1. WHAT TYPE OF GOLD INVESTMENT?

There are two types of gold investment: physical gold and paper gold. The physical gold consists of the tangible gold bars, jewelry and coins. While the paper gold consists of the gold exchange traded funds or gold-related equities in the stock market.

The latter is more at risk with fraud, as you have no guarantee that the fund holds the amount of gold they claim. Furthermore, the stock market can be vulnerable due to the government intervention and hacking.

2. WHY SHOULD YOUR PORTFOLIO INCLUDE GOLD?

Including gold to your overall portfolio is a good way to diversity your assets. As the price of gold generally moves in a different direction than other types of investments, it can balance out your returns when the others are performing badly.

Cary Guffey, a Certified Financial Planner Professional and Board Ambassador, forewarns that you must not put too much of your wealth in gold. According to him, a good rule of thumb is having no more than 5% of a certain commodity in your portfolio.

3. HOW PURE SHOULD YOUR GOLD BE?

Pure gold (100%) is too soft to manipulated as bars and jewelry, therefore it is mixed with other types of metals such as silver, nickel or copper to improve its strength. Based on the content of gold, it is divided into “karat” configurations namely: 9k (37.50%), 14k (58.33%), 18k (75,00%), 22k (91.66%), 24k (99.99%). Ensure that you are getting what you paid for.

4. WHERE SHALL YOU BUY THE PHYSICAL GOLD?

In Singapore, physical gold can be purchased online or at the bank. For online bullion shopping, consider the trusted bullionstar.com where 1 gram of PAMP Gold Bar costs about S$79.54. Alternatively, you can purchase gold bars and gold bullion coins at UOB.

5. WHAT IS THE REAL PRICE OF GOLD?

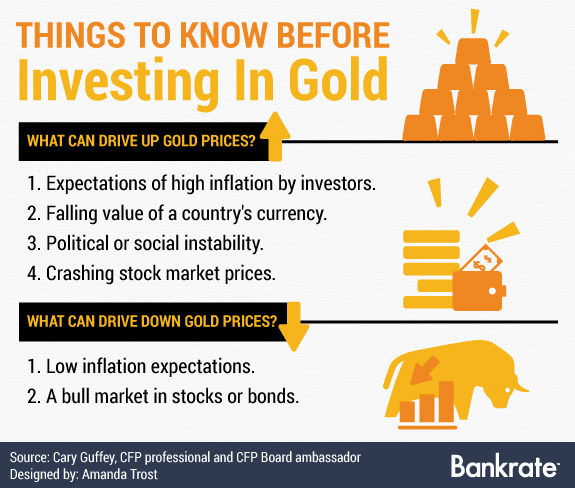

Just like anything else, the price of gold is influenced by the supply and demand dynamics. In fact, 5 years ago gold’s price was about S$1,800 per ounce compared to today’s S$1,664 per ounce. Alongside this dynamics are other factors that affect the gold’s price…