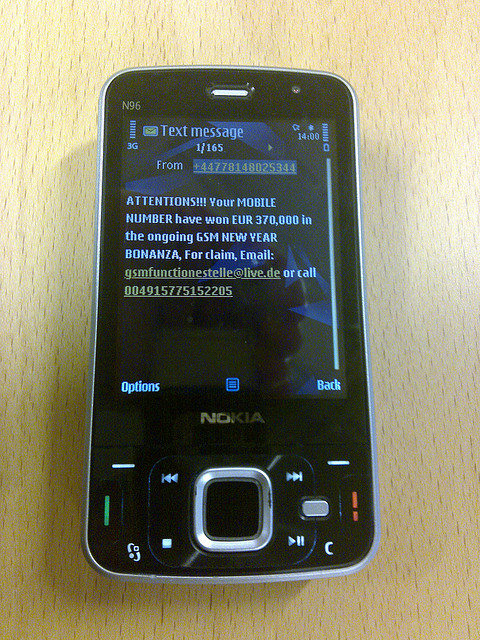

3. FAKE CUSTOMER SERVICE NUMBERS

Whenever I am in urgent need of professional help at home (e.g., plumber, technician, or locksmith), I immediately search for the service numbers online. You cannot blame me! This is the most convenient and quickest method that most people utilize. Scammers noticed this trend and created a scam called the “fake customer service numbers”.

Believe it or not, some people can receive messages online without a handphone or fake the contact numbers itself. Fraud artists purchase contact numbers that are similar or close to the authentic customer service numbers used by several financial institutions.

They buy the advertisement slots on the top of the search engines in order for the fake number to appear first. It is a such a clever tactic, to say the least. Clients who are in a rush can get trapped by these familiar looking numbers. Imagine the impact if these clients divulge sensitive information such as their credit card details!

Prevention: Proceed to the official website and use the customer service hotlines that are displayed there. Or, you may use the numbers written at the back of your credit card.

4. FAKE APP UPDATES

What do Instagram, Messenger, WhatsApp, and Snapchat have in common? They are quite addicting and most Singaporeans are hooked the moment that they were released. So when a new update such as Instagram stories comes along, people are quick to tap the necessary buttons.

Fraud artists can send blast emails that target the said app’s users. Enclosed in this email is a link or a button that directs the users to the pseudo update. Everything looks legitimate in its face value. However, the redirection includes a malware attack to your system. The malware that you downloaded may copy your all your passwords and personal details including your bank accounts. The attack is vicious and fast-acting!

Prevention: Developers seldom send you updates thru email. Updates are usually prompted in the application store or in the app itself. When you receive spams like the ones mentioned above, please confirm with the official customer service hotline first.

Next time you encounter tricky circumstances, it is up to you to outsmart the fraud artists!