Armed with five currencies in our arsenal, my friends and I decided to go to an Indochina trip. We foresaw great expenditures ahead! This is why we decided to divide the expenses throughout the months leading up to our trip. Our airline tickets and accommodations were all taken cared of. However, there were hidden expenses that we overlooked. This burnout my cash.

Now, I turned to the local ATM to replenish my funds. My friends, on the other hand, used credit cards and exchanged their American dollars. Which of us got the better deal? Well, this has been an ongoing debate ever since.

MONEY REMITTANCES

Say that you have an emergency and you do not carry extra cash or plastic cards. How will you solve the immediate situation? For starters, you may have someone from home wire money to you.

Within a day, you can get money from well-known international companies such as Western Union or MoneyGram. These two charge variable fees depending on how much money you are sending, how the recipient will access the money, and where it will be sent. The most economical price entails the slowest service.

The only downside is that remittance fees can run from 1 to more than 10 percent! Generally speaking, faster services entail more expensive fees.

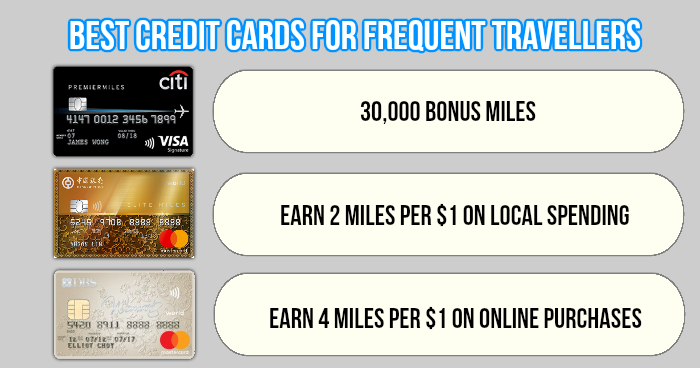

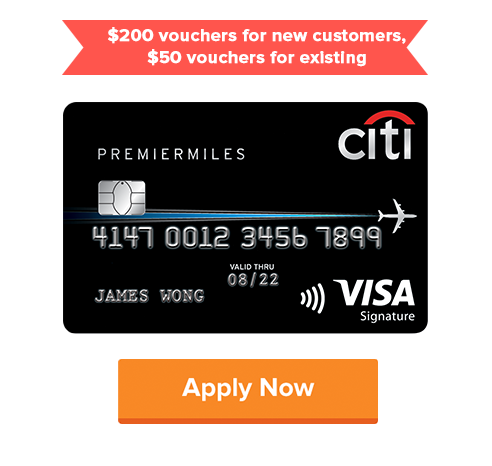

CREDIT CARDS

What will you when your hotel bills skyrocketed without warning? You may consider using credit cards for large purchases like this. I am referring to airline tickets, car rentals, and fancy meals too.

The most attractive advantage to using credit cards while traveling overseas is that purchases are exchanged at the interbank exchange rate. Usually, this is the best rate you can get for a currency exchange. While most credit card issuers ask for conversion fees, these fees are usually lower than what you must pay in currency exchange counters. Furthermore, there are a few cards that do not charge for foreign transactions!

The only downside is the idea of paying hefty late payment charges when the credit card bill arrives earlier than you. So, make advance payment arrangements.

DEBIT AND ATM CARDS

Debit card was my weapon of choice when we went to Thailand. It is a quick way to get cash exchanged in the local currency. I stress on its convenience as major cities and airports have ATMs available everywhere. Moreover, you will get the same interbank exchange rate when you withdraw with your debit or ATM card as you do with your credit card.

The only downside is that you will be charged a service or conversion fee for every withdrawal you make. Fortunately for me, there are several UOB ATMs in Thailand!

JUST A RECAP!!!

Image Credits:pixabay.com

The best ways to exchange currency include using your credit, debit, or ATM cards. As much as possible, use your financial institution’s ATMs to get lesser conversion fees. Before leaving for your travels, ensure that you have your money exchanged in at least two different currencies. When you are back home, see if your bank will buy back your foreign currencies.

Source: smartertravel.com