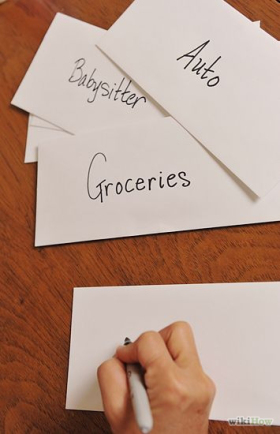

Grocery shopping can be costly at times especially because businesses are becoming more competitive in their prices. And if you were to use a credit card, be sure to indulge on all of its rewards by paying the bill in full each cycle. That said, here are the 5 Best Credit Cards For Your Grocery Shopping in Singapore…

5. OCBC 365 CREDIT CARD

Minimum Annual Income (Singaporean/PR/Foreigner): S$30,000

Do you want a card that allows rebates on your daily spending – all year round? Well then, say hello to the OCBC 365. It has rebates from grocery shopping, telecom bills, petrol, and dining. Waived for 2 years, the annual fee is S$161. Get 3% off on supermarkets islandwide, on recurring telecom bills (e.g., SingTel, StarHub, and M1), dining on weekdays, and on all your online spending (e.g., travel, movie tickets, and fashion).

4. ANZ OPTIMUM WORLD MASTERCARD CREDIT CARD

Minimum Annual Income (Singaporean/PR/Foreigner): S$80,000

ANZ Optimum World is an all around card with a touch of personalization. It gives you the decision to select your preferred category for a calendar quarter wherein you can earn 5% cash back and 1% cash back on all other spending. You can choose to have grocery, dining & leisure, travel, and shopping as your category. The best things is that there is no minimum spend and no limit on your total accumulated rebate! The annual fee is S$180, waived for a year.

3. CITIBANK SMRT PLATINUM VISA CARD

Minimum Annual Income (Singaporean/PR): S$30,000

As the name implies, Citibank SMRT Platinum Visa will give you good savings for your public transportation. Surprisingly, it is also good for grocery shopping. Get up to 7% savings on Fairprice, Sheng Siong, and Giant. Just pay an annual fee of S$161, waived for 2 years.

2. NTUC PLUS! VISA CREDIT CARD

Minimum Annual Income (Singaporean/PR): S$30,000

NTUC Plus! Visa will give you a whopping 10% off from all the items at FairPrice and FairPrice Online. What’s more? You can save up to 5% off at Unity, 3% off at Popular bookstore or Bata shoes, and 18% off at Esso fuel stations. All you have to do is pay an annual fee of only S$39 – waived for 2 years!

Minimum Annual Income (Singaporean/PR): S$30,000

Does 10% rebate at groceries and pharmacies sound tempting? Then, UOB Delight Card is perfect for you. Enjoy up to 10% off at Cold Storage, Jason’s, Giant, Market Place, and Guardian. To qualify for this, you must have a minimum spend of S$100 a month and pay an annual fee of S$87. Buying in bulk? Get a free home delivery at selected Giant Hyper with minimum S$150 in a single receipt.