Using a credit card can be a savvy move for various purchases, thanks to the added security and potential perks. Beyond building a strong credit history, some purchases are best made with a credit card to maximize these benefits.

Many cards offer rewards like points or cashback, which can accumulate over time, essentially giving you “free money” if you consistently pay off your balance without incurring interest fees. Remember to use your credit card wisely!

SCORING EVENT TICKETS

Credit cards often offer special access to event tickets. Many card companies have partnerships with event promoters or venues, giving cardholders the chance to buy tickets for concerts, sports events, and other activities before the general public. Sometimes, there are even exclusive events just for cardholders.

For instance, when Taylor Swift’s concert tickets in Singapore went on early sale, UOB cardholders had the advantage of grabbing tickets before others.

PURCHASE BIG-TICKET ITEMS

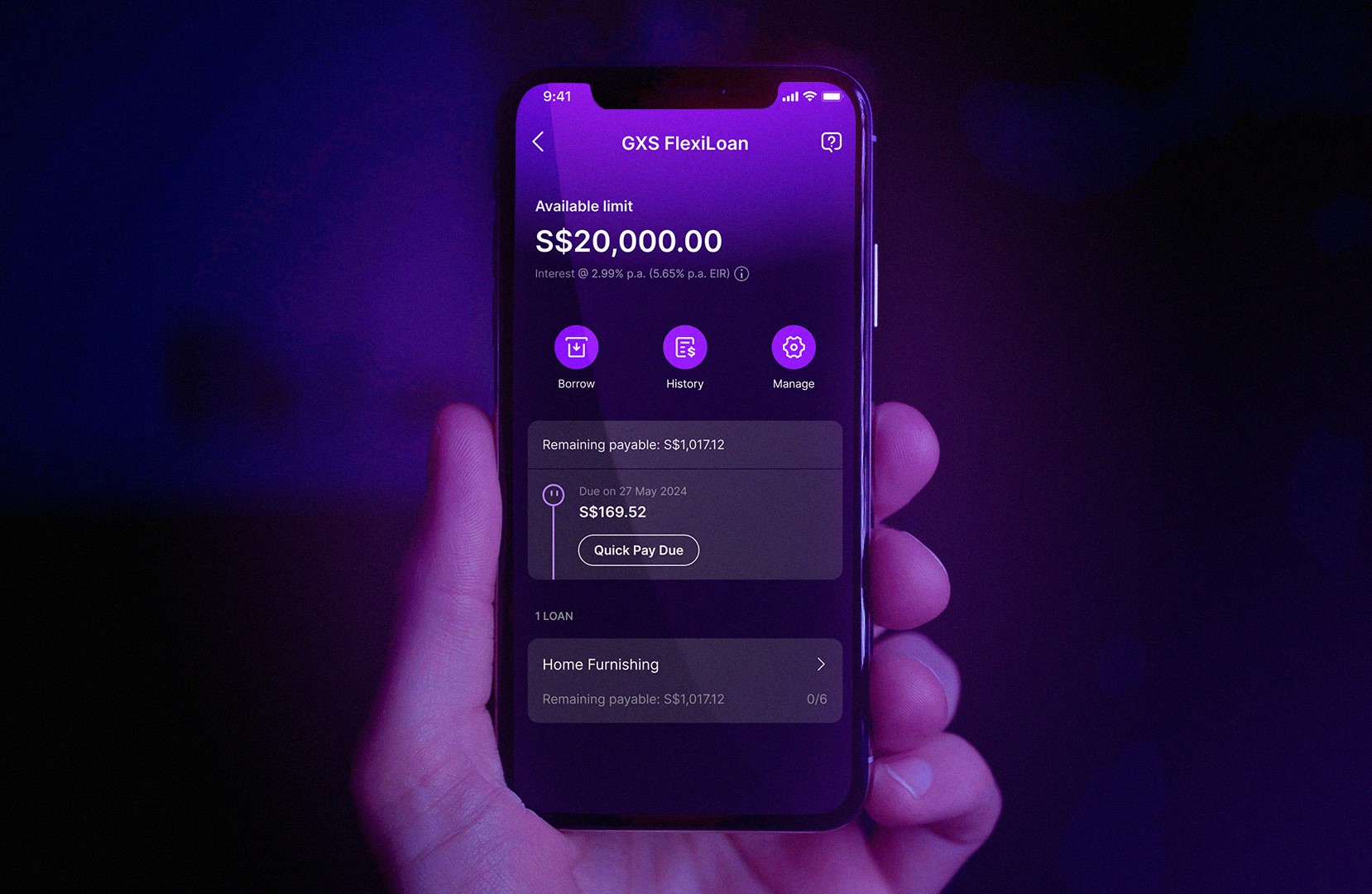

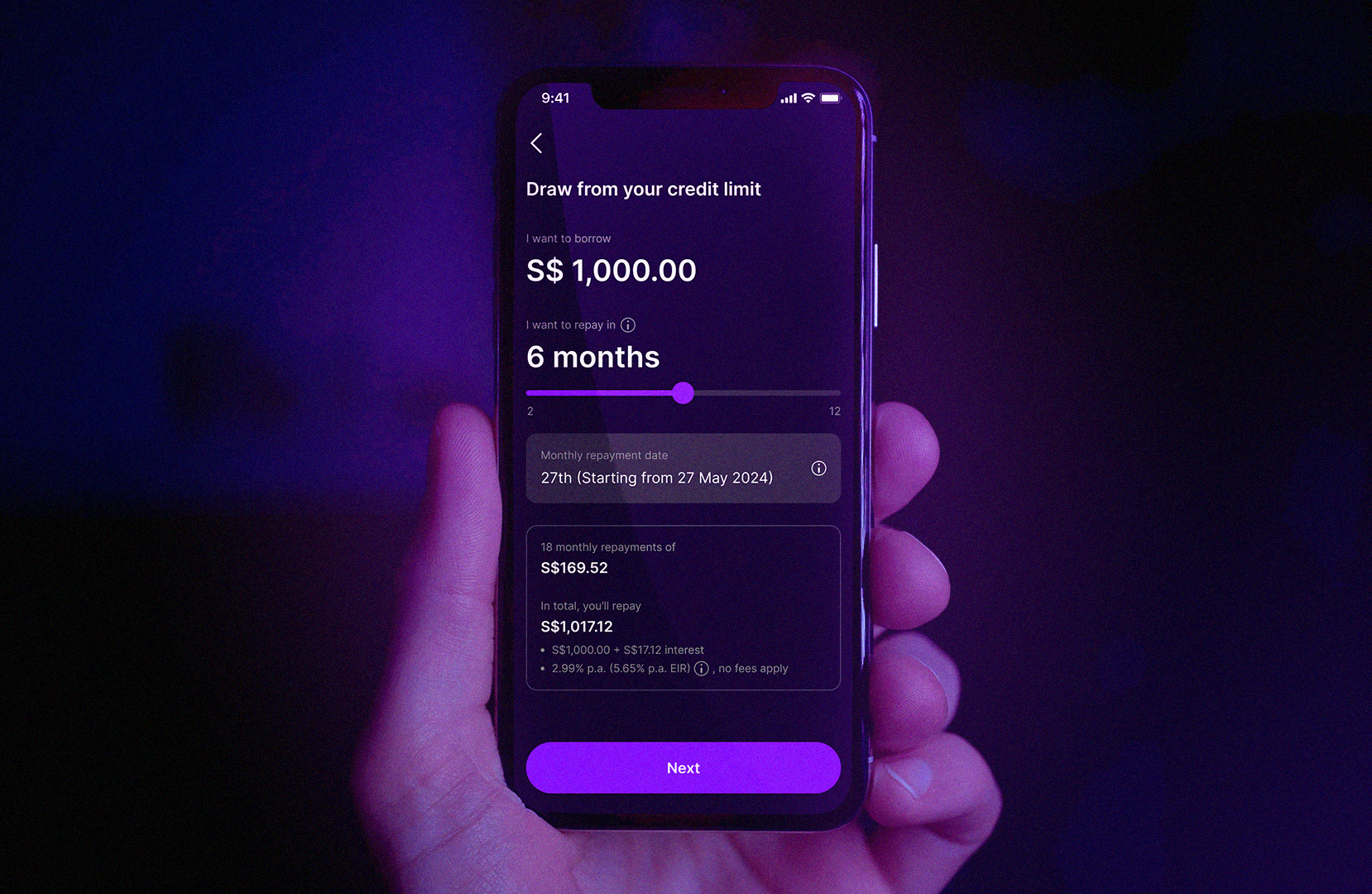

When buying big-ticket items like refrigerators, laptops, or other electronics, using a credit card is a great idea. Not only can you earn significant rewards points, but many credit cards also provide additional insurance on these items.

This might include extended warranties that double the manufacturer’s warranty or price protection if the item’s price drops shortly after purchase.

MAKE TRAVEL ARRANGEMENTS

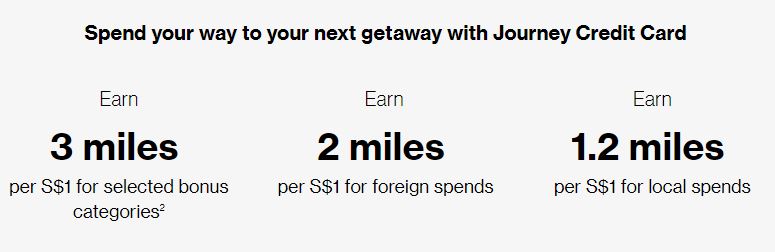

Booking travel with a credit card can offer substantial benefits. Many cards provide travel-related perks such as trip cancellation or interruption coverage, lost luggage insurance, and even emergency medical coverage. These benefits can save you from purchasing separate travel insurance.

Travel-themed credit cards typically offer higher rewards points for travel-related expenses. Plus, a credit card is often required to secure bookings for flights, accommodations, and car rentals.

SECURE OVERSEAS PURCHASES

Credit cards are generally more widely accepted than debit cards when traveling abroad. They are also safer to carry compared to large amounts of cash, as lost or stolen credit cards can be cancelled easily. Some credit card companies offer favorable exchange rates, providing additional savings.

Before traveling, notify your credit card provider of your itinerary to avoid any security issues or hindrances with your card while overseas.

ADD TO CART

Using a credit card for online shopping offers several advantages. Credit card transactions are easier to trace and often come with protections against fraudulent charges. Many cards also provide insurance for items lost or damaged in transit.

Always ensure that you never send your credit card information over email or text to safeguard your details.

CHARGE YOUR BUSINESS PURCHASES

For business owners, using a credit card to manage expenses can simplify accounting and help build business credit. Many business credit cards offer cash-back rewards or statement credits for purchases like internet services, cell phone plans, and office supplies, which can aid in tracking and managing cash flow.

Using a dedicated business card for recurring expenses can also help with tax deductions.

PROTECT PHONE PURCHASES

If you enjoy buying products via home shopping channels or infomercials, always use your credit card. This provides protection if you don’t receive the item or if it doesn’t match what was advertised. Credit card protections can save you from potential scams or disappointments from phone orders.

Image Credits: unsplash.com

Using your credit card for these types of purchases can provide additional security, rewards, and peace of mind, making it a smart choice for managing your finances.