If travelling was free, you’d never see me again

Many of us love to travel, but the idea of parting away a significant portion of your salary on just the airfares alone is going to put off most of us. What most people don’t realize is that it doesn’t have to cost you an arm and a leg to fly — and there’s a group of people who have been gaming frequent flyer programs to get free flights.

A concept known as travel hacking, if used correctly, can be used to save loads of money on your next air ticket to your dream destination. Then there’s this infamous story of how a civil engineer earned 1.25 million air miles by just buying pudding. Of course, you are not going to see that happen in Singapore.

There are many ways for you to earn miles in Singapore and the most straightforward way is through airline rewards credit cards. If you are new to this, you can start off with the FlyerTalk’s forum where you can see many discussion on what’s the best credit card to earn miles,

Choosing the right credit card

The next step is to choose the right credit card that meets your spending needs. For an entry-level card, we picked the American Express Singapore Airlines KrisFlyer Credit Card where you just need a minimum income requirement of S$30,000 to apply. You can earn 1.1 KrisFlyer miles per S$1 spent locally and 2 KrisFlyer miles per S$1 spent overseas on June and December.

Pick the low-hanging fruit first

American Express have several welcome offers that you should take advantage of. For example, they are giving away 5,000 KrisFlyer miles when you charge to your card for the very first time. You can basically swipe any amount to you card to earn this.

There is also a 3,000 KrisFlyer miles which you can easily earned when you spend at least S$700 in the first 6 months upon Card approval. It’s not that hard, really.

For a limited time only, make a Grab Ride booking with your card and you get another 500 KrisFlyer miles between 5 May 2016 and 4 May 2017.

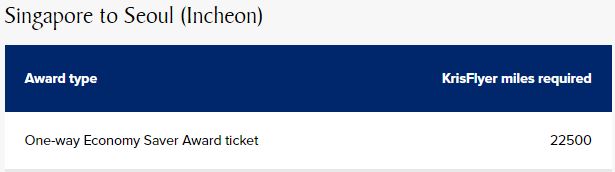

You should aim to pick up all these “easy” miles first and we are talking about a total of 8,500 KrisFlyer miles that doesn’t require you to spend too much money and time to achieve it. With that miles, you can already redeem for a free one-way Economy Saver flight to Bali with Singapore Airlines.

Work towards your goal

Now that you already have 8,500 KrisFlyer miles in your pocket, you can work towards your goal of redeeming higher-tiered awards such as a return tickets to Bangkok, Hong Kong and/or other popular destinations that you would like to travel. Check out the Singapore Airlines Awards Chart for more details. If you have a KrisFlyer’s account, you can use the miles calculator.

Start accumulating your miles

The key to accumulating your miles is to make your spending counts. Charge any daily expenses that you can think of to your credit card. Assuming you diligently do it for a year, here’s a rough estimate on how much miles you can accumulate:

| Transaction | KrisFlyer miles earned |

|---|---|

| 1st Transaction Welcome Bonus | 5,000 |

| Spend S$700 in 6 months | 3,000 |

| First Grab Ride booking | 500 |

| Pay for Starhub bills (Mobile, Broadband, etc) at S$120/month | 1,584 |

| Top-up EZ-Link Card using EZ-Reload at $80/month | 1,056 |

| Travelling to Hong Kong with AMEX-exclusive SQ fares at $188/pp (for 2 pax) | 752 |

| Hotels booked with Kaligo.com (3-night at Hong Kong Gold Coast Hotel at $163/night) | 3,490 |

| Spending in Hong Kong (S$1,000) | 2,000 |

| Dining out with friends $250/month | 3,300 |

| Movie at Cathay Cineplexes (Twice a month for 2pax) | 660 |

| Pay for groceries at FairPrice $100/month | 1,320 |

| TOTAL | 22,662 |

Take advantage of other card benefits

American Express let you enjoy up to 50% savings with American Express Selects at a wide selection of restaurants in Singapore and around the world. On top of that, you enjoy exclusive fares to 8 destinations with Singapore Airlines including an all-in return ticket to Hong Kong from just S$188 — if you get your card approved by 15 Jul. Click here for the full list of destinations

This American Express® Card is also eligible for use with Apple Pay.

Sign-up for a miles card today

There are many cards in the market which have higher rates such as the UOB PRVI Miles Card and Standard Charted Visa Infinite but requires a higher annual income of S$80,000 and S$150,000 per year. This will accelerate your accumulation process and you can consider upgrading your card once you meet the requirements.

For now, you can start off with the DBS Altitude Card or the American Express Singapore Airlines KrisFlyer Card which requires just a $30,000 annual income to be eligible.

Sign up for the American Express Singapore Airlines KrisFlyer Card before 31 Oct and you also receive S$80 worth of NTUC vouchers.

Apply online and get instant decision within 60 seconds.

How to get additional S$80 NTUC vouchers

Step 1: Click on the above products to apply

Step 2: Take a screenshot of the Thank You Page at the end of the application

See below for examples of Thank You Page of each bank

Step 3: Fill in the Form on SingSaver.com.sg

Fill in the form before 31 October 2016 to participate in the promotion! You will receive an email from SingSaver.com.sg after submitting the form. Reply with the screenshot of card approval from the bank after you receive it to claim the voucher!