Living in Asia as an expat offers dynamic urban landscapes and a rich cultural blend, making it an enticing prospect. Yet, this allure comes at a price. According to recent studies, several Asian cities rank among the world’s most expensive places for expatriates.

In a 2023 study by ECA International, cities like Hong Kong, Singapore, Seoul, Tokyo, and Shanghai made it to the top 10 global rankings for expat living costs. The rising cost of living, driven by high rental prices, inflation, and strong currencies, propels these cities up the ranks.

Image Credits: unsplash.com

SINGAPORE’S RISE IN GLOBAL RANKINGS

Singapore, renowned for its efficient infrastructure, safety, and quality of life, has seen a significant increase in expatriate living costs. The Lion City now ranks as the second most expensive city globally for expats. According to ECA International, soaring rental costs play a crucial role in this rise, making it increasingly challenging for expats to find affordable housing.

MOST EXPENSIVE CITIES IN ASIA

While Singapore’s ascent is remarkable, it’s not alone in experiencing a surge in living costs. According to the Mercer Cost of Living Survey for 2024, here are the most expensive cities for expats in Asia:

1. Hong Kong – This city frequently tops the list due to overwhelming housing prices and a competitive job market, yet it continues to attract international businesses and expats alike.

2. Singapore – Rapidly rising rental costs place Singapore as the second most expensive city globally for expats.

3. Shanghai – As a global financial hub, Shanghai has seen significant increases in housing expenses, cementing its status as one of Asia’s costliest cities.

4. Seoul – Known for its tech-savvy lifestyle and vibrant culture, Seoul demands a high price, particularly in housing and education.

5. Tokyo – With its blend of tradition and modernity, Tokyo’s high living costs are driven by pricey real estate and high standards of living.

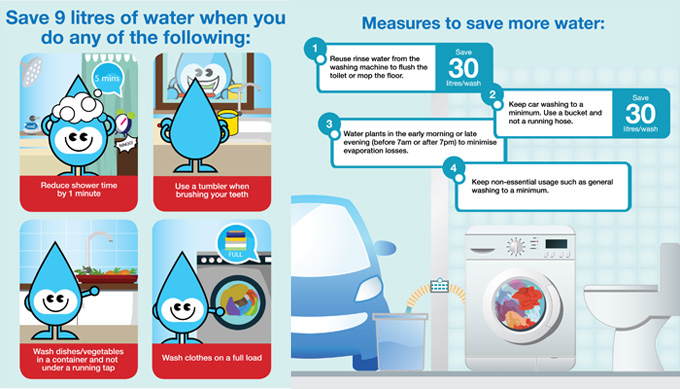

Image Credits: unsplash.com

BALANCING LUXURY AND COST

As Asia evolves into a hub for international business and lifestyle, understanding the financial landscape is crucial for prospective expatriates. High living costs in cities like Singapore offer world-class amenities and cultural experiences. Yet, balancing luxury and expenses is tricky. It will take time to navigate these financial pressures while enjoying the unique city living.