Are you the sort that never plans for rainy days?

Life is full of surprises, and they’re not all the good kind. If a sudden big expense pops up, you might go into panic mode. Best to start building your emergency fund now and make it a minimum of 3 to 6 months of your usual spend.

With an emergency fund, you can sleep more peacefully at night knowing you’ve got a financial cushion if life throws curveballs your way. Take control of your money situation now for less stress and more stability overall.

Strategies for building your emergency fund

- Cut out non-essential spending

Go through your monthly expenses and trim whatever you can, like eating out daily, entertainment, or subscriptions. Then redirect that money into your emergency fund. Even reducing discretionary spending by $50 a month can make a big difference over the course of a year.

- Save a fixed amount regularly

Set up an automatic transfer of a fixed amount, say $100 per month, from your paycheck or bank account to your emergency fund. The amount depends on your income and expenses, so start with whatever you can afford. The key is to save regularly, even if just a little bit. Over time, you will build up a good amount.

- Deposit any windfalls

When you receive unexpected money like a work bonus, cash gift, or even a government payout, put all or a portion of it into your emergency fund. Windfalls are a great way to give your fund balance a quick boost.

Where to keep your emergency fund

- High-yield savings account

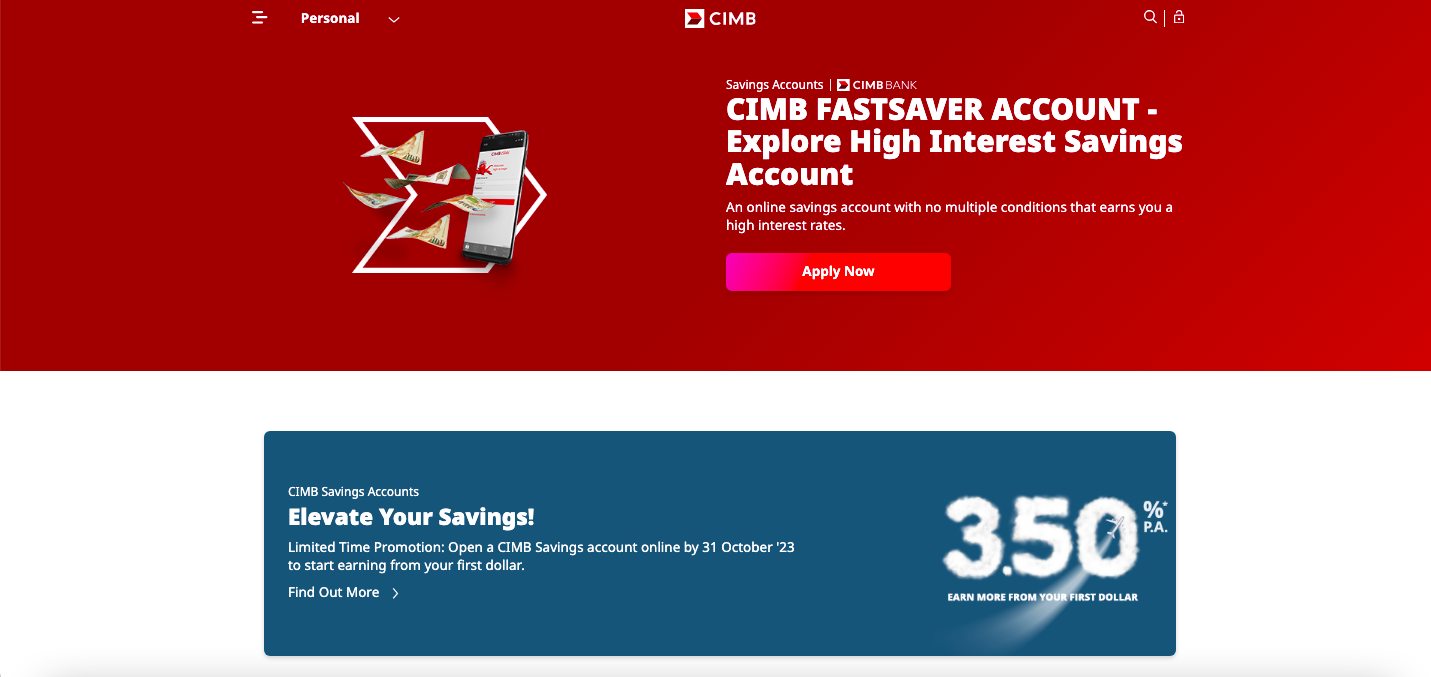

High-yield savings accounts are very liquid, meaning you can withdraw your money anytime without penalty. The interest rates are usually higher than normal savings accounts. Some recommended options are CIMB FastSaver (easy to start) and DBS Multiplier (easy to maintain).

- Fixed deposits

Fixed deposits lock in your money for a fixed period, usually a few months to a year. In return, you will get higher interest rates than savings accounts, up to 3 to 4% per year. If you need to withdraw early, most banks will charge a penalty fee. So only put in money you won’t need for a while.

- Singapore Savings Bonds (SSBs)

SSBs are issued by the Singapore government and you can earn up to 3%+ interest per year and your money is pretty safe. The catch is your money will be locked in for 10 years. Withdrawal is possible but you will need to pay a small fee.

- Cash management accounts

Cash management accounts are a good option if you want to earn higher interest (fluctuates) but still maintain liquidity. However, they aren’t guaranteed by the Singapore Deposit Insurance Corporation (SDIC) so do your thorough research before jumping in.

Saving for your emergency fund is important and you better start saving now before the next financial crisis comes knocking on your door. Even saving $50/month can go a long way. Remember, you want enough to cover at least 3 to 6 months of essential expenses in case anything happens. Once you hit your target, don’t stop—keep adding money whenever you can. The more you save, the more prepared you will be for unexpected events. Saving money may not be the most fun thing to do every month, but having that emergency fund will guarantee plus chop give you that peace of mind if life takes a wrong turn.