Singapore has tightened its monetary policy to stave off inflation. Against an environment of high interest rates, our savings can now grow at a faster pace. Let’s look at the recently enhanced UOB Stash Account which now provides up to 5% p.a. interest, making it so much easier for the everyday saver to compound his/her savings. When combined with the UOB One Account to form the Power Duo, it rewards savers with up to S$8,000 in interest a year. That is enough for a round trip to Europe for 2, a complete makeover of your room to make it more conducive to work from home or simply just to cover the increase in the cost of living with some spare change for a rainy day.

Here’s how you can make the most out of higher interest rates and get up to S$8,000 in interest a year! Let me break it down for you.

What is UOB Stash Account

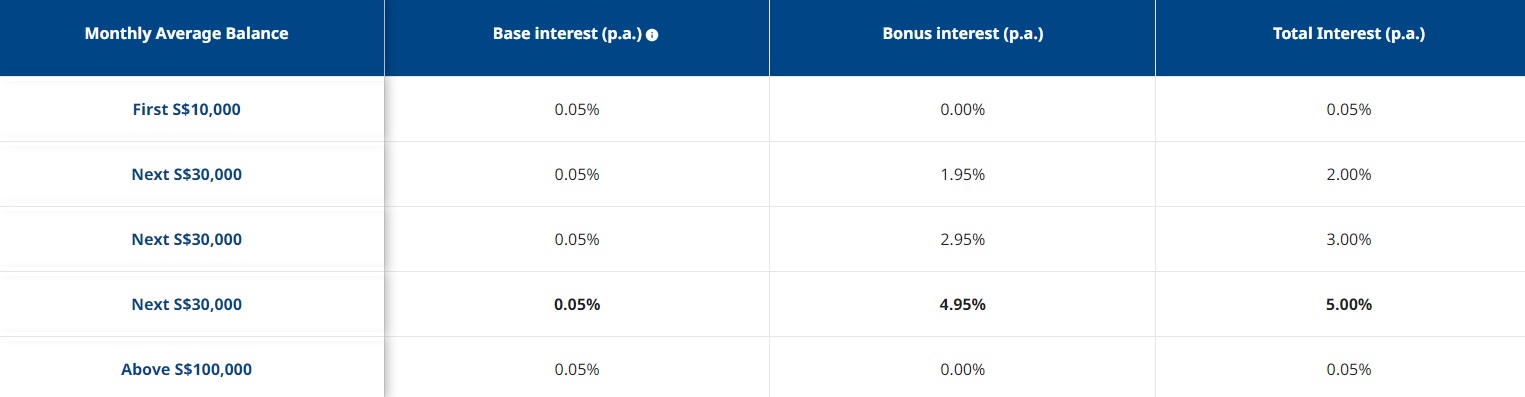

UOB Stash Account rewards the everyday saver for stashing their cash with them (pun intended). Simply by maintaining or increasing the monthly average balance*, savers can look forward to up to 5% interest p.a.on the highest tier. With bonus interest awarded for the first S$100,000 monthly average balance, the interest per annum works out to approximately S$3,000. This translates to an effective interest rate of 3%.

* Monthly Average Balance refers to the summation of each day-end balance in the Stash Account for each calendar month divided by the number of calendar days for that month.

What makes the Stash Account so attractive is the fact that, there is high liquidity on the savings as there is no lock-in period. This grants savers immediate access to funds to tide over rainy days – a valuable trait given the highly uncertain economic climate these days. You can continue to spend or transact with your Stash Account as you can still earn bonus interest as long as you maintain or increase your monthly average balance. Maintaining or increasing your monthly average balance is not difficult as the interest accrued is credited monthly.

But what happens if you have more than $100,000 in savings when UOB Stash Account only rewards bonus interest for the first $100,000?

Extend your savings further with the UOB One Account

Especially for those who have more than $100,000 of savings, do not stop with just UOB Stash. Instead, please combine it with the UOB One Account to elevate your savings further!

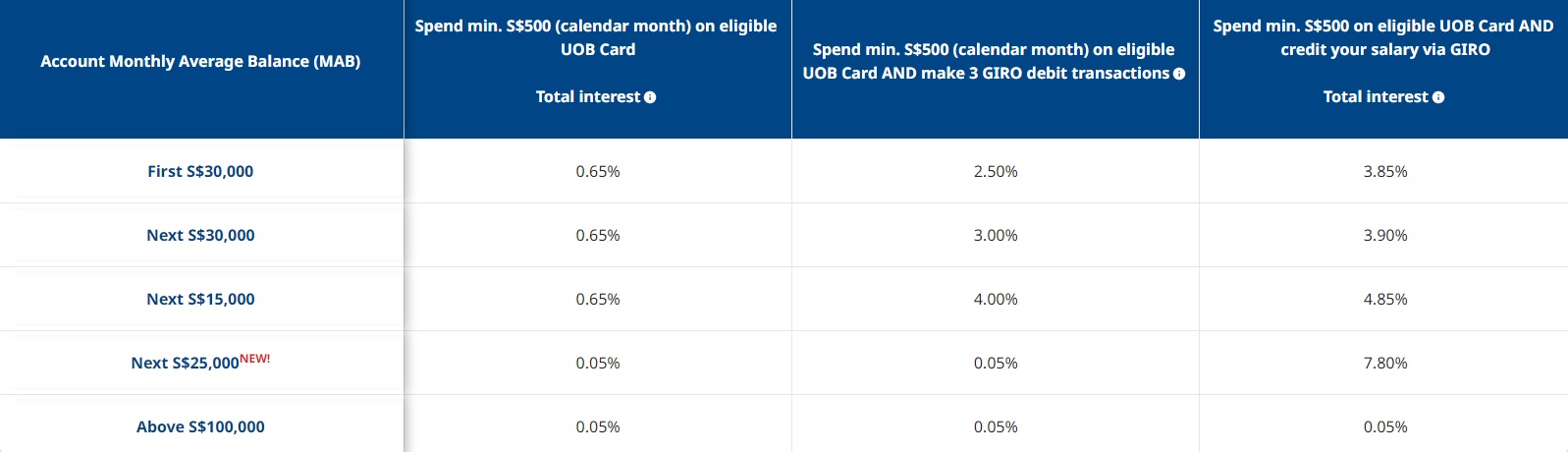

Besides the UOB Stash Account, the UOB One Account had also undergone a massive upgrade of its own. It rewards savers with up to 7.8% p.a. interest on the first S$100,000 in deposits when they complete 2 steps:

- Spend a minimum of S$500 on an eligible UOB card per month, and

- Credit your salary or make 3 GIRO transactions

The absolute interest works out to approx. S$5,000 a year which translates to 5% interest p.a. Wow, better than any fixed deposit out there!

Let the UOB Power Duo give your savings the boost it needs!

Together, UOB Stash Account and UOB One Account form the Power Duo which rewards savers with up to S$8,000 in interest a year. S$8,000 certainly goes a long way to combat rising cost of living expenses or for some, to fund their long-awaited holidays and big-ticket items that you have been eyeing for some time!

Did you think we were done? Stack it up with more rewards by participating in these limited-time promotions!

Stack your rewards further

Apply online for any of the savings accounts under Power Duo to receive up to S$210 worth of Lazada cashback vouchers.

Furthermore, simply deposit fresh funds, sign up for salary crediting and perform a GIRO transaction to receive another S$140 cash credit for the first 200 New-to-UOB Deposits customers. The first 200 existing customers who perform the same tasks will receive S$110 instead.

Concurrently, register for the Good Things Savings Promotion and deposit a minimum of S$50,000 into an eligible UOB account to receive a guaranteed $250 cash credit and 1 chance to win return air tickets for 2 to Tokyo, Japan. Of course, if you can deposit higher fresh funds, you will be duly rewarded with even higher cash credit (up to $1,300) and more chances to win the air tickets. Under the same promotion, Power Duo account holders receive double the chances to win return air tickets for 2 to Tokyo, Japan!

So what are you waiting for? Apply for the UOB Stash Account right away and start stashing away!