Contrary to popular belief, investing is not only for the rich and famous. Anyone can get started with an investing program. There are various ways to invest small amounts of money and to grow one’s portfolio over time. In fact, this differentiates investing from gambling. Investing takes time and effort!

#1: SET THINGS STRAIGHT

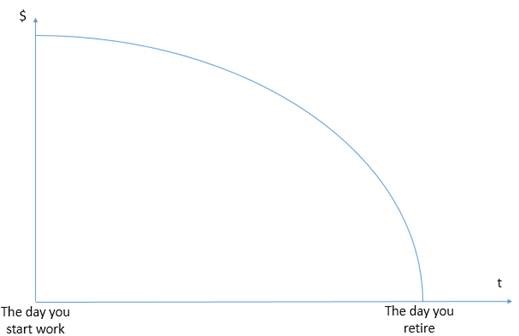

This week, I invited an insurance agent to enlighten my team about the products available in the market. She highlighted how important it is to map out one’s financial future. What are your goals? Will you keep the money for 3 years and withdraw all the earnings? Or, is the money coming from a disposable income that you can risk losing? You need to set a clear path to reach your target.

#2: FIGURE OUT HOW MUCH MONEY YOU NEED

Once you have your financial goals lined up, it is time to determine how much money you need to invest. Use online calculators such as the Central Provident Fund’s savings calculator to work out a monthly investment plan. What are the helpful strategies that you can employ to save money each month? Well, developing a budget is a good place to start.

If you do not seem to have enough money at the end of the day then, figure out what needs to be changed. Eliminate unnecessary expenses or expand your income streams. A combination of these two can help you adjust.

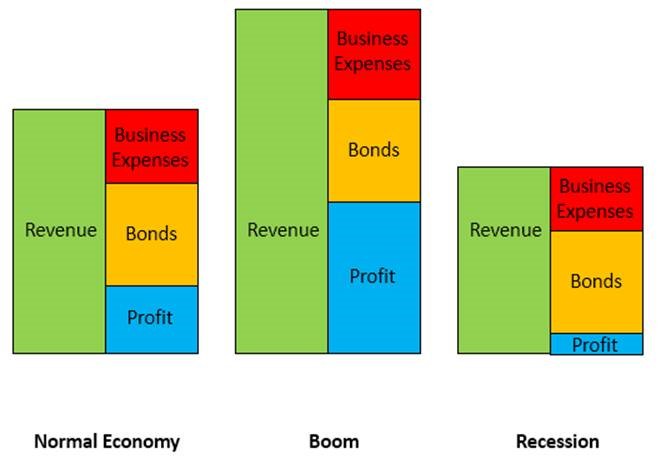

#3: KNOW HOW MUCH RISK YOU CAN TAKE

The next step is to identify your investment risk level. Are you willing to shell it all out just to gain high profits? Or, do you need to be as conservative as possible?

There are hundreds of investment programs that you can partake in. From bonds to equities as well as gold bars to expensive artworks, you need to narrow down your options. So, know your preferences.

Stocks gives you a hiigher return in the long run. However, it can be highly volatile in short-term basis. On the other hand, bonds are designed to create a steady stream of income. The most conservative option is the mutual funds. Think about these information.

Image Credits: pixabay.com

When things fall into place, you may open a brokerage account. Investing directly in shares and bonds or indirectly through the exchange-traded funds (ETFs) can be less costly. A mixture of investment types can help balance the potential gain and the risk.