We’re in the middle of a global pandemic, and with the economy swinging up and down, protecting and growing your money is a common concern. Some people may find it easier to save now that they’re home more often, but putting your paycheck in the bank isn’t making the most of your hard-earned savings, especially with banks reducing interest rates across the board.

In these uncertain times, it is definitely prudent to consider safe and flexible options to save smarter and grow your hard-earned savings. There are many financial tools available in the market that offer this, and you should choose one that gives you the best peace of mind, without compromising on your returns.

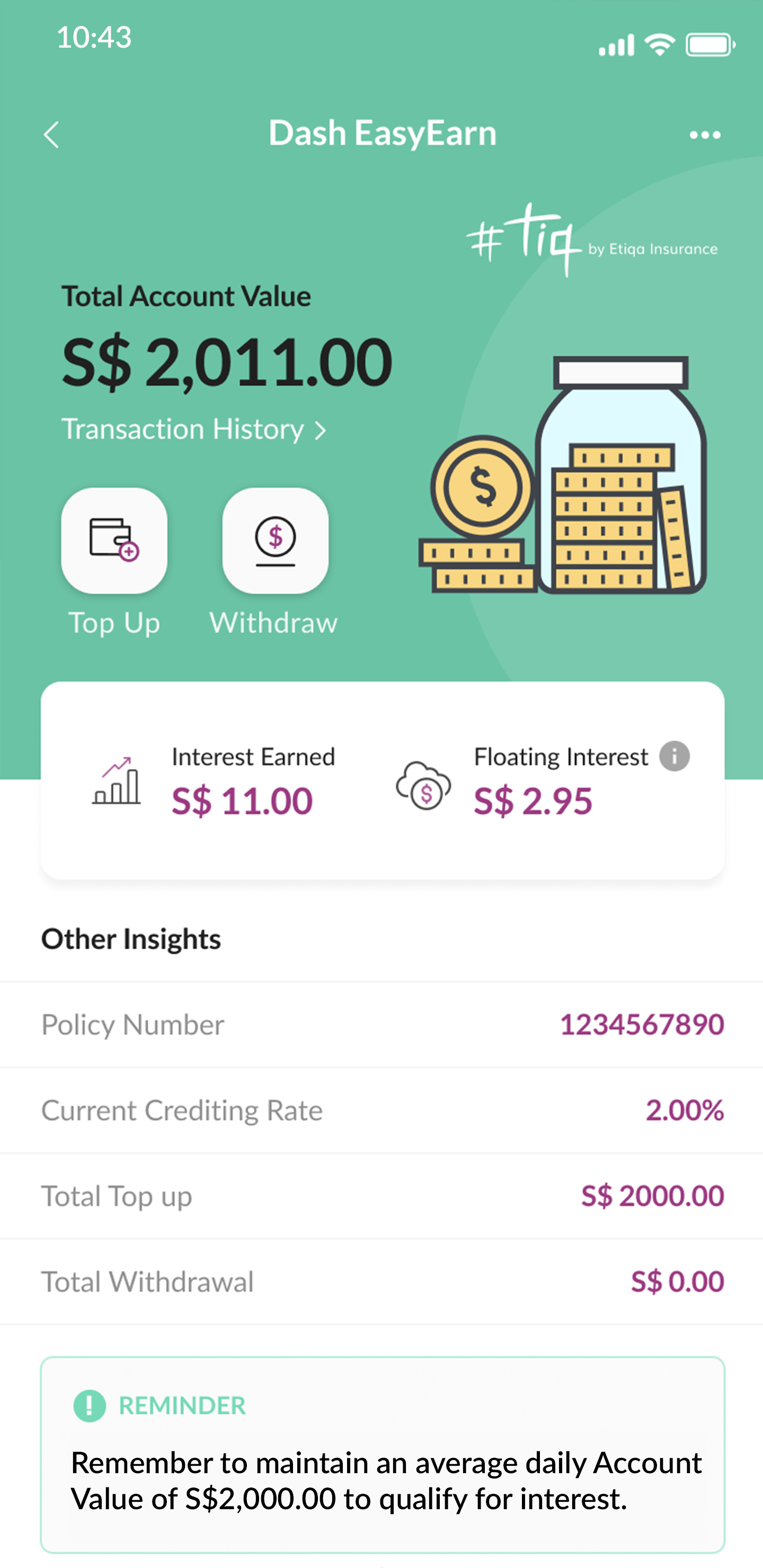

With that said, you might be excited to find out about the latest addition to the all-in-one mobile wallet Singtel Dash: Dash EasyEarn, a unique insurance savings plan underwritten by Etiqa Insurance, which will help you save better for a rainy day. This insurance savings plan offers an astounding 2% p.a. returns for your first year* with a minimum starting amount of S$2,000.

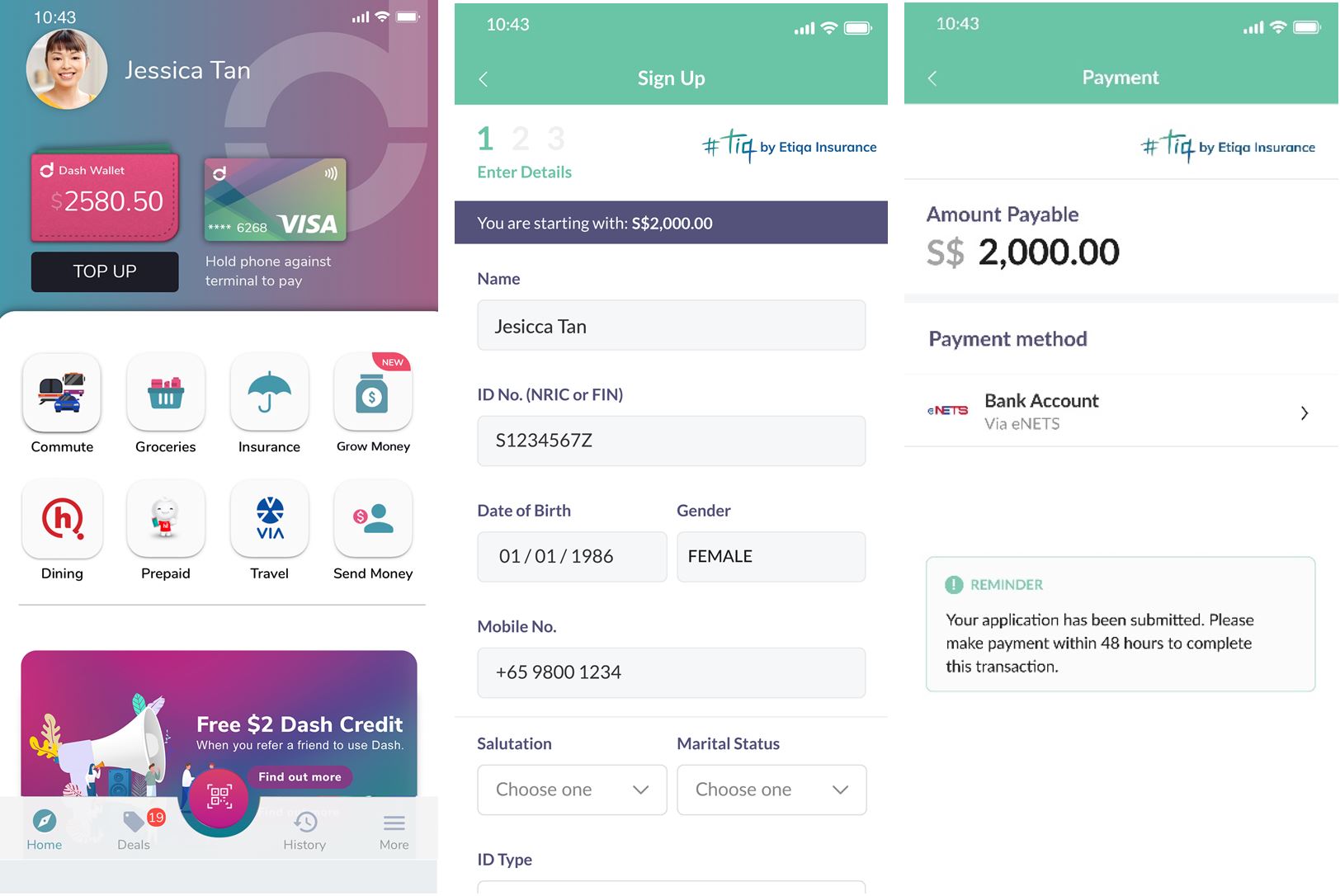

The best part? You can sign up directly through Dash on your mobile phone, with just a few clicks. Read on to find out more!

Enjoy attractive returns with capital guaranteed

Dash EasyEarn is capital guaranteed AND offers a very competitive 2% p.a. returns for your first year*, regardless of market movements. So if you’re risk-averse, especially in these uncertain times, you can rest assured that your savings will be safe – even if you have to withdraw it in times of need. Dash EasyEarn also has no lock-in requirements – which brings us to the next point on its flexibility.

NB: With effect from 25 September 2020, Dash EasyEarn will be revising its bonus rate to 0.3%, bringing the rate to 1.8%^ p.a. for the first policy year**.

Existing Dash EasyEarn users will continue to enjoy 2% p.a. (guaranteed 1.5% p.a. + 0.5% p.a. bonus) for the first year starting from their policy start date, including subsequent top-ups.

In addition, Etiqa Insurance will be extending an additional Financial Assistance Benefit for COVID-19 to all new and existing Dash EasyEarn policy holders. For more information on the benefits and other terms of this Financial Assistance Benefit, please visit https://www.tiq.com.sg/covid19/.

Ultimate flexibility with no lock-in period

Image credits: Singtel Dash

Another great thing about this product is how flexible it is. After you’ve transferred your initial minimum premium of S$2,000, you can always make additional top-ups^ when you want, or withdraw what you need with no penalties.

There is no lock-in period, so if an emergency should arise, you’ll be able to access your funds immediately by withdrawing directly into your bank account or Dash wallet to tide you over.

^Maximum account value is S$20,000. Each top up must be a minimum of S$500. Minimum account value of S$2,000 must be maintained to be eligible for returns.

Open to everyone

Whether you’re a student, young professional or already savvy at saving, anyone can download Dash and sign up for Dash EasyEarn – all you need is S$2,000 to start growing your savings. As an insurance savings plan, Dash EasyEarn also comes with a layer of insurance coverage of up to 105% of account value in case of death.

Can’t wait to get started? Simply download the free Dash app today to sign up for Dash EasyEarn, and watch your savings grow.

It only takes 3 simple steps to start your savings journey with Dash EasyEarn.

- Sign up for Dash EasyEarn through the app

- Top up your Dash EasyEarn plan with your bank account

- Watch your savings grow!

Image credits: Singtel Dash

For more information, please visit www.dash.com.sg/easyearn.

Disclaimers

- The information is meant purely for informational purposes and should not be relied upon as financial advice.

- This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 29 June 2020.

-

*Effective for sign-ups up to 24 September 2020 (date inclusive): Guaranteed at 1.5% p.a. + 0.5% bonus for the first policy year.

-

**Effective for new sign ups from 25 September 2020: Guaranteed at 1.5% p.a. + 0.3% p.a. bonus for the first policy year, available on a first come, first served basis.