The aged old question of “Does Money Buy Happiness” has been puzzling the minds of many over the past decades. A current research by University of British Columbia and Michigan State University showed that while more money decreases sadness, it might not increase joy.

The researchers named Elizabeth Dunn, Kostadin Kushlev, and Richard Lucas said: “having more money provides more options for dealing with adversity”. Hence, wealthier people may feel a greater sense of control on a difficult situation that poorer people.

1. MONEY RELATIVELY INCREASES HAPPINESS FOR SOME PEOPLE

Princeton researchers released a study in 2010 showing that happiness increases as the income increases until US$75, 000. After this certain point, it plateaus. It is due to the fact that stress and financial difficulties get harder and harder as your income descends in the five-figure realm.

For those who are struggling to make ends meet, making more money generally increases happiness. But, once a person has enough money to provide for the family and oneself, more money doesn’t lead to increased happiness.

2. YOU CONTROL THE EFFECT OF MONEY ON YOUR HAPPINESS

Having a balanced life, being able to practice your hobby, and volunteering certainly increases happiness. If you apply these ideals to money, you can generate happiness.

Studies show that you will get more satisfaction if you spend your cash towards memorable experiences such as vacations than towards material things such as a new table. Likewise, lending out possessions can help you enjoy the material things that your money bought.

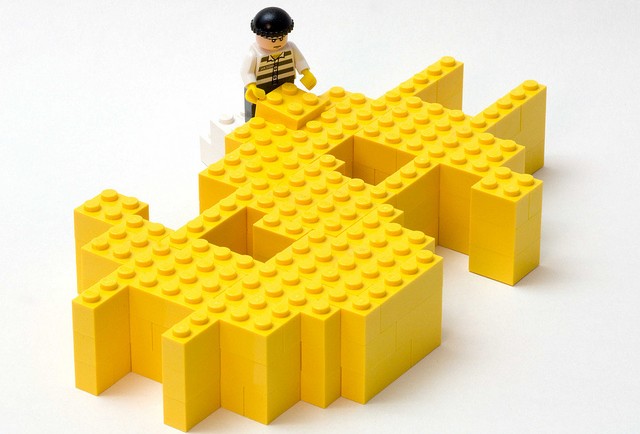

3. DOES OWNING MORE AND ACHIEVING MORE MAKE YOU HAPPIER

If more money comes at a cost of more responsibility and heightened stress in the workplace, then that person will not experience added happiness. Owning more or shopping more only increases happiness for a short run. Spending more on others generates more happiness than splurging on you.