Are you beginning to plan for your financial future? Or are you hoping to make a down payment on a big purchase or preparing to start a family?

Saving money is an integral part of personal finances, but it can be hard to refine and practice. For some, saving money can feel downright impossible! However, with practice and patience, you can turn a new leaf on your money-saving journey.

Need some motivation? Building up your savings account can be easier if you take on these money-saving challenges that are sure to guide you to more excellent financial health in the near future.

#1: Introduce a “no extra spend” week

One of the hardest things to do when saving money is figuring out where in your budget that extra cash will come from.

Cutting out excess spending can be a great way to create more cash flow, but it’s important to ease into it so you don’t become overwhelmed and give up too quickly. Try setting aside a single week and limit all your spending to absolute essentials: bills, groceries, and any necessary transport costs.

#2: Exercise the 1% trial

Image Credits: blackthorn.io

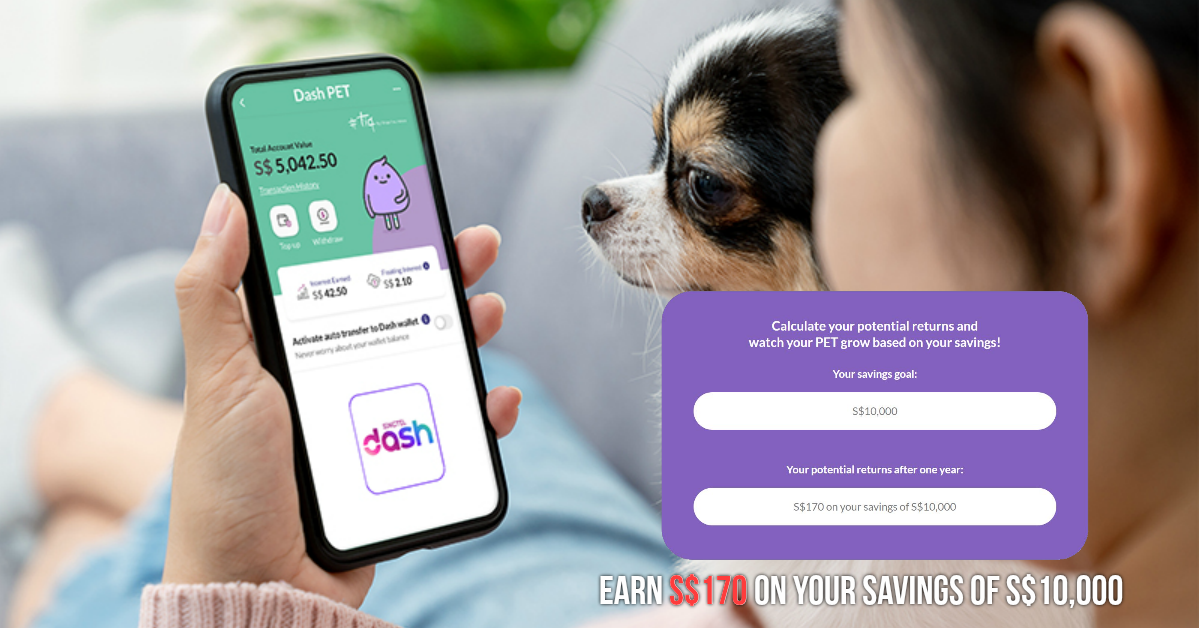

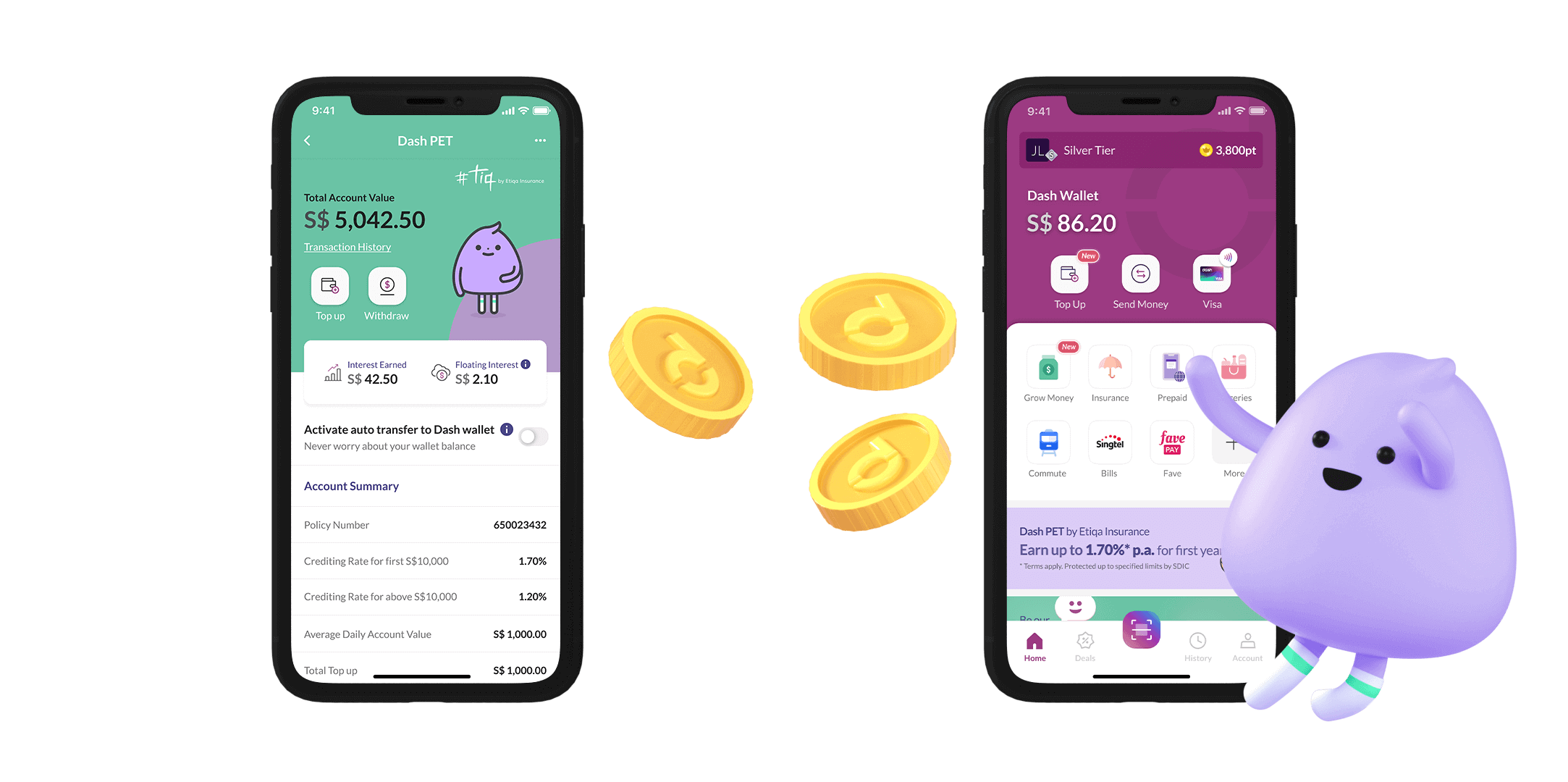

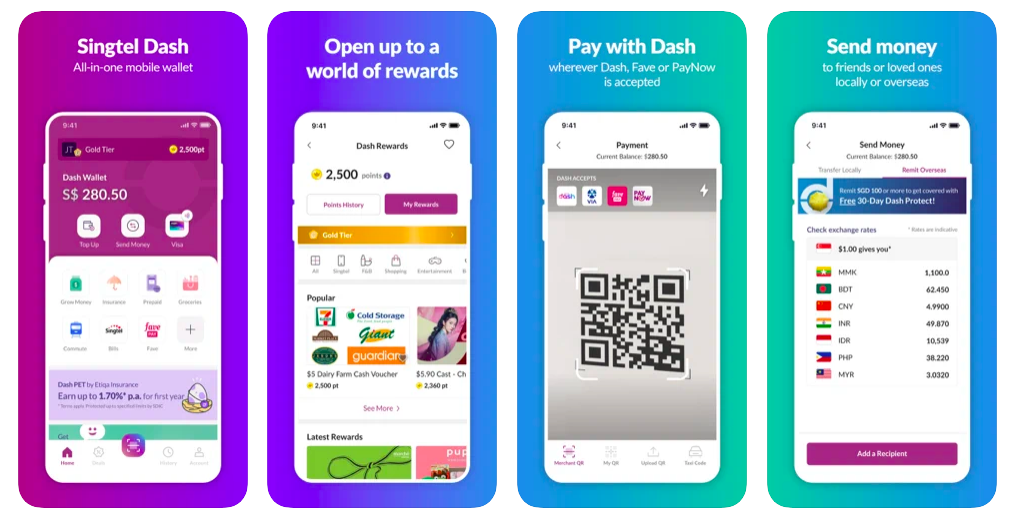

The 1% challenge is a well-known financial trend to help get in the habit of automatically setting aside a portion of your income every month for your savings.

Determine a small percentage of your monthly income (be it 1%, 5%, or even 10%) and arrange an automatic transfer that pulls that money into your savings account as soon as your paycheck lands. Over time, that will build up into some substantial added savings!

#3: Clear out your food pantry

Especially since the pandemic has made food delivery so inviting, it can be hard to remember what’s left in your food pantry. We know just how it feels like as foodpanda-ing or dapao-ing something is much faster and convenient.

But still, you want to force yourself to clean out all the food in your cupboards and intentionally cook or use up everything you have been storing for too long. This will aid you to save money and make more space in your kitchen!

#4: Borrow, don’t buy

Image Credits: thespruce.com

Are you struggling with the need to bring in new items but don’t want to spend the cash? Try swapping out buying for borrowing for a month.

Every time you feel the urge to purchase something new, see if a friend or coworker (or even a close neighbour) has a version you can borrow. You would be surprised by how much money you save just by sticking to this principle!

#5: Set aside your spare change

Do you use a lot of cash daily? Start saving even more of that money by designating a certain amount as your spare.

For example, it can be a simple S$1 coin. Every time you receive S$1 from your favourite aunty at the Kopitiam, drop it into a piggy bank. These spare change can add up!

Check out a range of visually appealing piggy banks from Lazada here if you need help getting started.

#6: Give yourself 52 weeks

Image Credits: unsplash.com

Other than the 1% challenge introduced earlier, the 52-week challenge is also one of the most famous money-saving techniques.

It has you begin setting aside a small (and increasingly growing) amount of money every week. That money sits in a jar or drawer and increases with every new week when you add to it. The best thing is that you just need to start with a dollar from the first week.

Keep increasing a dollar as you go (S$2 in the second week, S$3 in the third, and so on), and by the end of your 52-week challenge, you would have saved a little less than S$1,400!

Or if you think you can raise your game, why not go for the 365-day difficulty instead? This means rather than saving an amount each week; you do it for every single day of the year. But do set a realistic amount lest you backslide and abandon the whole challenge altogether.

#7: Sell your stuff online

There are several platforms to sell your stuff online. Ladies with neverending piles of clothes can try selling their clothes with Refash. Simply pack, send, and receive cash or credit in 30 days! Click here for more information.

For more general kinds of stuff, you can check out Carousell if you haven’t already. I’ve personally sold a couple of items on the Singapore-based app and think it’s a rather innovative platform for buyers and sellers to interact.

Or since most of us own a Facebook account, why not try Facebook Marketplace? You can easily create a listing under various categories, including home goods, pet supplies, and even properties for rent/sale.

Beware of scammers, though.

Final thoughts

Image Credits: ediblecommunities.com

You don’t have to take on the abovementioned challenges all at once since that would be overwhelming. Pick and partake in the ones you think are interesting and feasible. For example, after reading this article, why not put down your phone and start emptying your food pantry?

Little actions can lead to unexpected outcomes. Keep at it!