Any Stranger Things fans out there?

Bath & Body Works has rolled out a range of online exclusive products from $12 for fans of the Netflix series and we’re excited to intro them to you through this post.

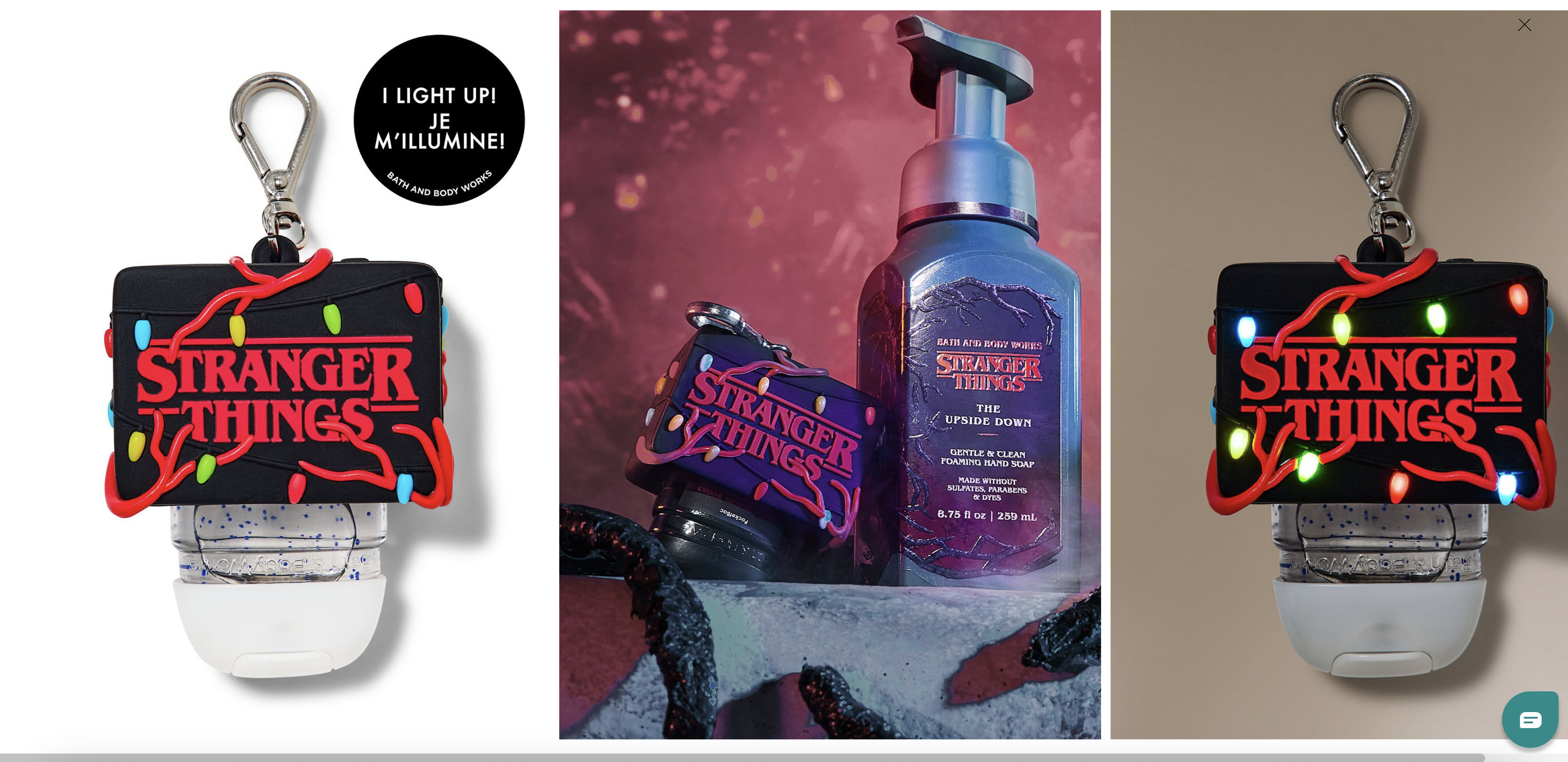

PocketBac Holders

Demogorgon Head PocketBac Holder

Price: $12

What’s scarier than the Upside Down?

Forgetting your hand sanitizer, ha.

Fortunately, this Demogorgon Head PocketBac Holder has you back with a (delightfully) monstrous way to keep your favorite sanitizer close by.

Drawing inspiration from Stranger Things, this creature’s gaping maw will scare away any microscopic nasties while allowing you to sanitize with ease.

And with its convenient clip, you can attach it to any bag for sanitizing on the go.

It’s also available in two other versions:

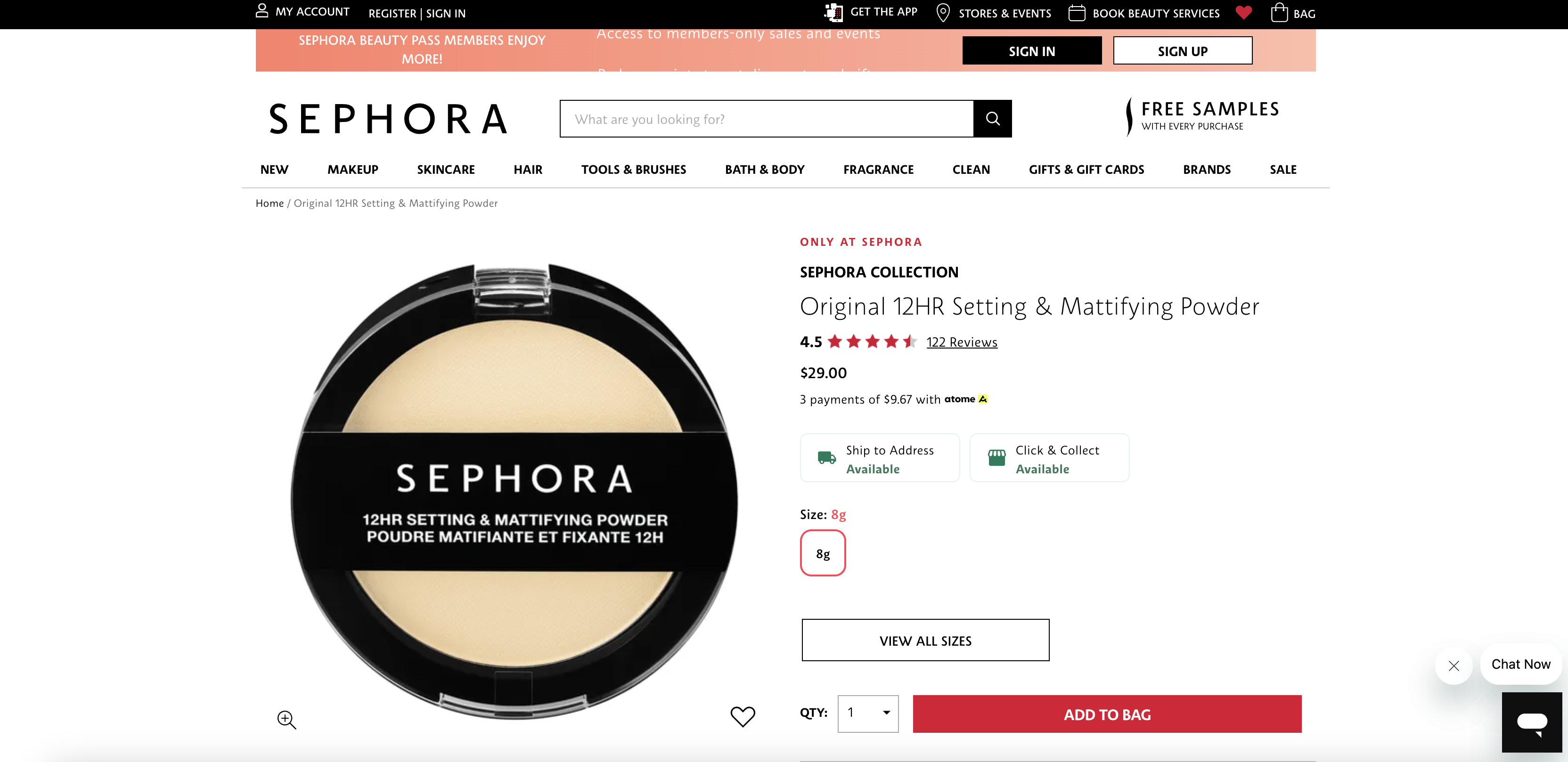

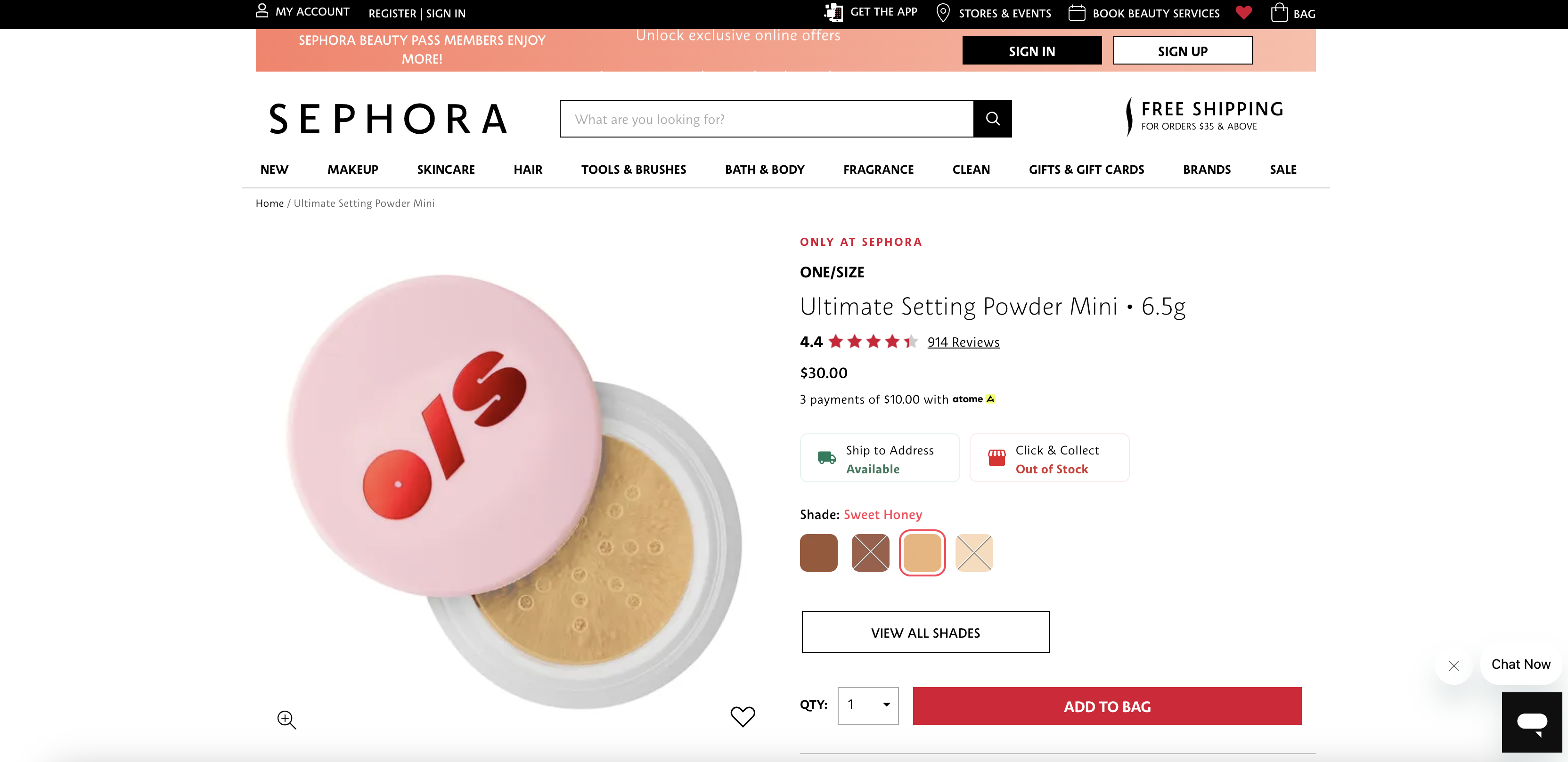

Hand Soaps

The Upside Down Gentle & Clean Foaming Hand Soap

Price: $15

The Demogorgon Gentle & Clean Foaming Hand Soap

Price: $15

Summon the supernatural with this gently cleansing hand soap, where black orchid petals bloom amongst spicy cedarwood and dark patchouli.

Inspired by the eerie beauty of nature’s forgotten gardens, its floral-woody fragrance will bewitch your senses.

Yet this demon-inspired bottle is no wicked witch—it’s infused with natural essential oils, vitamin E, shea extract, and aloe to wash away germs while upholding your skin’s delicate moisture barrier.

No dyes, parabens, or sulfates sully its purity.

Eddie’s Leather Jacket Gentle & Clean Foaming Hand Soap

Price: $15

Candles

The Upside Down Single Wick Candle

Price: $30

Something wicked this way comes… and it smells entrancing.

With its notes of mossy stone, smoky birch tree, and eerie fog, The Upside Down Single Wick Candle lures you into its shadowy realm.

This Bath & Body Works wick candle conjures visions of a misty forest at twilight—the air thick with mystery.

Light the single wick and let its dusky fragrance fill your space.

In no time, you will be transported to a dimly lit glade, leaves crunching underfoot as you navigate the darkness like stumbling upon an old, moss-covered ruin.

The candle’s long-lasting scent (30-50 hours in small rooms) summons the strange and the utterly spellbinding.

You can also get The Upside Down 3-Wick Candle ($49) by clicking through the link.

The Demogorgon 3-Wick Candle

Price: $49

Eddie’s Leather Jacket 3-Wick Candle

Price: $49

Begin your rock star fantasy with this Eddie’s Leather Jacket 3-wick candle from Bath & Body Works.

Inhale the intoxicating aroma of a well-worn bomber jacket—a symphony of black leather, smoked suede, and soft musk that’s equal parts tough and tender.

This candle fills any room with its bold scent, thanks to the high concentration of rich fragrance oils in the premium wax blend; it has a long-lasting burn of 25-45 hours.

To shop the full collection, head here: bathandbodyworks.com.sg/stranger-things