ArtScience Museum located at Marina Bay Sands (MBS) is the world’s first museum that focuses mainly on Art and Science. Exhibitions in this building exude creativity and curiosity as well as the role of these characteristics in shaping our society.

You might have seen the building from afar because of its iconic shape that has “10 fingers” anchored by a unique round base in the middle. The modern and exquisite detailing is perfect for the central themes of the museum. That said, you must visit it at least once.

If you are on a budget, you are in luck! Some exhibitions in the museum are free! You read that right. Not everything in MBS is expensive.

1. PICK UP YOUR FREE-ENTRY TICKET AT THE MUSEUM BOX OFFICE

To celebrate SG50 and Straits Times’ 170th anniversary, ArtScience Museum is showcasing an exhibition on their behalf that is free – for all visitors! From now until October 4, 2015, you must pick up your free-entry tickets to the “Singapore STories: Then, Now, Tomorrow Exhibition” at the museum foyer.

Straits Times (ST) has been the longest running English newspaper in the Lion City.

The exhibition recaptures the tales of our nation since ST’s founding in 1845 through significant articles, headlines, and pictures (i.e., including ones that the public has never been seen before). Imagine having to squeeze and filter through more than 40,000 issues of the newspaper just to give us the best ones! Furthermore, they added a futuristic element by envisioning what Singapore would be like 50 years down the road.

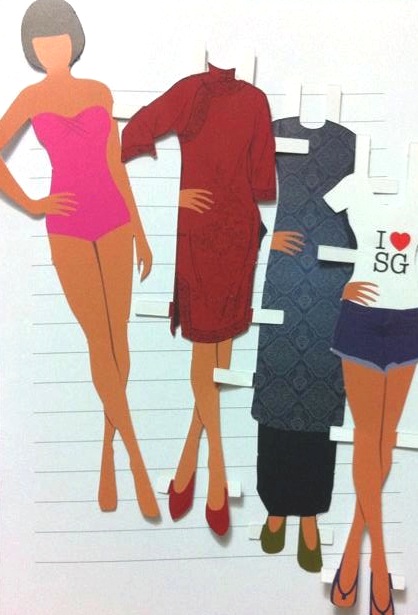

What I liked most about the exhibition are the interactive activities such as testing your knowledge on the Singaporean acronyms, sliding the pictures to see the before and after shots of different infrastructures, and the complementary paper dress-up wherein you can lean more about the different types of Singaporean dresses (e.g., Cheongsam, Sari, and Baju Kurung).

2. TAKE YOUR KIDS ON A FRIDAY FAMILY DAY

Every Fridays, families with children can enjoy enriching and engaging exhibitions for free. Only the children (maximum of four) of an adult who purchased a standard ticket will be given the free passes on the same exhibition/s. For the child to be honored with the free-entry ticket, he or she must be 12 years old or under. Furthermore, all tickets are issued for the same day at the museum box office only.

Imagine how much fun your children and your wallet would have when you take them to the DreamWorks Animation Exhibition or The Deep Exhibition. Not only are these exhibitions educational but also they are also interactive.

Read more about the Terms and Conditions, here.

3. JOIN ARTSCIENCE MUSEUM’S FACEBOOK COMPETITIONS

About 2 weeks ago, ArtScience Museum’s Facebook page hosted a competition wherein 10 winners received all-access passes to the exhibitions as well as goodie bags from the museum’s gift shop. The lucky winners have been announced last night. Worry not if you missed your chance because the museum guarantees that there are more giveaways in the future!

So, like them on Facebook at facebook.com/ArtScienceMuseum.