A wealth manager offers a high-level professional service which combines investment advice, accounting services, tax services, retirement planning, and legal planning. Generally speaking, wealth management is more than just about investments as it encompasses all the areas of one’s financial life.

Because of the pervasive nature of wealth management, a crucial factor affecting its success is your personality. Understanding your own personality toward money will help you identify the factors that are beneficial and harmful to your wealth. Start identifying which personality category you belong to. This can increase your self-awareness as well as take the right wealth management plan.

THE IMPULSIVE BUYER

A prey to bargains and sales, an impulsive buyer is a person who hates shopping lists and likes to go with the flow. He or she achieves psychological gratification through spending money on things that are often unnecessary. The urge to spend is usually regretted.

Solution: Remove the immediate ability to spend by keeping all your credit cards at home and by bringing nothing but a substantial amount of cash.

THE UNCONTROLLABLE DEBTOR

Falling under the umbrella of spenders, the uncontrollable debtor borrows money that he or she will readily spend. They are at risk of incurring high amounts of debts, impaling their credit score, and bankruptcy itself. With an outstanding amounts of debts, no successful wealth management can take place.

Solution: Identify all your debts and rank them according to interests. Start by ceasing the debts with higher interests and progress from there.

THE CAUTIOUS MANAGER

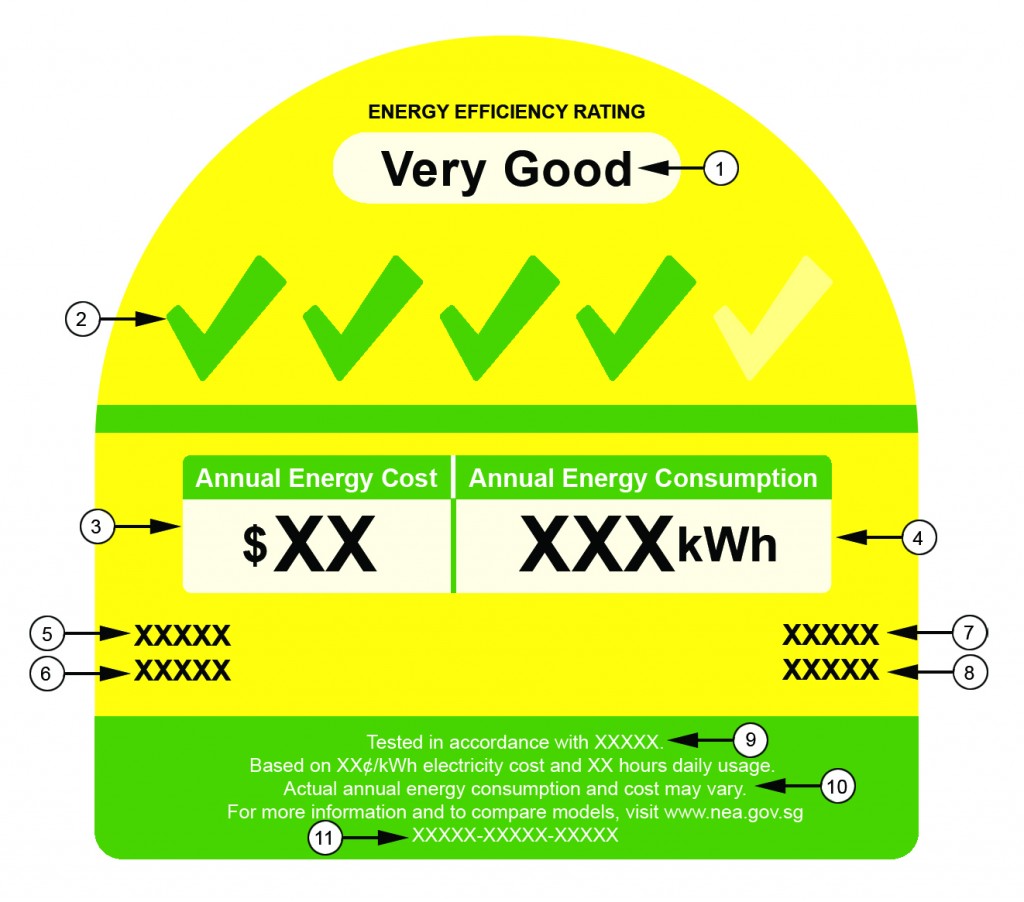

Unlike the two personalities mentioned above, the cautious manager likes lists and plans. People in this category also love to spot the greatest deals for their money.

Personally, I consider myself as a cautious manager. I keep track of my monthly expenses in order to analyze my spending habits. In terms of my wealth management efforts, I am very conservative that I invested my money on Mutual Funds (Bonds) alone.

Solution: As you take lesser risks, look for the savings account that offer the highest interest rates.

THE SMART INVESTOR

The smart investor is capable of managing his or her own money well. People under this category have a clearer understanding of their financial situation and they are actively putting their money to work.

Solution: Improve your knowledge on in-depth topics on investments and wealth management through several resources such as books and online articles.