Turn your spending into miles, cash backs and other exclusive perks.

Whether you want to enjoy cash back or accumulate miles, credit cards when used responsibly can be a way to stretch your dollar further. Wouldn’t it be great to save a little on things you usually spend on? Besides perks and convenience, you can also build a positive credit history when you make your repayment on time! The key is to use them wisely.

SingSaver.com.sg, one of Singapore’s one-stop comparison portal, has turned 3 this year. To celebrate this milestone, users who use their portal and sign up for any of the credit cards will get extra sign-up bonus in addition to the bank’s welcome gift when you apply for these cards. Forget roadshows. This is the real deal. Did we say more than $500 cash and shopping vouchers or more? (Yes, the cash will be deposited into your designated bank account.)

Sign up for more than one and receive multiple welcome gifts:

- 1 Credit Card = Up to $150 Cash

- 2 Credit Cards = Up to $300 Cash ($150 + $150)

- 3 Credit Cards = Up to $300 Cash ($150 + $150) + Samsonite Luggage etc

- .. and so on

Start applying here now or by clicking on the cards below.

Travel Credit Cards

1. American Express Singapore Airlines KrisFlyer Card

With a minimum income requirement of S$30,000, this is probably one of the easiest to qualify for those who want to turn their spending into free flights. It is also one of the most convenient way to earn KrisFlyer miles since all miles earned are automatically credited to your KrisFlyer account with no conversion fee!

- Earn 1.1 KrisFlyer mile for every S$1 spent on all your eligible purchases with your Card

- Earn 2 KrisFlyer miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases during June and December.

- Earn 3.1 KrisFlyer miles for every S$1 spent on Grab and Uber rides, up to S$200 each calendar month.

2. American Express Singapore Airlines KrisFlyer Ascend Card

More miles and more rewarding privileges. The American Express® Singapore Airlines KrisFlyer Ascend Credit Card earn more miles on every S$1 spent. It also gives you complimentary airport lounge access 4 times in a year and a complimentary night with Millennium Hotels and Resorts.

- Earn 1.2 KrisFlyer miles for every S$1 spent on all your eligible purchases with your Card

- Earn 2 KrisFlyer miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases during June and December

- Earn 3.2 KrisFlyer miles for every S$1 spent on Grab and Uber rides, up to S$200 each calendar month

3. Citi PremierMiles Visa Card

Earn your miles faster with one of the best cards for your travel needs. The Citi PremierMiles Card lets you redeem from the widest range of airlines, where 1 Citi Mile = 1 Mile, with KrisFlyer, Asia Miles, Qantas, Qatar, Flying Blue, and more. With no caps on miles earned, redeem your miles for flights, hotels and merchandises. You can also receive up to 42,000 bonus miles as welcome gift.

- Earn 1.2 miles for every S$1 spent on all your eligible purchases with your Card

- Earn 2 miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases

The card that offers you the highest local and overseas earn rate all year round. The UOB PRVI Miles Card lets you earn 1.4 for every S$1 spent locally and 2.4 miles on every S$1 spent overseas. Earn 6 miles for spends on major airlines and hotels booked through Expedia, UOB Travel, and Agoda.

With no minimum spend and cap on miles earned, every spend adds up to free flights. Redeem miles from over 40 partner airlines and complimentary personal accident and travel inconvenience insurance coverage of up to S$1,000,000.

The new OCBC Titanium Rewards Card now gives you more rewards points in more places. Whether you shop online or in stores, locally or overseas, or pay using mobile payments – you now earn 10x OCBC$ for every S$1 spent on selected categories – equivalent to 4 miles for every S$1 spent!

The Titanium Rewards Card should be in miles collector’s portfolio because of its high miles per dollar rate, and also because mobile payments also qualify for 10X OCBC$ (4mpd), you don’t have to worry whether your spend belongs to any qualifying categories. As long as Android/Samsung/Apple Pay is accepted, you can be sure you will get your 10X bonus!

Dining Credit Cards

1. Standard Chartered Rewards+ Credit Card

Live large with the new Standard Chartered Rewards+ Credit Card. Earn up to 10X rewards points with every S$1 spent on foreign currency and more. No minimum spend required.

- Get up to 10X rewards points for every S$1 spent in foreign currency on overseas retail, dining and travel transactions. No minimum spend required. (Rewards+ Card Promotion T&Cs apply)

- Get up to 5X rewards points for every S$1 spent on dining transactions. No minimum spend required. (Rewards+ Card Promotion T&Cs apply)

- Get 1 rewards point for every S$1 spent, on all eligible spend. No minimum spend required. (Rewards+ Card Promotion T&Cs apply)

Enjoy 1-for-1 Platinum Movie Suites Tickets with Cathay Cineplexes².

Apply now and make 5 qualifying transactions on your mobile wallet to receive up to $120 cashback.

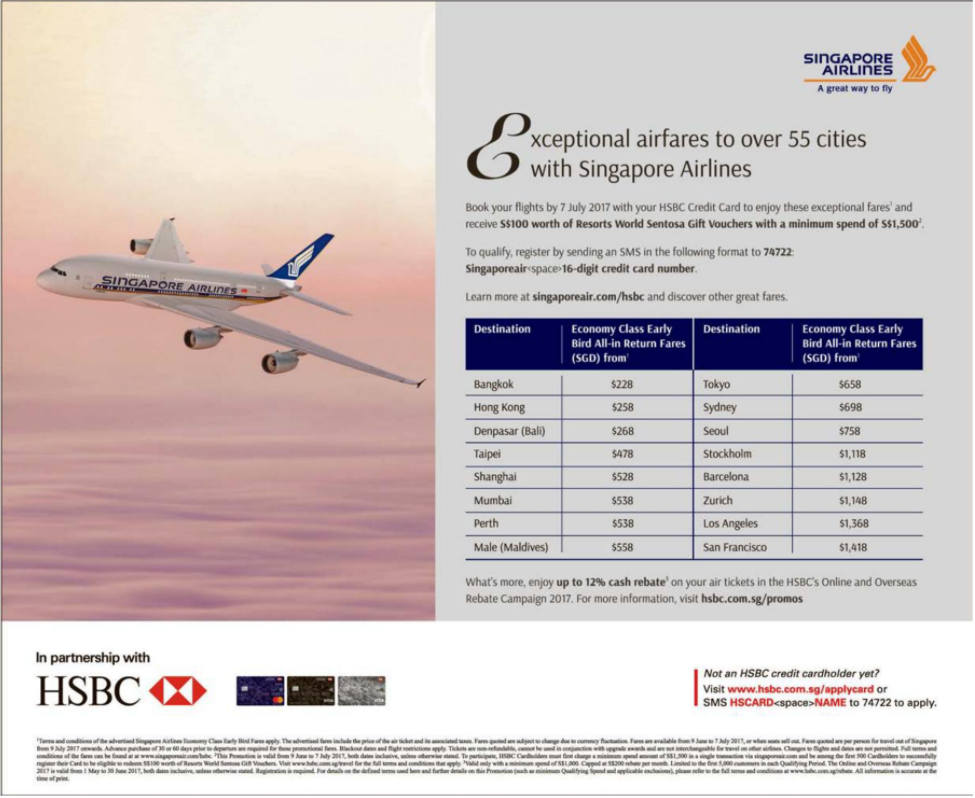

2. HSBC’s Revolution Credit Card

Get 5x Rewards on dining, entertainment and online purchases (equivalent to 2 miles for every dollar spent) with HSBC’s Revolution credit card. What’s more, there’s no minimum spend and 2 years’s annual fee waiver. 5x Rewards include:

- Dining: restaurants, cafes and fast food outlets on your local dining transactions.

- Online purchases: airlines, movies, concert tickets, hotels, taxi bookings, food orders, insurance premiums and online shopping

- Entertainment: clubs, pubs, bars and family KTVs

Enjoy 1x Rewards on all other purchases.

If you’re only going to live once, you might as well live large. The UOB YOLO Card has a bundle of exciting offers, but its entertainment deals are truly remarkable.

You get 8% rebate on weekend entertainment, 3% rebate on weekday entertainment, 1-for-1 movie tickets at Cathay Cineplexes, and exclusive access to the Priority Queue at Switch, Barber Shop, Timbre @ The Substation, and Timbre @ The Arts House. You and a friend also get free entry at Zouk and one free house pour on Wednesdays and Fridays!

Cash Back Credit Cards

1. Standard Chartered Unlimited Cashback Credit Card

No cashback cap and no minimum spend, the Standard Chartered Unlimited Cashback Card lets you enjoy 1.5% cashback on all spend – from beach holidays to buffet feasts, or even your new wardrobe. How much better can it gets? Think of it as the card to use after maxing out the benefits on other cards. This card gives you 1.5% cash back with no cap and no minimum spend requirement to make all your spend even more worthwhile.

2. American Express® True Cashback Card

You can earn absolute 1.5% cashback on any spend, without caps. This means that you can earn cashback on every dollar you spend on your American Express True Cashback Card, without having to worry if you have maxed out the cashback you would be receiving.

What’s more? You get to earn 3%* cashback on your first S$5,000 spend during the first 6 months of your Card Membership.

When you use your Card for everyday purchases, you won’t believe how quickly your cashback can add up. With no spend caps imposed, earning cashback is simpler.

3. Citi Cash Back Visa Credit Card

Keep this card in your wallet. The Citi Cash Back Card is one of the best cash back card in the market, offering a whopping 8% cash back on your Dining, Grab rides, Groceries and Petrol daily, worldwide. Imagine this: every $1,000 spends get you $80 cash back in a month. That works out to be almost a thousand dollar of cash savings in a year!

Get cashback on your daily spend. The OCBC 365 Card lets you enjoy up to 6% cash back on dining, online shopping, petrol, grocery and more. That’s not all. You can even enjoy 3% cash back your telco bills.

Are you the one paying for the recurring mobile, cable TV and Internet bills? Apply for the HSBC Visa Platinum Card and start paying less! The HSBC Platinum Card offers up to 5% cash rebate on your daily expenses such as groceries, fuel and dining and it is also one of the only few cards that includes your recurring telephone bills.

In addition, you also get 1 Reward point for every $1 spent. This is on top of the cash rebates which you would have already enjoyed. With the Reward point, you can redeem a great variety of rewards, from everyday essentials to gourmet delights and a dedicated range of luxury rewards to cater to your fancy side.

The right connections can be rewarding. With no minimum spend required, you will now enjoy up to 3.5% cash back on all your purchases* with the new, well connected HSBC Advance credit card. HSBC Advance banking customers enjoys additional 1% cash back.

- Up to 3.5% Cash Back on all purchases

- No minimum spend required

- 1 year’s annual fee waiver (Perpetually waived for HSBC Advance banking customers)

Shopping Credit Cards

1. Standard Chartered Spree Credit Card

Another great reason to go on that shopping spree. With no minimum spend and up to $60 cashback monthly, there’s another great reason to go on that shopping spree with Standard Chartered Singpost Spree Card.

- Earn 3% cashback on all online spends in foreign currency and all vPost spends.

- Earn 2% cashback1 on all online spends in local currency, all contactless and mobile payments.

- Earn 1% cashback1 on all other retail spends.

- Online Price Guarantee: Get a refund of 50% of the price difference if you find a lower price for the same item within 30 days of your online purchase

2. Citi Rewards Visa Credit Card

Enjoy 20X Rewards^ when you shop at selected department stores in Singapore with your Citi Rewards Card. Plus, earn 10X Rewards* on your shopping all year long. Shopping is more rewarding with the Citi Rewards Card!

- Get 20X Rewards^ (20 points or 8 miles for every S$1 spent) when you shop at Duty Free Singapore (DFS), Takashimaya and TANGS. Valid till 3 May 2018.

- Earn 10X Rewards* when you shop for shoes, bags and clothes at online or retail stores, or department stores, locally and overseas.

- Redeem your points from an amazing range of merchandise from across the globe or for the perfect holiday through Citi ThankYousm Rewards.

Get rebates for the things you love. Chill out and hang out with OCBC Frank Credit Card – Get 6% rebate on online shopping (including flights and hotels) and 5% on weekend entertainment.(i.e Starbucks, The Coffee Bean & Tea Leaf, Cinemas, Bars and Clubs)

Earn up to $60 rebates per month — that’s $720 worth of savings a year! Express your individuality with 120 unique card designs to choose from.