In Singapore, there’s always a constant strive to earn more money.

It’s perfectly understandable considering how high goods and services are priced, and how we want to provide a better future for our family.

Some of us take the next step by preserving our wealth and future income through the use of different types of insurance.

But only a few go even further to make it all fool-proof with estate planning.

What is estate planning all about? And what are some of the easy things we can do right now?

Let’s find out.

What Is Estate Planning?

When death happens, all your eligible assets (e.g properties, money in the bank account, investments, insurance) will form your estate which will be distributed according to prior instructions (if any).

The purpose of estate planning (which can only be done before death) is to decide how your estate is going to be distributed upon the inevitable.

This distribution is indicated with the use of several legal documents.

All these ensure that the wealth you’ve accumulated thus far will go to the intended beneficiaries (people/entities who’ll be receiving your assets), in a timely and efficient manner.

Why Should You Care?

We tend to focus on wealth accumulation (savings and investments) and wealth preservation (insurance).

But a lot less on wealth distribution (estate planning), which is equally important in the grand scheme of things.

Why?

When estate planning tools are not set up and death happens, consequences will come up.

Firstly, the process of unlocking assets will be more tedious and complex. This inevitably prolongs the time for beneficiaries to receive proceeds. If the family depends on timely money coming in, this issue will be more dire. Who’s going to provide them with liquidity to pay off current bills and expenses?

Secondly, also because of the complex and lengthy process, it’ll cost more.

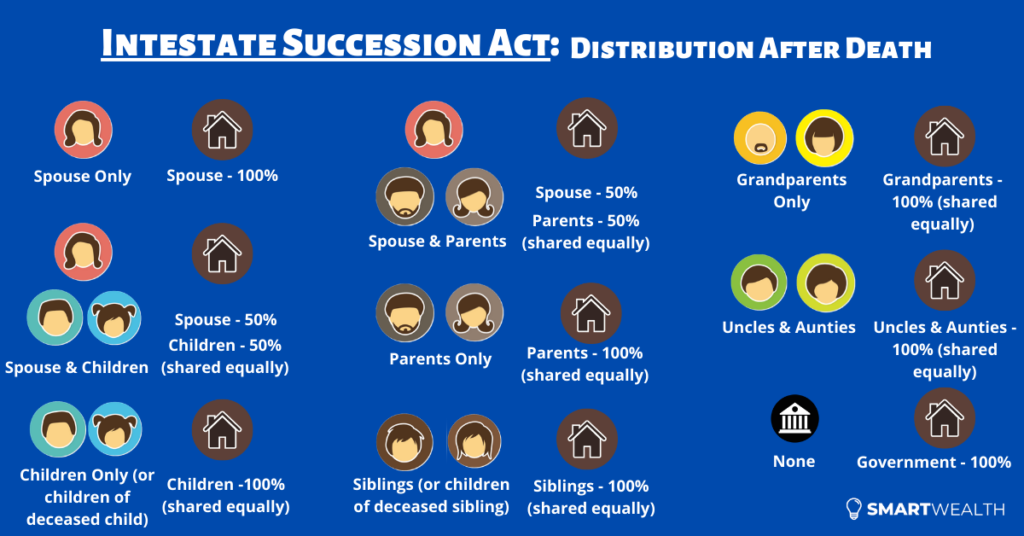

And lastly, most of the proceeds will go according to the intestate succession act or the Muslim law.

Therefore, your assets may not go to the intended people. And even if they do, not in the correct allocation that you wish for.

For example, if your spouse, children and parents are still living, your assets will be distributed to your spouse and children only, and none goes to your parents (even if they raised you up since young).

And it could also go to the unintended people.

For example, if your spouse and children are still living, and you think that your spouse doesn’t deserve anything, distribution will still go to your spouse.

These will cause ugly disputes amongst family members because there’s no clear and distinct indication of WHO should receive WHAT.

Furthermore, when you’re not around anymore, there’s no one else to turn to except for any legal documents you leave behind.

But when you employ even the simplest of estate planning tools, you effectively eliminate all these potential problems.

What are some of them?

3 Core Estate Planning Tools in Singapore

When dealing with financial matters, there’s always some resistance in taking action.

For example, people always want to find out what’s the best investment before investing, which is perfectly fine. But a problem that comes out from that is that too much information paralyses them and nothing is done in the end.

It’s also the same with estate planning.

But I can assure you that setting up these 3 tools will have the most impact and take the least amount of effort.

1) CPF Nomination

If you’re a Singapore Citizen or a Permanent Resident, you will have CPF accounts – Ordinary, Special, MediSave, Retirement.

If you don’t make a CPF nomination, and death happens, distribution of CPF savings will take a longer time, higher costs and goes by the law.

So you’d always want to get it done. It’s free anyway.

But most see it as a hassle because it used to be done via hardcopy forms (with 2 witnesses) or by going to the CPF service centres.

However, back in 2020, CPF allowed the nomination to be done online, and this made the application easy and convenient. While you still need 2 witnesses, the entire process is done electronically. If you want a step-by-step guide, you can check out how to make a CPF nomination online.

Even if a nomination is made, you can easily change it in the future. It’s usually done by submitting a new one, and that will override the existing nomination.

2) Insurance Policy Nomination

If you’ve bought life insurance and think nothing else needs to be done, think again.

The second part is to make a nomination where you can specify who will receive the proceeds and in what percentage.

Nominations can be made on life insurance policies with a death benefit. Take note that nominations can only be done on private individual policies and not on company/group insurance – they’re not owned by you.

There are 2 types of nominations: revocable and irrevocable (trust). Most choose the former as the nomination can be changed easily in the future.

Although it isn’t compulsory, it’ll be useful.

This is because by nominating, the insurance company can pay out directly to the beneficiaries when there’s an eligible claim. This effectively bypasses the usual probate process, saving time and money.

But here’s a trick question: do you want to nominate all your insurance policies?

The answer: it depends.

If your proceeds are large and all your policies are nominated, it’ll mean that your beneficiaries will receive the proceeds all at once.

Will they be able to handle such amounts?

There are many cases where the beneficiaries mishandle monies, and in the end, it got them into further trouble.

So if your proceeds aren’t that much (which you should have it reviewed), then it wouldn’t matter all too much.

But if it amounts to a bigger sum, you can make nominations on a few policies just for liquidity purposes. The rest can still be specified in a Will to pay out on a staggered or monthly basis.

To make a nomination, you can download the relevant forms from the insurance company, fill it out properly and sign in the presence of 2 witnesses. Or you can approach your financial consultant to help you with it.

3) Writing a Will

Even when you’ve done the CPF and insurance policy nominations, some assets will still be left out.

Examples:

- Money in the bank account

- Investments over several platforms

- Properties (depending on the ownership type)

- etc

If you don’t make a Will, all these will still be distributed according to the intestate law or the Muslim law.

Other than the usual benefits of writing a Will, you can also use it to appoint a guardian to take care of young children and create a testamentary trust to stagger payouts.

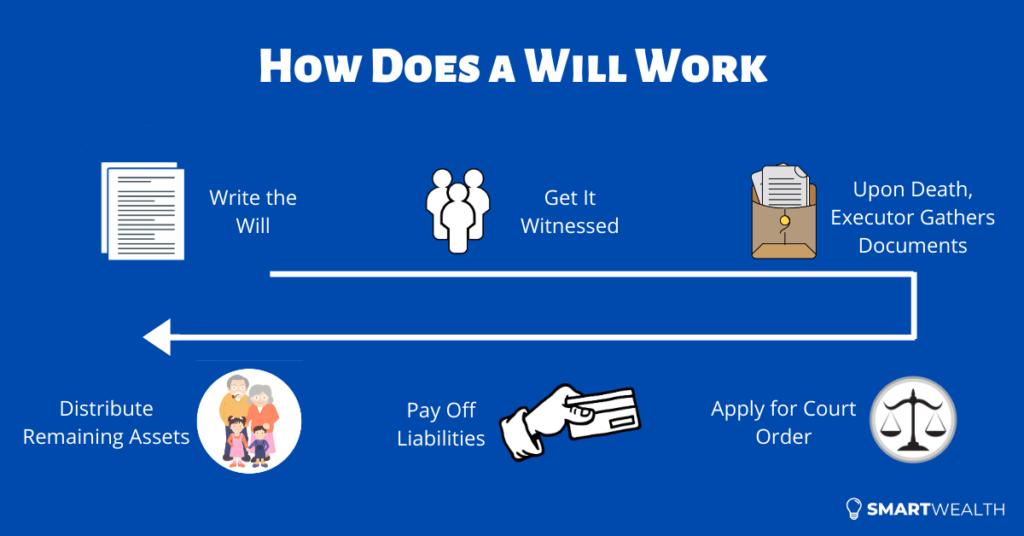

How do you create a Will?

You can DIY or you can pay someone else to do it for you.

Just know that getting a professional to write a Will only costs a few hundred dollars.

The obvious advantage is convenience but more importantly, the Will is drafted to be able to stand in court if challenged.

Other Points to Take Note Of

Apart from the 3 basic tools mentioned above, there are other aspects you should know also.

Firstly, setting up trusts can give you greater control.

Although the Will covers most needs, the trust will bring estate planning to the highest level.

These benefits include:

- can be created when you’re living

- provide for a special needs child

- utmost confidentiality

- delaying gifts to beneficiaries

- etc

While higher net-worth individuals derive more value from it, there are affordable trusts out there that can suit the needs of the masses.

Secondly, a distant cousin to estate planning is advance care planning.

Have you thought of what happens when you’re neither “dead” nor “alive”? In other words, mentally incapacitated.

You can’t do anything about your finances. And estate planning doesn’t kick in.

That’s when advance care planning comes in. It also involves different tools such as the Lasting Power of Attorney and the Advance Medical Directive.

These are important because it will specify what happens next when certain situations come up.

For example, when an Advance Medical Directive is done up, you specify that you don’t wish to be on life support to artificially prolong your life.

And for the last point, you need to have wealth.

You see, if you don’t have any wealth (your liabilities are higher than assets), there’s nothing to distribute even if you’ve done estate planning properly. Even if you’re mentally incapacitated, there may not be money to even pay for your medical expenses.

That’s why, financial planning (wealth accumulation and insurance protection), estate planning and advance care planning, all have a part to play in the bigger picture.

If one is missing, your financial plan is not wearing its full suit of armour. And when a battle comes, damages will be done.

What’s Next?

Estate planning is often in the back seat.

But at times, you have to bring it to the forefront.

That means either to set up the tools or to review them.

So take small steps by looking at the 3 basic ones first – CPF Nomination, Insurance Policy Nomination, and Writing a Will.

And then explore other areas when you’re ready.

About the Author:

Abram Lim runs SmartWealth which covers topics on personal finance – insurance, savings, investments, retirement planning, etc. It strives to produce research-backed articles so that readers can make better financial decisions with objectivity.