After days of Chinese New Year, many of us feel “richer” after collecting red packets from your parents and relatives. (For those that gave out red packets, i hope your rubbed shoulder with God of Fortune and got your windfall) Now as you hold and sniff your stacks of new notes, you may be thinking of the best place to put away this sum of money other than your tin can or under your pillow. Should you just deposit these money to your standard POSB/DBS account?

We take a look at the banks you should be putting away your money with, which includes fixed deposits and your daily saving accounts.

1. POSB

If you are not aware, POSB launched a cash gift promotion of 1.88% for 12 months on 23 January 2015. What this means is that any single sum deposit between SGD 1,000 to SGD 1,000,000 to your saving account will earn you an interest of 1.88% for 12 months. The catch is you cannot withdraw these top-up amount during this 12-month period.

Note: You must sign up before 28 February 2015 to be eligible for the promotion.

For more info and terms: http://goo.gl/0YxWqk

2. DBS

DBS launched the same promotion earlier this month for customers who deposit SGD 1,000 to SGD 3,000,000 can earn an additional 1.88% p.a for 3 months on top of the 2.08% of their DBS Multiplier Account. Likewise, you need to register with them by 28 February 2015 and make a one-time top-up to be eligible for the promotion. You will need to hold on to the fund for 3 months.

For more info and terms: http://goo.gl/ZaUqht

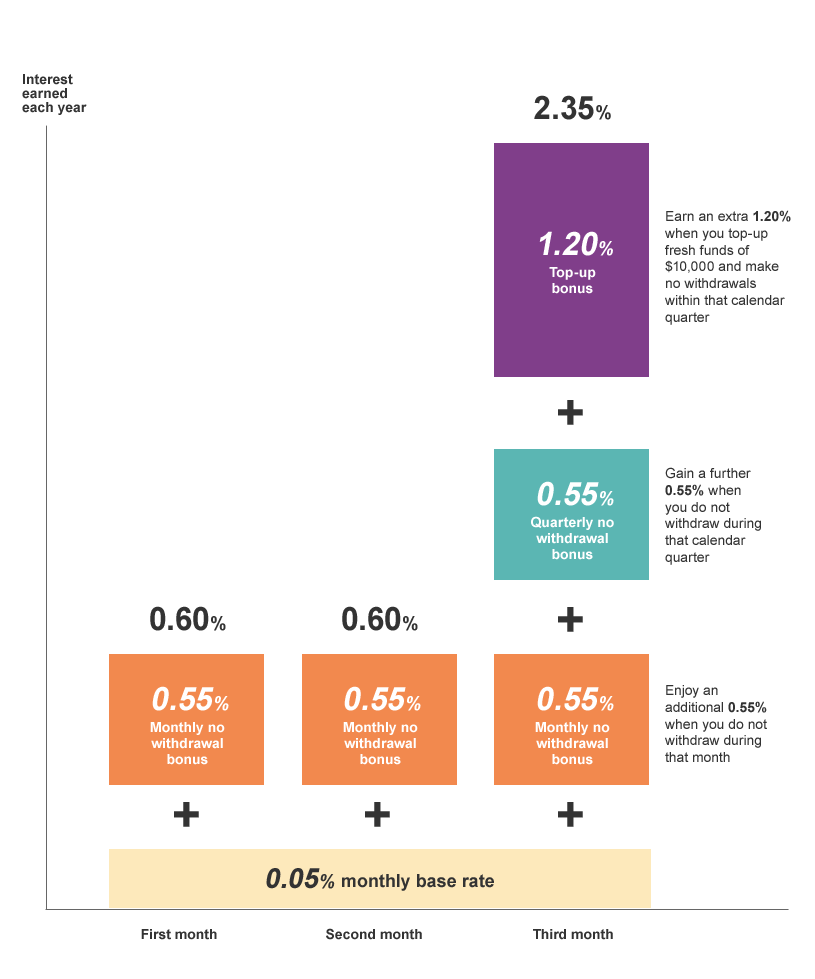

3. OCBC

For those who makes a larger deposit of fresh funds of SGD 10,000 and more can consider OCBC Bonus+ Savings Account with up to 2.35% p.a. All funds will earn a base interest rate of 0.05% p.a if no withdrawals are made. If no withdrawals are made in a month, you get an additional 0.55% p.a. Get an additional 0.55% p.a if you do not withdraw in that calendar quarter and a whopping 1.20% p.a top-up bonus if you deposit $10,000 of fresh funds. (0.05% + 0.55% + 0.55% + 1.20% = 2.35%)

For Premier customers, you get an additional 0.05% p.a on each tiers which means you could earn up to 2.50% p.a.

For a 12 month Time Deposit, earn up to 1.40% when you deposit a minimum of $20,000 in fresh funds.

For more info and terms: http://goo.gl/0qx9YC

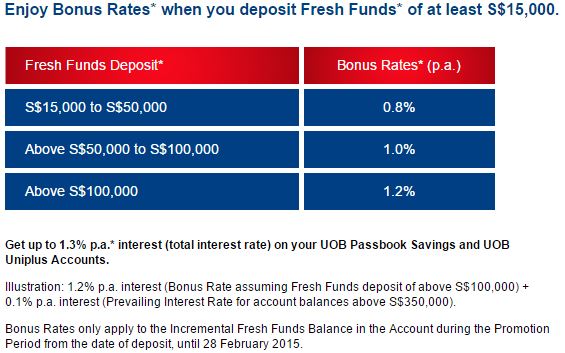

4. UOB

Enjoy bonus rates of 0.8% p.a when you deposit fresh funds of at least $15,000. If you deposit fresh funds of $50,000, you will get 1.0% p.a bonus rates and 1.2% p.a if you deposit $100,000 and more. Get an additional 0.1% if your account balance is above S$350,000.

Receive a limited edition 24K Gold-Plated RISIS Magnificent Goat Figurine (valued at S$238) with S$108,000 fresh funds deposit*.

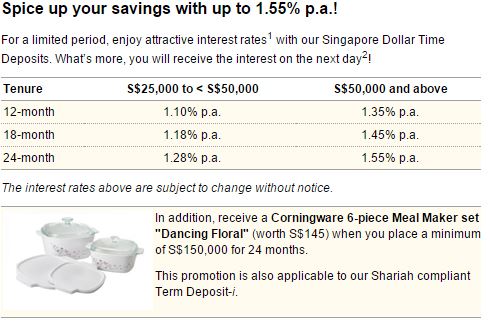

5. Maybank

Maybank offers more choices for their Time Deposit plans and the interest rate varies depending on the amount and tenure of your deposit. From S$25,000, you can get 1.10% p.a if you can lock away for 12 months and can go up to 1.28% p.a if you can stretch longer to 24 months. If you have double the amount (S$50,000 and above), you fall into the higher tier and can receive up to 1.55% p.a for a 24-month Time Deposit.

If you deposit S$150,000 for 24 months, you stand to receive a Corningware 6-piece Meal Maker Set “Dancing Floral” worth S$145.

More info and details: http://goo.gl/5n4oyN

6. CIMB

Deposit a minimum of $25,000 to get an interest rate of 1.25% p.a for their 12-Month SGD Fixed Deposit Account. For larger amount deposit of $250,000 and more, you will receive 1.30% p.a. That’s not all, depending on the amount of fresh funds you deposit, you stand to receive a New Moon Abalone Set.

Register no later than 5 March 2015 to be eligible for the promotion.

For more info and terms: http://www.cimbbank.com.sg/promo/cny2015/

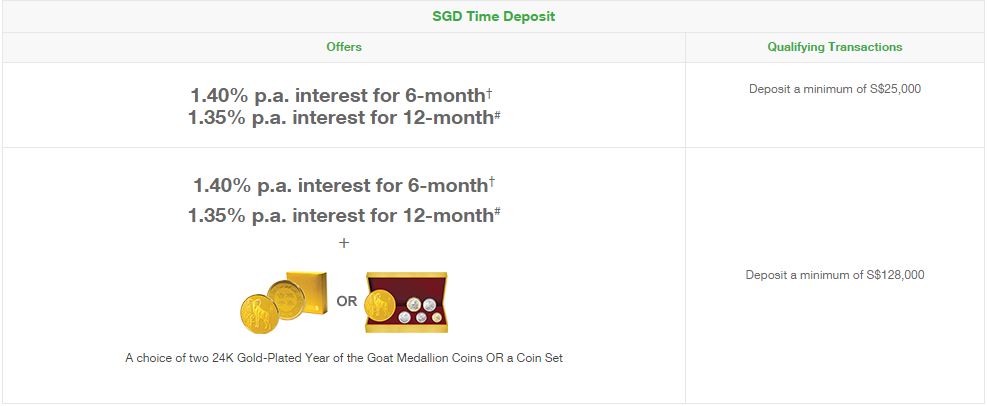

7. SCB

Deposit a minimum of S$25,000 and get up to 1.40% p.a for 6-months and 1.35% p.a for 12 months. For larger amount of S$128,000 and more, you stand to receive a choice of two 24K Gold-Plated Goat Medallion coins OR a Coin Set. Promotion ends 28 February 2015.

More info and details: http://goo.gl/GYWzxy

* For those who want to deposit a smaller amount (with no min deposit) and no tenure can opt for their e$aver Account where you stand to earn an interest rate of 1.35% p.a until 31 March 2015. More info: http://goo.gl/18oKdx

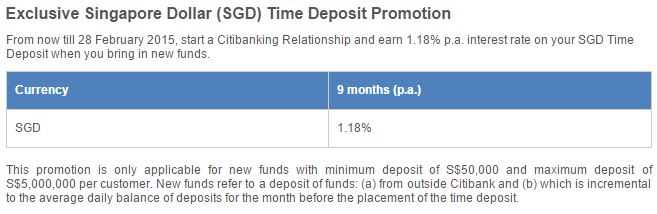

8. Citibank

Want time deposit with a shorter tenor? Then go for Citibank’s 9-month Time Deposit and receive an interest rate of 1.18% p.a. You will need to deposit a minimum of S$50,000 and up to a maximum of S$5,000,000 of fresh funds. Promotion ends on 28 February 2015.

More info and details: http://goo.gl/1VfPsT