Straits Times has reported today that the government will soon offer a new type of bonds in the market in the second half of the year.

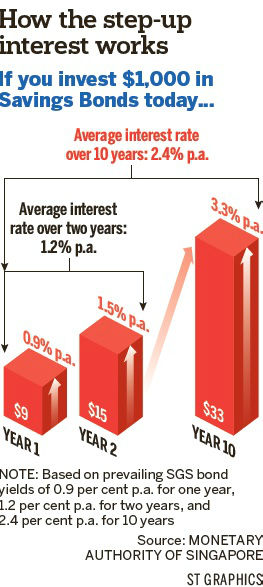

Coined the Singapore Savings Bonds, being first of its kind, is different from the current SGS bonds which offers fix interest rates every year. It offers a step up interest starting with a smaller rates that rises over year. (Refer to the diagram in the newspaper article below)

Photo: Straits Times

The new bonds will be offered at a 10 years tenure linked to the long-term SGS Bonds Rate with no penalty for early redemption.

The minimum amount to invest is $500, with additional multiples of $500 up to a certain cap.

This roll out would really benefit the risk-adverse investors as it open up an alternative investment other than fixed deposits.

To sum up the features of the Singapore Saving Bonds:

- Step up interest with rates rising over the years

- No penalty of early redemption

- Minimum investment of $500

- Capital guaranteed by the government

You can also read the electronic version on Straits Times here: http://www.straitstimes.com/news/business/economy/story/new-government-bond-offers-rising-rates-20150331

What you should also know about the Singapore Saving Bonds: http://www.straitstimes.com/news/business/banking/story/singapore-savings-bonds-what-you-should-know-20150331

To find out more on SGS Bonds, check out: http://www.sgs.gov.sg/~/media/SGS/SGS_T-bill_English.pdf