KK Women’s and Children’s Hospital (KKH) has launched a new genetic screening program with Temasek Foundation to help couples planning or expecting children.

The free pilot from 2024 to 2027 identifies carriers of severe genetic disorders passed to children and helps with family planning decisions.

Called the first in Asia, the Temasek PREDICT (PaREnthood Genetic Disease Carrier Test) program screens over 80 disorders relevant to Asians.

Public carrier screening in Singapore usually tests specific disorders, as such, all pregnancies get screened for the Thalassemia major.

This has reduced cases by over 90%.

According to a joint press release with the KKH-led SingHealth Duke-NUS Maternal and Child Health Research Institute (MCHRI), children with Thalassemia major face lifelong health challenges.

Meanwhile, antenatal screening is available for all pregnancies checking for Down syndrome and common chromosomal disorders.

High-risk pregnancies also get screened based on family history or the mother’s age.

Image Credits: kkh.com.sg

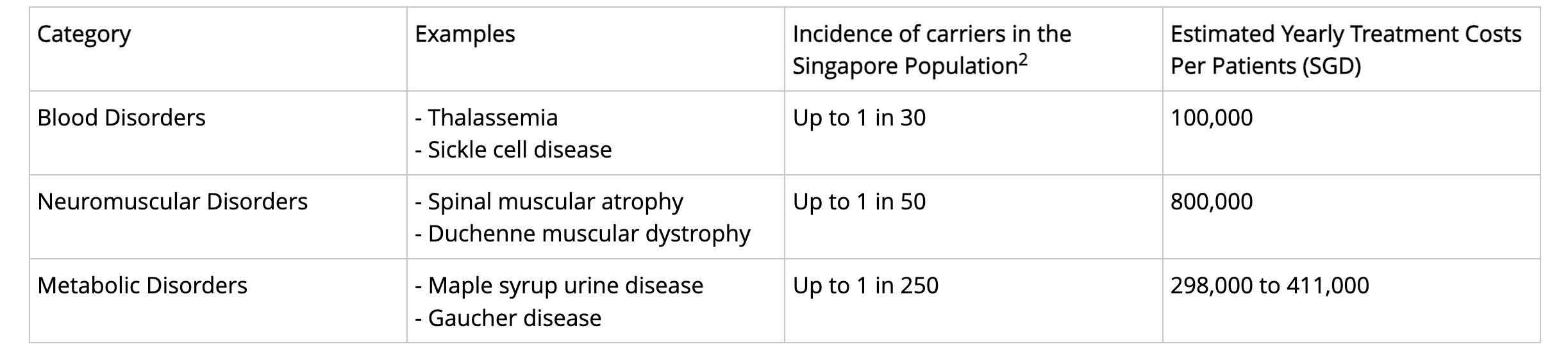

The new program screens a wider panel of over 80 relevant disorders that may cause shortened life and severe disability, which occurs in 1 in 1,000 people in Singapore.

All screenings will be done at KKH at the moment with plans to expand to selected clinics.

KKH will assess scaling it up by 2027 based on the pilot.

Identifying risks of inherited disorders

This new genetic screening program addresses gaps in existing tests since most panels miss over 25% of common severe recessive disorders in Asians.

This means many Singapore couples are unaware of the risks of passing on conditions.

Three in 100 babies born each year have rare disorders or defects.

Carriers (parents) may not have issues themselves but could have affected children without knowing those risks beforehand; up to one in 250 couples risks being carriers of the same disorder.

The program thus allows informed decisions for managing pregnancies to understand inheritance risks.

How to sign yourself and your spouse up

As mentioned earlier, KKH is piloting the voluntary carrier screening program for couples planning pregnancy.

Testing involves a simple blood test or cheek swab so it’s nothing too scary.

Couples identified as carriers will receive counseling to understand results and options like family planning.

The pilot aims to screen 40,000 couples and KKH will assess feedback and technology before potentially expanding the program.

Carrier screening empowers couples with knowledge and choices aligned with their family goals and values, helping them plan for parenthood and be well-prepared for the challenges of raising a child.

The program screens eligible couples for genetic conditions before or during pregnancy and couples interested can self-refer by emailing [email protected] or Whatsapping 6394 3998 for more info.