Investing is the act of allocating your money in the hopes that you will achieve a profit in the future. The money generated from your investments can provide income and fulfillment of long-term financial security.

Now is the ideal time to start investing! Allow me to convince you with these “6 Essential Reasons Why You Should Learn To Invest”.

#1: WORK SMARTER, NOT HARDER

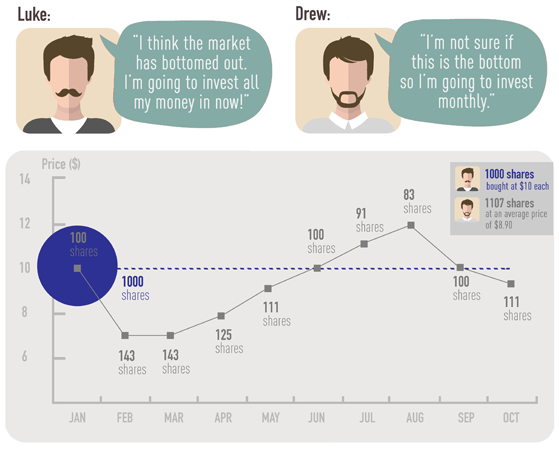

Many people do not think about investments until they are well into their 20s or 30s. Although opportunities to invest may come before that, investing is not something that is automatically embraced by all. Do not panic! You can become an investor at any age.

The sooner you open an investment account, the better it will be for your financial future. Take advantage of the greatest asset of all – time. Investing while you are young gives you the chance to work smarter. Would you rather save a considerable amount of money every year or save a huge amount of money later in life? Think about that.

#2: GET MORE EARNING POTENTIAL

Investing your money allows you to grow your wealth. Most investment vehicles such as stocks and bonds offer returns on your money over the long run. The return allows your money to build over time.

The money you build can be used to create a business or expand your existing one. Many investors support entrepreneurs and contribute to the creation of new products and new jobs. The more successful entities you have backed up, the stronger your returns will be.

#3: SAVE FOR RETIREMENT

Let us face it! You need to be prepared for your retirement. You should save money for retirement as you are working. You can put your retirement savings into a portfolio of diversified assets such as real estate, precious metals, stocks, mutual funds, and bonds. As soon as you retire, you will be able to live off from the funds that you have earned.

Base your personal tolerance of risk on your age and lifestyle. You may employ greater risks to increase your chances of earning greater wealth in your younger years. Becoming more conservative with your investments as you grow older can be wise.

#4: POWER OF COMPOUND INTEREST

Learning about investments will enable you to know the power of compound interest. Compound interest allows your money to make more money for you. It pays to invest early and often. The longer your money can benefit from the power of compound interest, the higher your gains will be as time goes by.

Say you invest S$1,000 this year and you earn a 10% return on that. This means that you will end up having S$1,100. If you do not contribute anything next year, you will still make money through the compound interest. Instead of earning another S$100, you will earn S$110 because you are getting 10% from a balance of S$1,100. You will have S$1,210 by the end of next year.

#5: DIVERSIFY YOUR ASSETS

You need to diversity your assets as your investments make one part of your financial picture – not all of it. You should not keep all your money in cash, in your house, or in your car. Instead, invest in a variety of categories to cushion unforeseen losses. It makes more financial sense to keep your emergency fund, your house (real estate), your hard assets (e.g., car), and your portfolio of investments.

#6: REACH YOUR FINANCIAL GOALS

Image credits: pixabay.com

Learning how to strategically invest your money allows you to reach your financial goals. If your money is earning a higher rate of return than your savings account, you will be able to earn more money within a faster period. This return on your investments can help you reach your financial goals such as buying a car, starting your own business, or putting your children through university.