FIRST BANK IN SINGAPORE TO REWARD CUSTOMERS WITH MONTHLY CASHBACK FOR REGULAR BANKING TRANSACTIONS

With “POSB Cashback Bonus”, customers need only to fulfil three or more types of regular banking transactions to enjoy cashback rewards, without the need to make additional deposits

It pays to bank more with POSB – customers can earn up to SGD 130 per month via salary crediting, credit card spending, home loan instalments, insurance premiums, or investments

SINGAPORE, 17 October 2016 – POSB, Singapore’s oldest and most loved bank, today announced the launch of an innovative “bank and earn” programme which will reward customers with cashback every month through regular banking transactions. This programme is also the first-of-its-kind in Singapore which allows customers to earn straight cashback rewards without making additional funds deposits on their account balances.

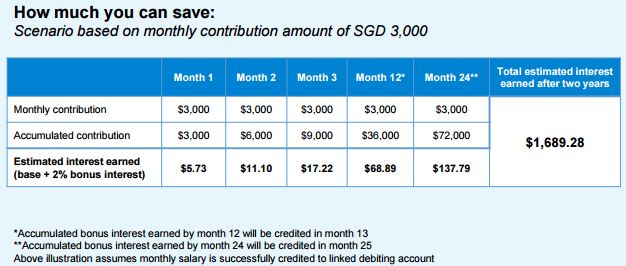

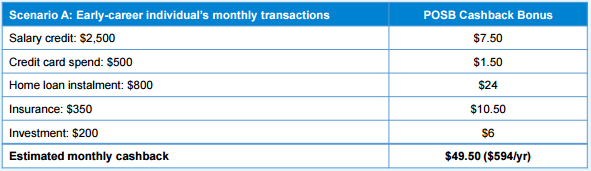

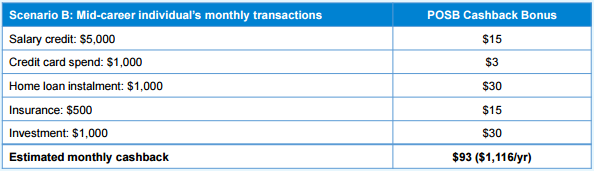

The “POSB Cashback Bonus” programme is the first of its kind in Singapore to offer customers direct monthly cashback simply by fulfilling at least three types of regular banking transactions. This is a simple programme for customers to earn cashback as the majority of POSB/DBS customers are already conducting these transactions with the bank. For example, customers will only need to conduct at least three of the following transactions every month to earn up to SGD 130 per month in cashback rewards:

2. Spend on their POSB/DBS credit cards (No minimum amount required; cashback of 0.3%; monthly cashback cap of SGD 20)

3. Pay their monthly home loan instalments (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30)

4. Pay their POSB/DBS insurance premiums (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30; insurance products should be purchased after signing up for the programme)

5. Invest through POSB/DBS (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30; investment products should be purchased after signing up for the programme)

See below for two examples of how a customer can earn generous cashback rewards from regular banking transactions:

· Rewards structure that is straightforward and simple to understand

· Cashback rewards which are credited to their accounts regularly

· Rewarded based on their multiple relationships and transactions done with the bank

· No requirement to make additional deposits to earn rewards

Said Jeremy Soo, Head of Consumer Banking Group Singapore, DBS Bank, “We are delighted to introduce this programme that rewards our customers based on their banking relationships with us. Currently, most of our customers are already conducting regular banking transactions with us and this means that customers can simply enjoy monthly cashbacks with ‘POSB Cashback Bonus’ without doing a lot more. As the ‘People’s Bank’, we are committed to offering our customers greater value through innovative products and services, and to providing superior deals for them to enjoy.”

To enroll in the “POSB Cashback Bonus” programme, customers simply have to log on to POSB/DBS iBanking to register, and nominate a deposit or credit card account to receive their monthly cashback. Visit www.posb.com.sg/cashbackbonus for more information on the programme.

In 2013, the bank launched the DBS Multiplier Programme to reward emerging affluent customers for consolidating their finances with DBS. With DBS Multiplier, which was recently enhanced in August 2016, customers are able to enjoy a higher interest of up to 2.68% p.a. on their account balances by fulfilling any three of the five transaction categories. The programme has been a hit with customers and the bank has now more than 90,000 accounts. For more information on the “DBS Multiplier Programme”, please visit www.dbs.com.sg/multi.

With DBS/POSB banking most of Singapore, the bank sees some 45,000 requests per month for replacement debit or ATM cards, and 7,500 requests per month for replacement internet banking tokens – mostly as a result of misplacement. To use the POSB VTMs, customers will need to have valid ID (such as their identity card or passport) or their ATM card for verification. POSB VTMs will also provide the option of biometric fingervein scanning for verification if required. With POSB VTMs, customers will be able to perform transactions such as:

With DBS/POSB banking most of Singapore, the bank sees some 45,000 requests per month for replacement debit or ATM cards, and 7,500 requests per month for replacement internet banking tokens – mostly as a result of misplacement. To use the POSB VTMs, customers will need to have valid ID (such as their identity card or passport) or their ATM card for verification. POSB VTMs will also provide the option of biometric fingervein scanning for verification if required. With POSB VTMs, customers will be able to perform transactions such as: