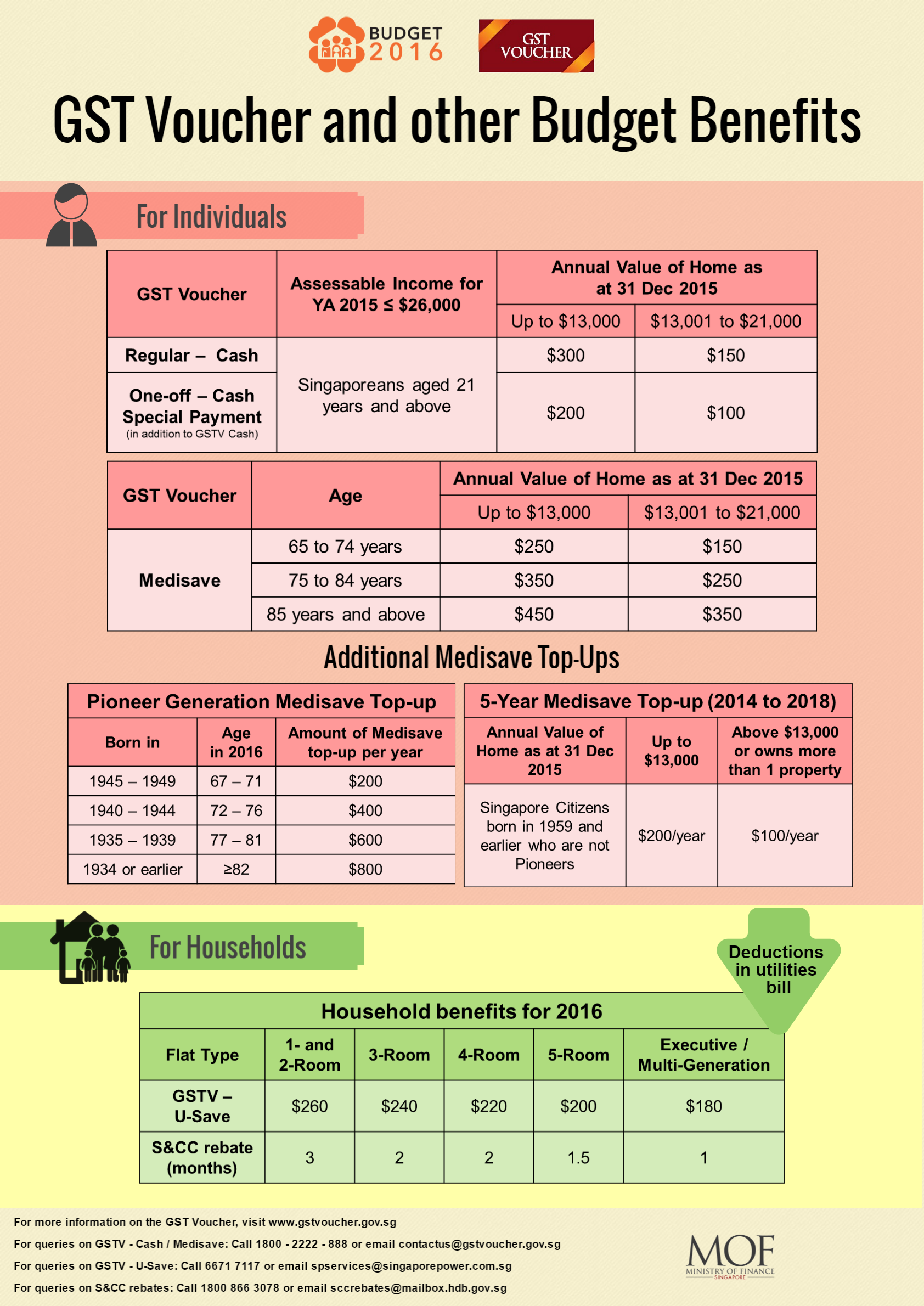

The Ministry of Finance has announced in a press release that 1.54 million Singaporeans will receive a letter by 1 July 2016 with details on the 2016 GST Voucher Benefits (GSTV) as well as information on other Budget benefits such as Service and Conservancy Charges (S&CC) rebates, U-Save and Medisave Top-ups.

1. GST Voucher – Cash Payment

About 1.3 million eligible Singaporeans will receive up to $300 in GSTV – Cash. In addition, as announced at Budget 2016, a one-off GSTV – Cash Special Payment of up to $200 will be provided to support households amid current economic conditions.

This means that eligible GSTV recipients will receive up to $500 in cash in 2016, which will be disbursed in two payments in August 2016 and November 2016.

2. Medisave Top-ups

About 425,000 Singaporeans aged 65 years and above will receive the GSTV – Medisave of up to $450 in August 2016. In addition, Singaporeans born on or before 31 December 1959 (57 years and above in 2016) and do not receive Pioneer Generation (PG) benefits will receive a Medisave top-up of up to $200 each year till 2018. The top-up for this year will also be made in August 2016.

In total:

- A non-Pioneer aged 65 in 2016 and who is living in an HDB flat (and does not own a second property) can receive $450 of Medisave top-ups this year.

Pioneers would also be receiving their PG Medisave top-ups of $200 to $800 in July 2016. Taking both the PG Medisave and GSTV – Medisave together:

- A Pioneer aged 70 in 2016 who is living in an HDB flat (and does not own a second property) will receive $450 of Medisave top-ups;

- A Pioneer aged 85 in 2016 who is living in an HDB flat (and does not own a second property) will receive $1,250 of Medisave top-ups.

You can also refer to the infographic by MOF below:

More information on Assessable Income and Annual Value of Home:

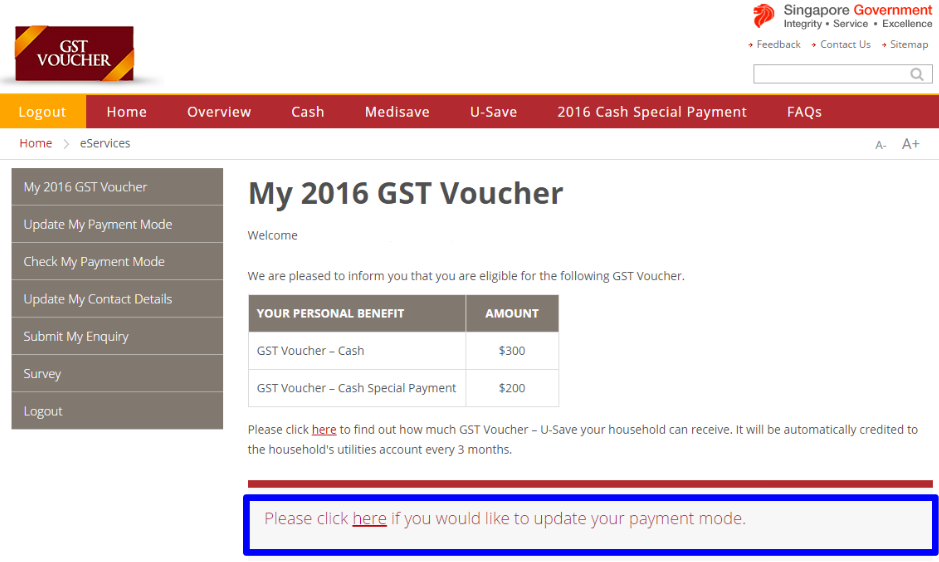

To find out how much you are eligible for, you can log on to https://www.gstvoucher.gov.sg with your SingPass.

You will then see something like this:

* Remember to update your payment mode.

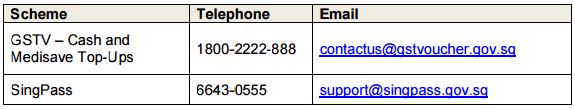

Details on the GSTV can be found at www.gstvoucher.gov.sg, and information on the other Budget benefits can be found at www.singaporebudget.gov.sg. If you require more information, the contact details are as follows: