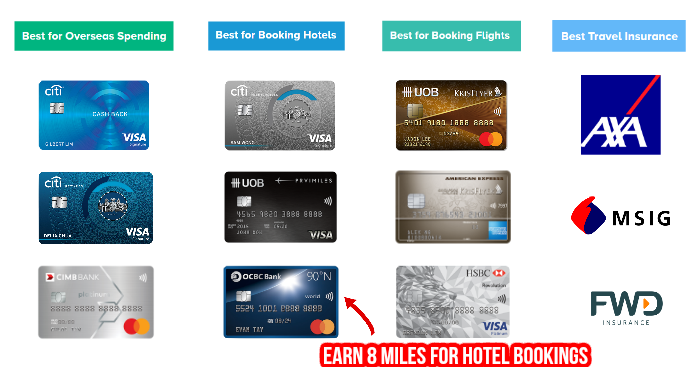

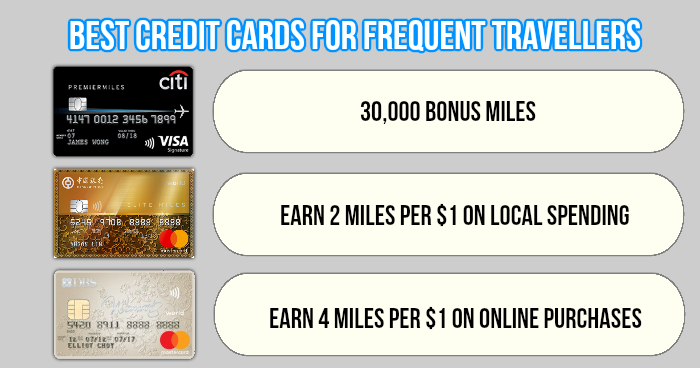

Keep this checklist handy the next time you plan for a holiday

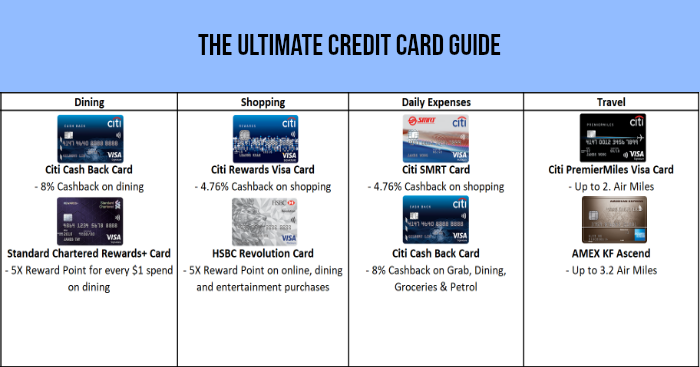

One of the easiest ways to save money on your holiday trip is leveraging on the right credit card rewards. Some cards offer you higher miles for each dollar spent on flight and hotel bookings, whereas some offer better perks for overseas spend. Using the right card for the right spend is the key.

Here we round up some of the best cards for each categories:

Best for Flight booking:

- Earn 3 KrisFlyer miles per S$1 spend on Singapore Airlines, SilkAir, Scoot and KrisShop purchases

- Earn Up to 3 KrisFlyer miles per S$1 spend on everyday* spend categories with S$5o0 min. annual spend on Singapore Airlines Group.

- Earn 1.2 KrisFlyer miles per S$1 spend on other spend

Welcome gift, apply now and get:

- S$50 cash via PayNow

- Up to $150 cash credit and 3,000 KrisFlyer miles

- 1 lucky draw chance to win $1,000 cash

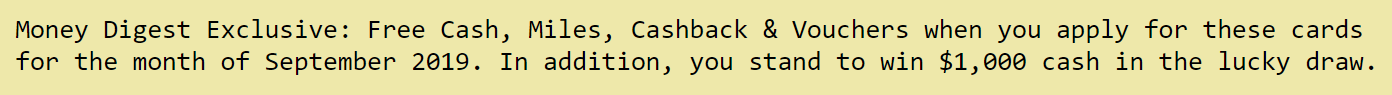

2. American Express KrisFlyer Ascend

- Earn up to 3.2 KrisFlyer miles on your Grab and everyday spend, up to S$200 each calendar month.

- Earn 2 KrisFlyer miles for every S$1 spend on SingaporeAir.com, SingaporeAir app, silkair.com and KrisShop, with no cap.

- Earn 2 KrisFlyer miles for every S$1 spend on eligible overseas transactions during the months of June and December.

- Earn 1.2 KrisFlyer miles for every S$1 spend on eligible local transactions, with no cap.

Welcome gift, apply now and get:

- Up to 49,200 welcome miles

- 1 lucky draw chance to win $1,000 cash

- Earn 5x Rewards on dining, entertainment and online purchases (equivalent to 2 miles for every dollar spent)

No minimum spend required.

Welcome gift, apply now and get:

- 150 cash back or Samsonite T5 68cm Spinner with built-in scale

- $20 Grab vouchers

- 1 lucky draw chance to win $1,000 cash

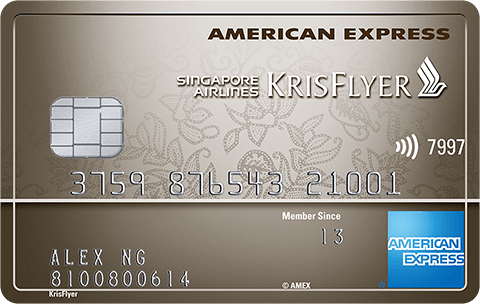

4. DBS Altitude

- Earn 4 miles per $1 spend on Singapore Airline tickets booked through DBS Travel MarketPlace

- Earn 4 miles per $1 spend when you commute with your DBS Altitude Card This includes your bus, train, taxi rides and even your fuel spend! (From 1 Aug to 31 Dec 2019)

- Earn 3 miles per $1 spend on online flight & hotel transactions (capped at S$5,000 per month), such as:

singaporeair.com agoda.com

cathaypacific.com expedia.com.sg

qatarairways.com airbnb.com.sg and more! - Earn 2.4 miles per $1 spend when you re-fuel at Esso (From 1 Aug to 31 Dec 2019)

- Earn 2 miles per $1 spend on overseas spend (in foreign currency)

- Earn 1.2 miles per $1 spend on local spend

The best part? Your miles never expire.

Welcome gift, apply now and get:

- Up to 38,000 welcome miles

- 1 lucky draw chance to win $1,000 cash

Best for Hotels:

- Agoda: Earn up to 7 Citi Miles per S$1 spent OR Enjoy up to additional 8% off hotel bookings

- Expedia: Get 10% off hotel bookings

- Kaligo: Earn 10 Citi Miles per S$1 spent on kaligo.com/bonus-miles

Welcome gift, apply now and get:

- $250 cash via PayNow

- Up to 30,000 welcome miles

- 1 lucky draw chance to win $1,000 cash

- Agoda: Earn 6 miles per S$1 spent

- Expedia: Earn 6 miles per S$1 spent

- UOB Travel: Earn 6 miles per S$1 spent

Apply now and get S$150 cash credit.

Welcome gift, apply now and get:

- $50 cash via PayNow

- Up to $150 Cash Credit

- 1 lucky draw chance to win $1,000 cash

3. American Express KrisFlyer Ascend

- Complimentary Airport Lounge Access: Four complimentary access each year to any participating SATS Premier Lounge in Singapore and Plaza Premium Lounge around the world.

- Complimentary Night Stay at Hilton: One night each year at one of over 160 Hilton Properties in Asia Pacific and complimentary upgrade to Hilton Honors Silver membership tier.

Welcome gift, apply now and get:

- Up to 49,200 welcome miles

- 1 lucky draw chance to win $1,000 cash

- Earn 8 miles on your accommodation booking at Agoda, Expedia, Airbnb, Millenium Hotels, Mr & Mrs Smith

Apply now and get S$50 cash rebate plus 7,000 miles for new card sign-ups.

Welcome gift, apply now and get:

- $50 Cash Rebate

- 7,000 Welcome Miles

- 1 lucky draw chance to win $1,000 cash

Best for Overseas spending:

- Earn 8% cash back on Dining, Groceries and Petrol daily, worldwide.

- Citi World Privileges: Get deals and discounts locally & in 95 other countries

Welcome gift, apply now and get:

- Up to $250 Cash via Pay Now

- 1 lucky draw chance to win $1,000 cash

- 10X Rewards^ for every S$1 spent on retail shopping worldwide.

- Citi World Privileges: Get deals and discounts locally & in 95 other countries

Welcome gift, apply now and get:

- Up to $250 Cash via Pay Now

- Up to 30,000 Citi ThankYou Points

- 1 lucky draw chance to win $1,000 cash

Best travel insurance:

- Best for flight delays, baggage loss

Welcome gift, apply now and get:

- $8 Cash via Pay Now

- 1 lucky draw chance to win $1,000 cash

- Most comprehensive coverage across all categories

Welcome gift, apply now and get:

- $8 Cash via Pay Now

- 1 lucky draw chance to win $1,000 cash

- Cheapest travel insurance from $9

Welcome gift, apply now and get:

- $8 Cash via Pay Now

- 1 lucky draw chance to win $1,000 cash