As shopping and payment transactions can be smoothly done through the power of your fingertips, about S$443 billion were spent in 2014’s mobile transactions – all over the world. But while digital wallets increase in popularity, so does the risk of scams.

What are handphone or mobile phone scams anyway? Handphone scams involve a variety of dishonest tactics, such as persuading you to buy a non-existent product or making you sign up to expensive subscription services, that are done for the scammer’s own profit.

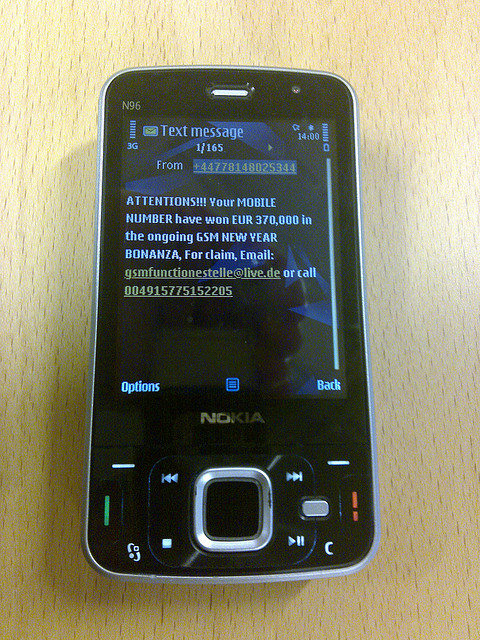

According to Scams Singapore, a blog dedicated to identify and relay information about the existing frauds, common handphone scams occur when an unknown number contacts you and tells you to collect your prize or to pay for your kidnapped relative. With innovative ways to communicate and connect, the risk of scams rises. This is why it is important to stay vigilant and take preventative steps such as these:

1. PICKING PASSWORDS

When deciding which password you can use for your phone, do not choose the common ones such as 1234, 1111, or 0000. Also, you must change as often as possible.

For your mobile banking, maximize the use of your privacy settings by using two-factor authentication. Furthermore, do not make the security questions easy to answer because the scammers can just access your social media accounts.

2. OPENING ATTACHMENTS

To avoid downloading virus or other malware, only open attachments that were given by your friends, family, partners, and clients. Avoid phishing messages (i.e., when an unknown number asks for your bank account details). Simply, if you do not recognize the sender’s number and the area code is not +65 (i.e., Singapore’s area code) then, it is most likely a scam.

3. DOWNLOADING APPS

When downloading Smartphone Apps, opt for the Apps that are available on the official retailers such as the iTunes or Google Play stores. Otherwise, there is a possibility of downloading bugs, virus or other malware. Downloading a tracking App for your devices is helpful in case you get robbed.

CompAsia Online Warehouse Sale – One Day Only! Up to 30% OFF Pre-Owned Devices

CompAsia Online Warehouse Sale – One Day Only! Up to 30% OFF Pre-Owned Devices