Cryptocurrency has taken the world by storm, and Singapore is no exception. Although the worldwide cryptocurrency ownership rates were around 4.2% in 2022, Singapore and Thailand are leading the way in Southeast Asia with significantly higher adoption rates of 11.05% and 6.47%, respectively. These numbers are mainly attributed to the digital savviness of their populations and the supportive regulatory environment in both countries. While investing in cryptocurrencies can be attractive and lucrative, it is also not without risks.

Firstly, let’s discuss the rewards. Cryptocurrency is decentralized, meaning it is not controlled by any government or financial institution. This makes it a popular investment option for those looking to diversify their portfolio and reduce their reliance on traditional banking systems. Cryptocurrencies can also provide quick and easy access to liquidity, making it an attractive option for those looking to make quick profits. For example, digital artists can easily sell their artwork using cryptocurrencies and still own its copyrights.

Furthermore, the Monetary Authority of Singapore (MAS) has issued guidelines for the trading and exchange of cryptocurrencies, making it easier for investors to enter the market. To address money laundering and illegal activities, MAS issued Notice PSN02, also known as the detailed Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) guidelines for Digital Payment Token service providers.

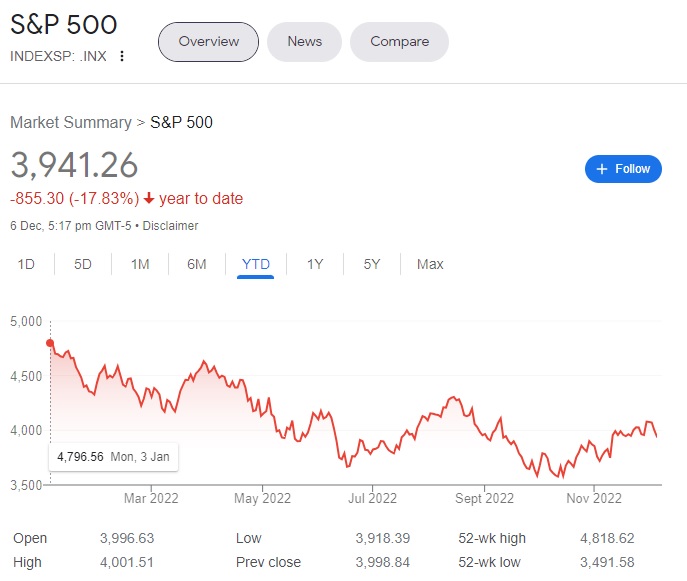

However, investing in cryptocurrency also comes with its own set of risks. One of the biggest risks is volatility. Despite Singapore’s ambitions to become a global crypto hub, it has been cracking down on the industry after many retail investors lost their life savings to crypto trading. The country has repeatedly warned that cryptocurrency trading is “highly risky and not suitable for the general public” due to its volatile and speculative nature.

The general public must know that cryptocurrencies are subject to unpredictable price fluctuations. As they are less regulated, their value is influenced by other factors, such as psychological hype. For example, in 2017, Bitcoin’s price reached an all-time high of nearly $20,000, only to crash to $3,000 the following year. Another example is the rise of the first meme coin called Dogecoin.

Image Credits: unsplash.com

Another risk is security. Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking and cyber-attacks. If a hacker gains access to an investor’s wallet, they can steal their digital assets, resulting in significant losses. Can you imagine betting your life savings on cryptocurrencies and losing it all in a day?

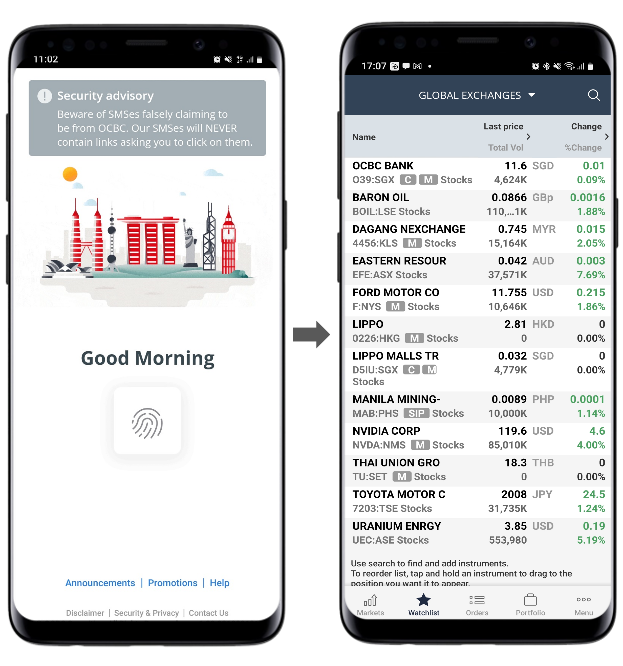

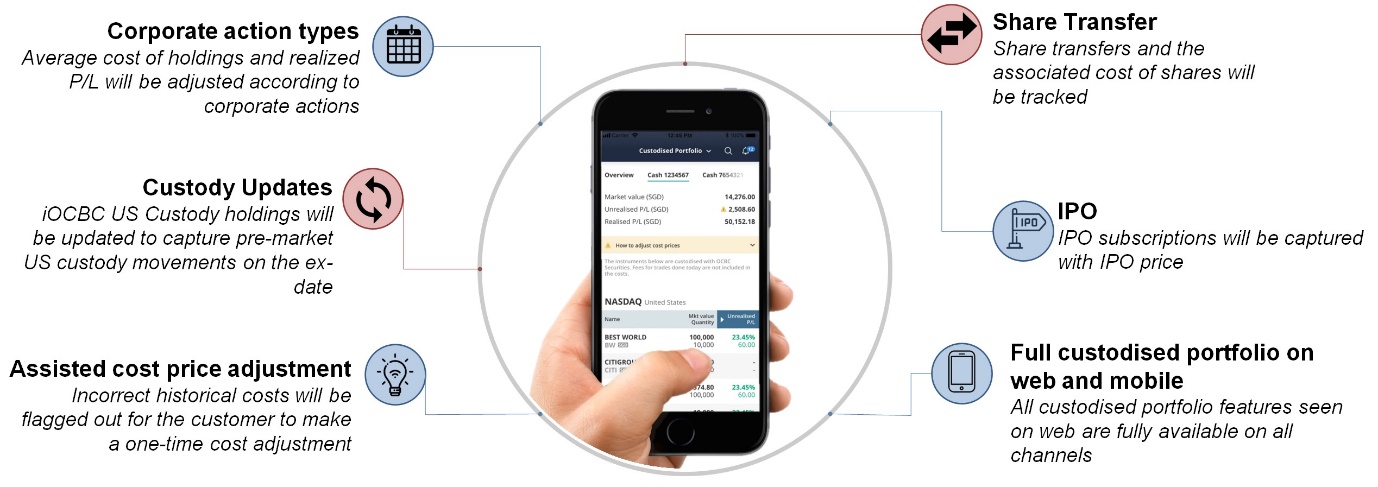

Lastly, to thrive in the cryptocurrency scene, a certain level of technical knowledge is required. Don’t fall victim to frauds and scams by lacking technical knowledge. Investors need to understand how the blockchain works, how to manage digital wallets, and how to navigate cryptocurrency exchanges.

Despite the risks, the interest in cryptocurrency investment remains high among investors in Singapore. To minimize these risks, it is essential for investors to conduct comprehensive research before investing, keep their digital assets in secure wallets, and only invest a reasonable amount they can afford to lose. With prudence and caution, investing in cryptocurrency can be a fulfilling experience for Singaporean investors.