Stepping into adulthood comes with its share of firsts—your first paycheck, first apartment, and yes, the dreaded first experience of paying bills. Don’t worry, though. With a little organization and some smart strategies, you can manage this like a pro.

Let’s break it down step by step, with some relatable tips along the way!

#1: ORGANIZE YOUR BILLS

When Marcus and his wife got their first flat, they found himself drowning in unopened envelopes and emails about utilities, rent, and more. Their solution? A master list of all the bills, split into two categories: automatic payments and those that needed manual attention.

Take a leaf out of their book. Start by listing out your recurring expenses including rent or mortgage, utilities, car loans, insurance, and even those sneaky subscription services. Next, prioritize them by due dates and importance. Not only will this save you from late fees, but it also keeps your finances in check.

Pro Tip: Create a “paid” folder (i.e., physical or digital) to file receipts and proof of payment.

#2: MARK PAYMENT DATES

Ever forgotten a birthday and scrambled for a last-minute gift? Missing a bill deadline feels worse, except it comes with late fees. Avoid this by setting up a payment calendar.

Image Credits: unsplash.com

Whether you prefer a physical planner or your phone’s calendar app, having due dates marked makes it easier to plan your finances and avoid the dreaded Oh no, I forgot! moment.

#3: KNOW WHAT YOU CAN AFFORD

When it’s payday, it’s tempting to splurge on a new gadget or that café-hopping adventure with friends. But adulting also means setting limits. Take some time to understand your monthly income and expenses.

Break your expenses into fixed (like rent) and variable (like dining out). Allocate a portion of your income to bills, and don’t forget to build an emergency fund for those unexpected surprises, like a burst water pipe.

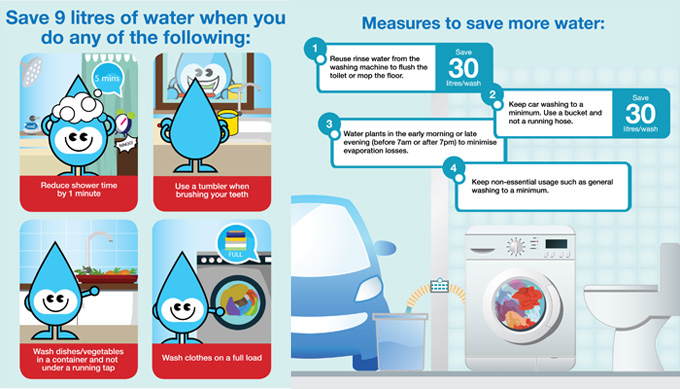

#4: AUTOMATE EXPENSES WHENEVER POSSIBLE

Automation is the magic wand for forgetfulness. If it’s an option, set up automatic payments to avoid missed deadlines. For instance, paying your SP Utilities bill is as easy as using PayNow QR in the SP app or through eGIRO. Not into apps? No problem as you can head to an SP customer service center for a hands-on walkthrough.

Remember, automation doesn’t mean you stop checking. Always review statements for any discrepancies. You wouldn’t want to pay for something you didn’t use!

Image Credits: unsplash.com

Taking control of your bills might seem overwhelming at first, but it’s a skill that grows with time. Start small, stay consistent, and celebrate the wins (i.e., like making your first on-time payment). Because let’s face it, mastering bills is just one more step toward owning your adulting game.